No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

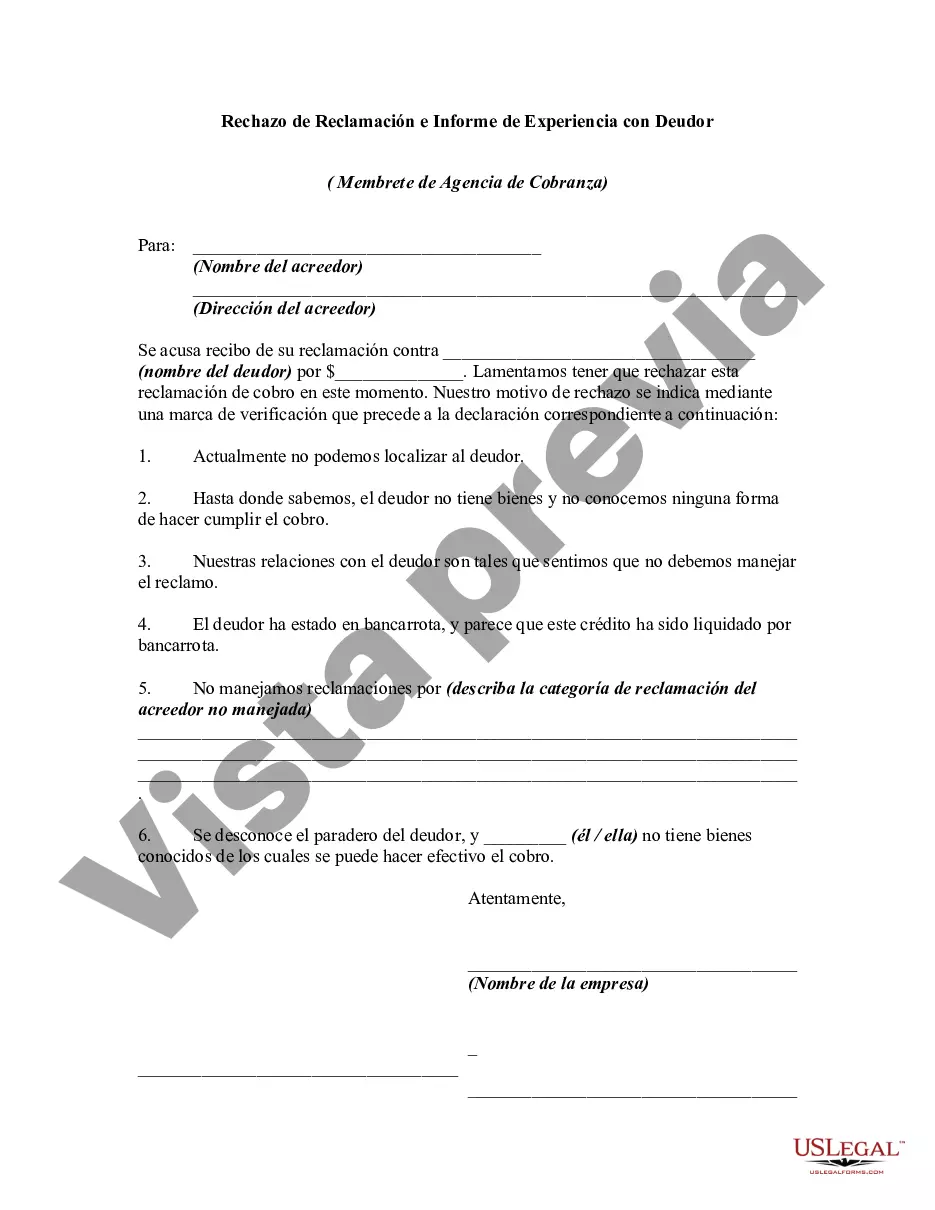

Chicago Illinois Rejection of Claim and Report of Experience with Debtor Chicago Illinois Rejection of Claim: The Chicago Illinois Rejection of Claim is a legal process used in the state of Illinois to dispute and reject a claim made by a creditor against a debtor. It is an important step in the debt collection and legal proceedings, which allows the debtor to challenge the validity or accuracy of the creditor's claim. In Chicago, like in many other jurisdictions, a rejection of claim is typically filed in a court of law, such as the Circuit Court of Cook County, where the debtor resides or where the claim is being pursued. The rejection of claim can be initiated by the debtor or their legal representative to contest the legitimacy of the debt, the amount claimed, or any other relevant aspects. When filing a rejection of claim in Chicago, the debtor must present a well-documented and substantiated argument disproving or challenging the creditor's claim. Supporting evidence, such as financial records, receipts, contracts, or any other relevant documents, should be included to strengthen the debtor's case and provide a compelling defense. Chicago Illinois Report of Experience with Debtor: The Chicago Illinois Report of Experience with Debtor is a document that records the experiences and interactions of a creditor with a debtor, highlighting the debtor's behavior, payment history, and any relevant information that might be useful for future legal proceedings or debt collection activities. This report is typically prepared by the creditor or their designated representative and serves as a detailed account of the debtor's actions, responsiveness, and compliance with payment obligations. It may include information such as missed or late payments, communication records, attempts to evade payment, or any misconduct related to the debt repayment process. Different types of Chicago Illinois Rejection of Claim and Report of Experience with Debtor: 1. Rejection of Claim for Incorrect Amount: This type of rejection is filed when the debtor challenges the accuracy of the claimed amount by the creditor, providing evidence or calculations that prove a different owed sum. 2. Rejection of Claim for Invalid Debt: This type of rejection is filed when the debtor argues that the claimed debt is unauthorized or fraudulent, presenting evidence to support their assertion. 3. Rejection of Claim for Statute of Limitations: In cases where the statute of limitations has expired, the debtor can file a rejection of claim, arguing that the creditor's claim is no longer enforceable. 4. Report of Experience with Debtor for Non-Payment: This type of report details instances of non-payment, missed or late payments, and the general behavior of the debtor regarding fulfilling their financial obligations. 5. Report of Experience with Debtor for Evasive Actions: This report highlights situations where the debtor has attempted to avoid payment or has shown a lack of cooperation throughout the debt collection process. Examples may include changing contact information, refusing to respond to communication attempts, or hiding assets. By utilizing the Chicago Illinois Rejection of Claim and Report of Experience with Debtor processes, debtors and creditors can navigate the legal landscape in a fair and transparent manner, ensuring the resolution of disputes and accurate