No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

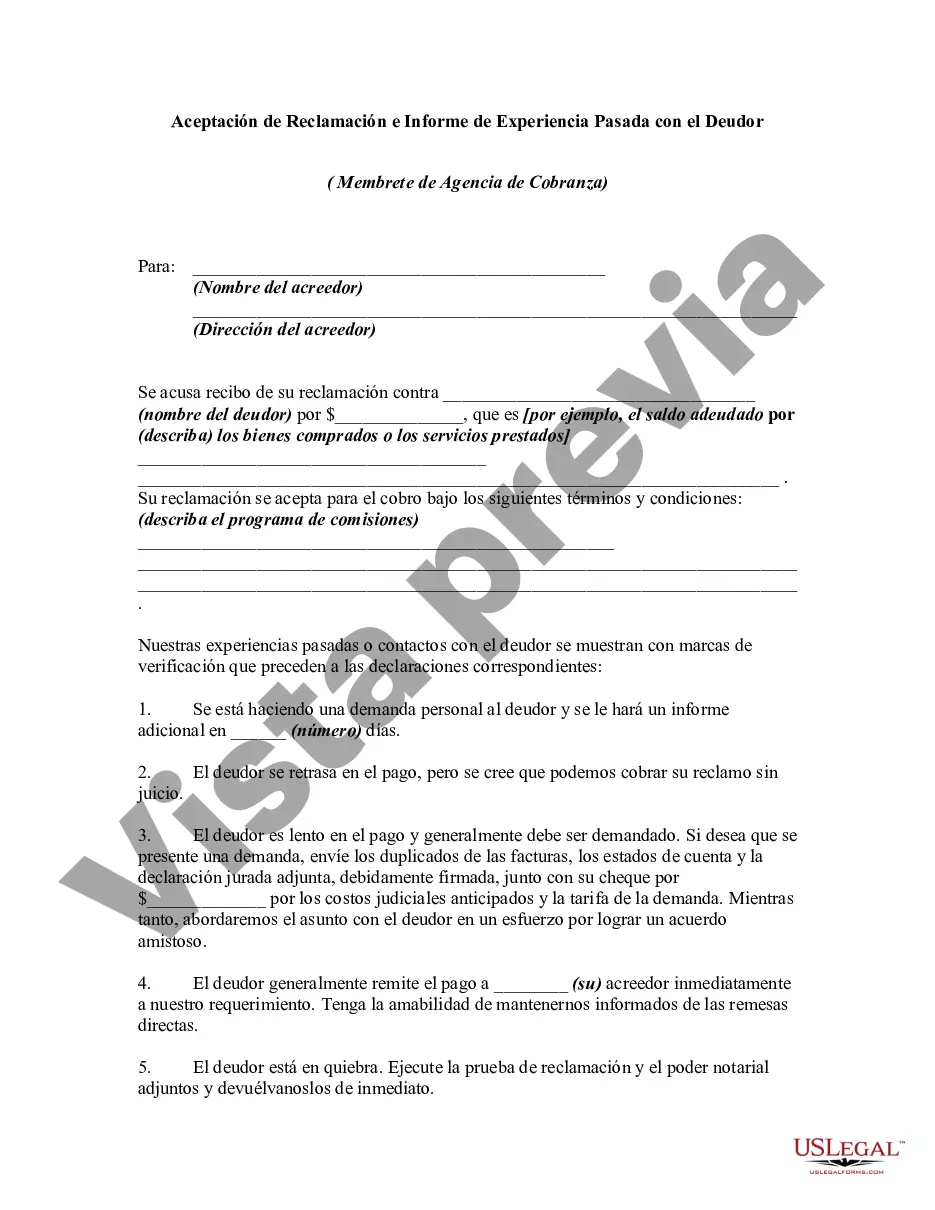

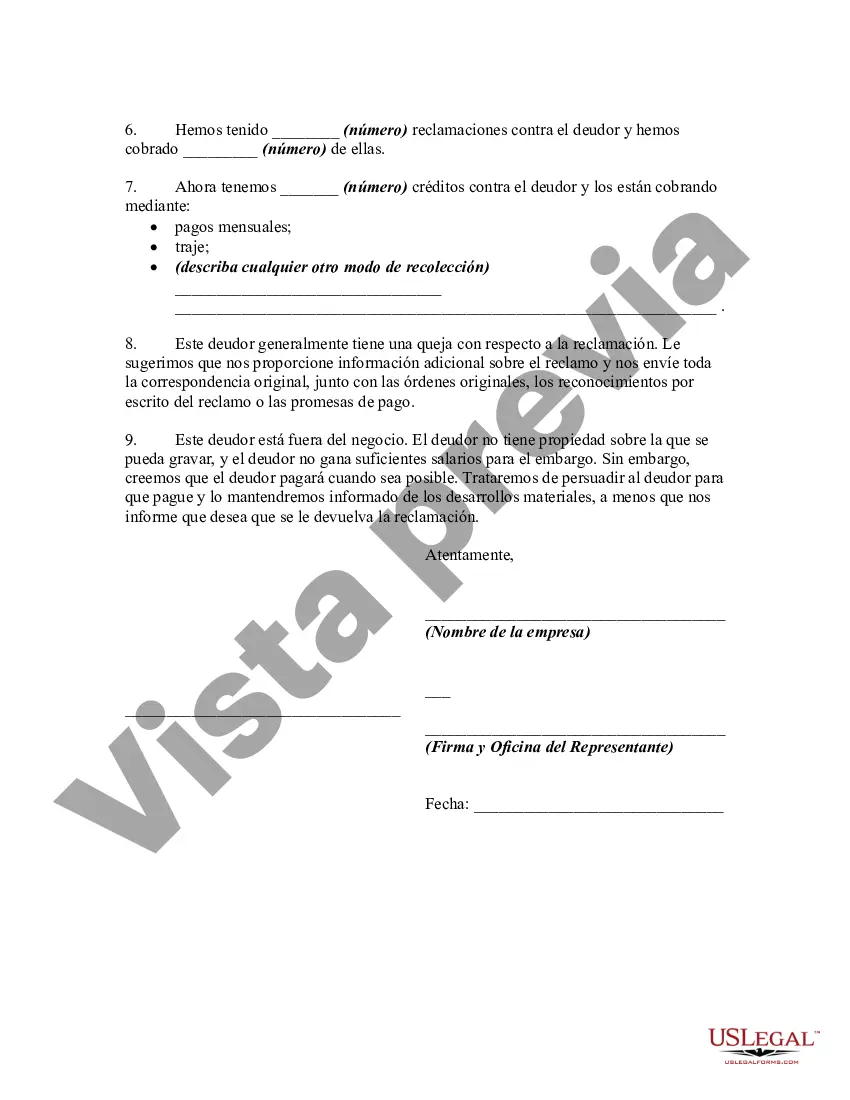

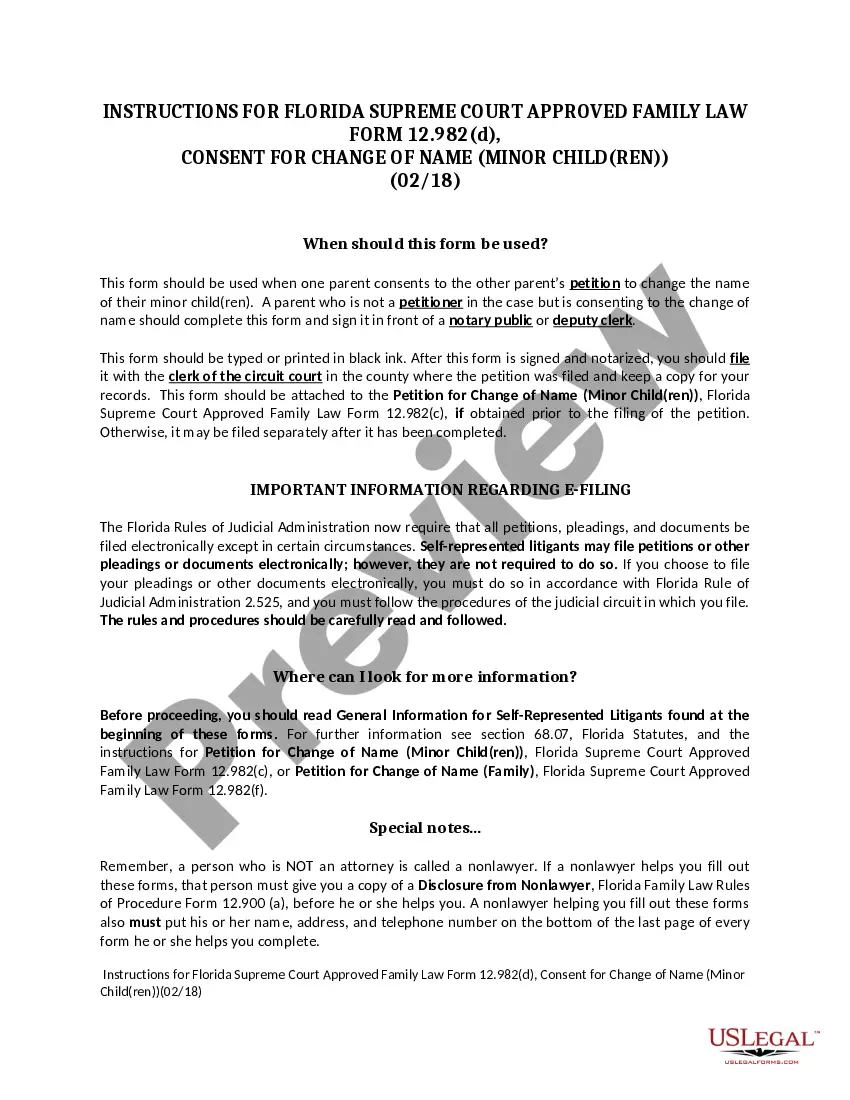

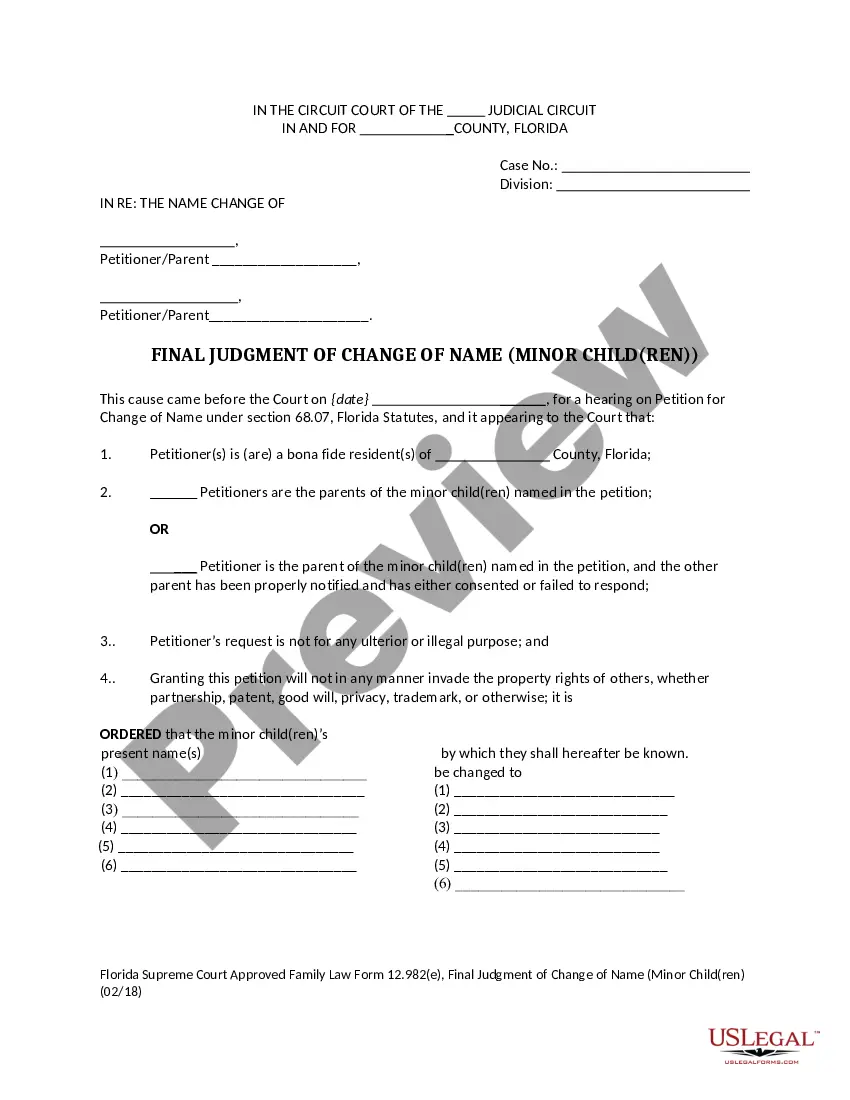

San Diego California Acceptance of Claim and Report of Experience with Debtor is a legal document that is typically used in the process of debt collection or bankruptcy proceedings. This document serves as a formal acknowledgement by a creditor that a claim made by a debtor is valid and has been accepted for consideration. The acceptance of claim section in San Diego California Acceptance of Claim and Report of Experience with Debtor outlines the creditor's agreement to review and evaluate the debt claim submitted by the debtor. It shows that the creditor is willing to assess the legitimacy of the claim and potentially engage in negotiations or settlement discussions. The report of experience with debtor section in San Diego California Acceptance of Claim and Report of Experience with Debtor allows the creditor to provide details about their previous interactions and experiences with the debtor. This may include information about any previous attempts to collect the debt, the debtor's payment history, or any other relevant facts related to their past business relationship. There may be variations or specific types of San Diego California Acceptance of Claim and Report of Experience with Debtor based on the particular circumstances or legal proceedings. Some common