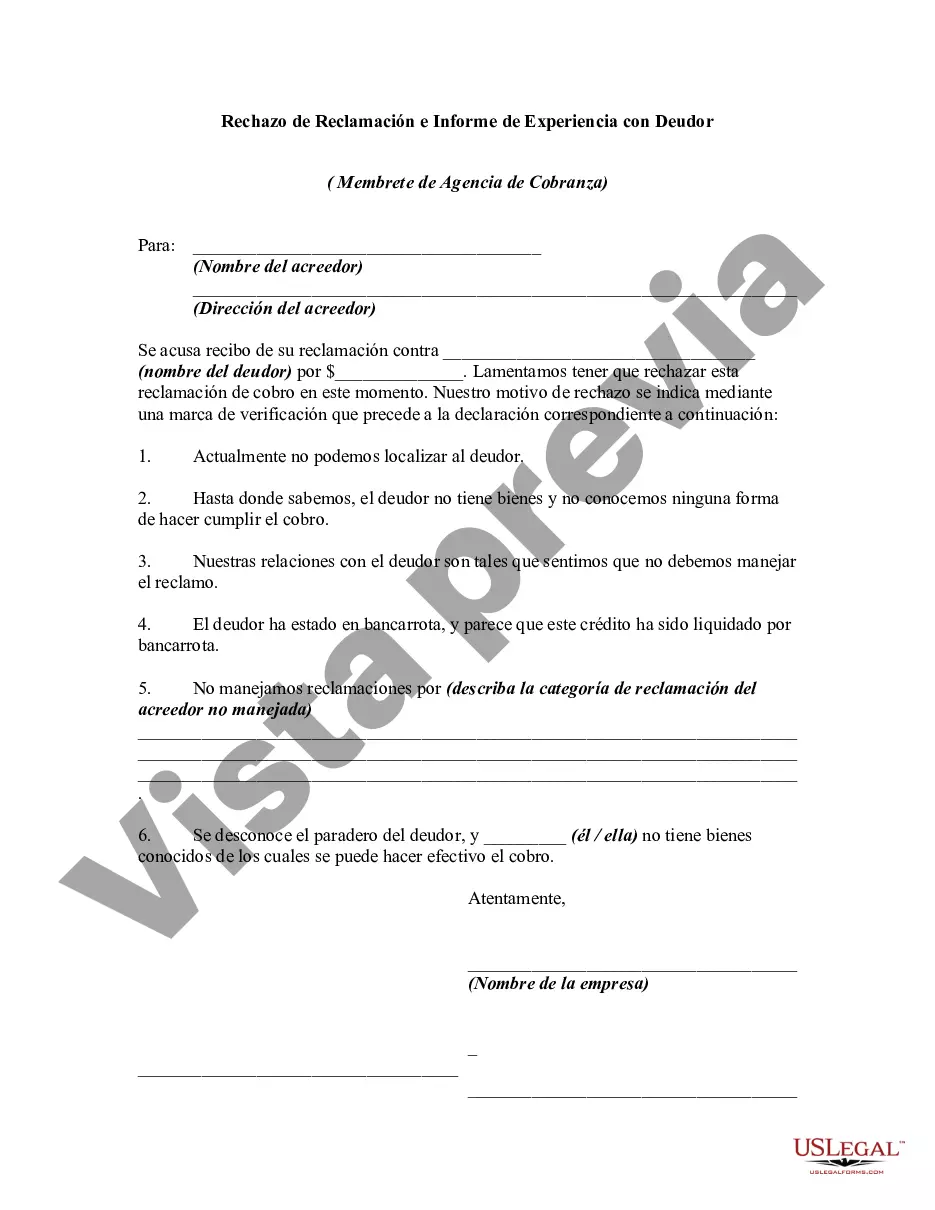

No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

Houston Texas Rejection of Claim and Report of Experience with Debtor is a legal process utilized by creditors when disputing or denying a claim made by a debtor. This procedure allows creditors to outline their reasons for rejecting a debtor's claim and present supporting evidence. In Houston, Texas, there are various types of Rejection of Claim and Report of Experience with Debtor processes, including: 1. Unfounded Claim Rejection: This refers to a situation where a creditor rejects a claim made by a debtor based on evidence suggesting that the claim lacks validity or credibility. The creditor must provide documentation supporting their rejection, such as invoices, contracts, or other relevant proof. 2. Non-compliance Rejection: When a debtor fails to adhere to the agreed-upon terms and conditions of a contract or repayment plan, a creditor may reject their claim based on non-compliance. This could include missed payments, breaches of contract, or failure to provide necessary documentation. 3. Fraudulent Claim Rejection: If a creditor suspects fraudulent activity on the debtor's part, they may reject the claim and report their experience with the debtor. This could involve providing evidence of false information, documentation tampering, or intentional misrepresentation of financial circumstances. 4. Insufficient Evidence Rejection: Creditors may choose to reject a debtor's claim if they find the evidence provided to be insufficient or lacking in authenticity. This rejection type requires the creditor to clearly articulate the reasons for their decision and provide alternative documentation or evidence requirements if necessary. 5. Counterclaim: In some cases, a creditor may reject a debtor's claim and file a counterclaim, asserting that the debtor actually owes them money or has caused damages through their actions. This type of rejection and report involves a more extensive legal process and typically requires thorough documentation and legal representation. It is essential for creditors in Houston, Texas, to follow the appropriate legal procedures when rejecting a debtor's claim and reporting their experience. They must ensure that their rejection is supported by relevant evidence, clearly explaining why the claim is being denied. By adhering to these protocols, creditors can protect their rights and financial interests in cases involving disputed claims and debtors.Houston Texas Rejection of Claim and Report of Experience with Debtor is a legal process utilized by creditors when disputing or denying a claim made by a debtor. This procedure allows creditors to outline their reasons for rejecting a debtor's claim and present supporting evidence. In Houston, Texas, there are various types of Rejection of Claim and Report of Experience with Debtor processes, including: 1. Unfounded Claim Rejection: This refers to a situation where a creditor rejects a claim made by a debtor based on evidence suggesting that the claim lacks validity or credibility. The creditor must provide documentation supporting their rejection, such as invoices, contracts, or other relevant proof. 2. Non-compliance Rejection: When a debtor fails to adhere to the agreed-upon terms and conditions of a contract or repayment plan, a creditor may reject their claim based on non-compliance. This could include missed payments, breaches of contract, or failure to provide necessary documentation. 3. Fraudulent Claim Rejection: If a creditor suspects fraudulent activity on the debtor's part, they may reject the claim and report their experience with the debtor. This could involve providing evidence of false information, documentation tampering, or intentional misrepresentation of financial circumstances. 4. Insufficient Evidence Rejection: Creditors may choose to reject a debtor's claim if they find the evidence provided to be insufficient or lacking in authenticity. This rejection type requires the creditor to clearly articulate the reasons for their decision and provide alternative documentation or evidence requirements if necessary. 5. Counterclaim: In some cases, a creditor may reject a debtor's claim and file a counterclaim, asserting that the debtor actually owes them money or has caused damages through their actions. This type of rejection and report involves a more extensive legal process and typically requires thorough documentation and legal representation. It is essential for creditors in Houston, Texas, to follow the appropriate legal procedures when rejecting a debtor's claim and reporting their experience. They must ensure that their rejection is supported by relevant evidence, clearly explaining why the claim is being denied. By adhering to these protocols, creditors can protect their rights and financial interests in cases involving disputed claims and debtors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.