representation of experiences.Chicago Illinois Rejection of Claim and Report of Experience with Debtor Chicago Illinois Rejection of Claim: The Chicago Illinois Rejection of Claim is a legal process used in the state of Illinois to dispute and reject a claim made by a creditor against a debtor. It is an important step in the debt collection and legal proceedings, which allows the debtor to challenge the validity or accuracy of the creditor's claim. In Chicago, like in many other jurisdictions, a rejection of claim is typically filed in a court of law, such as the Circuit Court of Cook County, where the debtor resides or where the claim is being pursued. The rejection of claim can be initiated by the debtor or their legal representative to contest the legitimacy of the debt, the amount claimed, or any other relevant aspects. When filing a rejection of claim in Chicago, the debtor must present a well-documented and substantiated argument disproving or challenging the creditor's claim. Supporting evidence, such as financial records, receipts, contracts, or any other relevant documents, should be included to strengthen the debtor's case and provide a compelling defense. Chicago Illinois Report of Experience with Debtor: The Chicago Illinois Report of Experience with Debtor is a document that records the experiences and interactions of a creditor with a debtor, highlighting the debtor's behavior, payment history, and any relevant information that might be useful for future legal proceedings or debt collection activities. This report is typically prepared by the creditor or their designated representative and serves as a detailed account of the debtor's actions, responsiveness, and compliance with payment obligations. It may include information such as missed or late payments, communication records, attempts to evade payment, or any misconduct related to the debt repayment process. Different types of Chicago Illinois Rejection of Claim and Report of Experience with Debtor: 1. Rejection of Claim for Incorrect Amount: This type of rejection is filed when the debtor challenges the accuracy of the claimed amount by the creditor, providing evidence or calculations that prove a different owed sum. 2. Rejection of Claim for Invalid Debt: This type of rejection is filed when the debtor argues that the claimed debt is unauthorized or fraudulent, presenting evidence to support their assertion. 3. Rejection of Claim for Statute of Limitations: In cases where the statute of limitations has expired, the debtor can file a rejection of claim, arguing that the creditor's claim is no longer enforceable. 4. Report of Experience with Debtor for Non-Payment: This type of report details instances of non-payment, missed or late payments, and the general behavior of the debtor regarding fulfilling their financial obligations. 5. Report of Experience with Debtor for Evasive Actions: This report highlights situations where the debtor has attempted to avoid payment or has shown a lack of cooperation throughout the debt collection process. Examples may include changing contact information, refusing to respond to communication attempts, or hiding assets. By utilizing the Chicago Illinois Rejection of Claim and Report of Experience with Debtor processes, debtors and creditors can navigate the legal landscape in a fair and transparent manner, ensuring the resolution of disputes and accurate representation of experiences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.