variations could include: 1. San Diego California Acceptance of Claim and Report of Experience with Debtor in Bankruptcy Proceedings: This type of acceptance of claim and report is used specifically in cases where the debtor has filed for bankruptcy. It is often required by the bankruptcy court to establish the validity and legitimacy of the claim. 2. San Diego California Acceptance of Claim and Report of Experience with Debtor in Small Claims Court: In small claims court cases in San Diego, this document may be modified to comply with the rules and regulations of the specific court jurisdiction. It outlines the creditor's acceptance of the claim, along with their previous experiences with the debtor, providing crucial information for the court's decision-making process. 3. San Diego California Acceptance of Claim and Report of Experience with Debtor in Commercial Collections: This variation is commonly utilized in cases involving commercial debts. It emphasizes the creditor's acceptance of the claim made by a business entity and includes details regarding the debtor's payment history, creditworthiness, and any previous attempts made by the creditor to collect the debt. In conclusion, San Diego California Acceptance of Claim and Report of Experience with Debtor is a legal document used in debt collection or bankruptcy proceedings. It acknowledges the validity of a debtor's claim and allows the creditor to provide relevant information about their experiences with the debtor. Variations of this document may exist based on specific legal contexts or court jurisdictions.San Diego California Acceptance of Claim and Report of Experience with Debtor is a legal document that is typically used in the process of debt collection or bankruptcy proceedings. This document serves as a formal acknowledgement by a creditor that a claim made by a debtor is valid and has been accepted for consideration. The acceptance of claim section in San Diego California Acceptance of Claim and Report of Experience with Debtor outlines the creditor's agreement to review and evaluate the debt claim submitted by the debtor. It shows that the creditor is willing to assess the legitimacy of the claim and potentially engage in negotiations or settlement discussions. The report of experience with debtor section in San Diego California Acceptance of Claim and Report of Experience with Debtor allows the creditor to provide details about their previous interactions and experiences with the debtor. This may include information about any previous attempts to collect the debt, the debtor's payment history, or any other relevant facts related to their past business relationship. There may be variations or specific types of San Diego California Acceptance of Claim and Report of Experience with Debtor based on the particular circumstances or legal proceedings. Some common variations could include: 1. San Diego California Acceptance of Claim and Report of Experience with Debtor in Bankruptcy Proceedings: This type of acceptance of claim and report is used specifically in cases where the debtor has filed for bankruptcy. It is often required by the bankruptcy court to establish the validity and legitimacy of the claim. 2. San Diego California Acceptance of Claim and Report of Experience with Debtor in Small Claims Court: In small claims court cases in San Diego, this document may be modified to comply with the rules and regulations of the specific court jurisdiction. It outlines the creditor's acceptance of the claim, along with their previous experiences with the debtor, providing crucial information for the court's decision-making process. 3. San Diego California Acceptance of Claim and Report of Experience with Debtor in Commercial Collections: This variation is commonly utilized in cases involving commercial debts. It emphasizes the creditor's acceptance of the claim made by a business entity and includes details regarding the debtor's payment history, creditworthiness, and any previous attempts made by the creditor to collect the debt. In conclusion, San Diego California Acceptance of Claim and Report of Experience with Debtor is a legal document used in debt collection or bankruptcy proceedings. It acknowledges the validity of a debtor's claim and allows the creditor to provide relevant information about their experiences with the debtor. Variations of this document may exist based on specific legal contexts or court jurisdictions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.