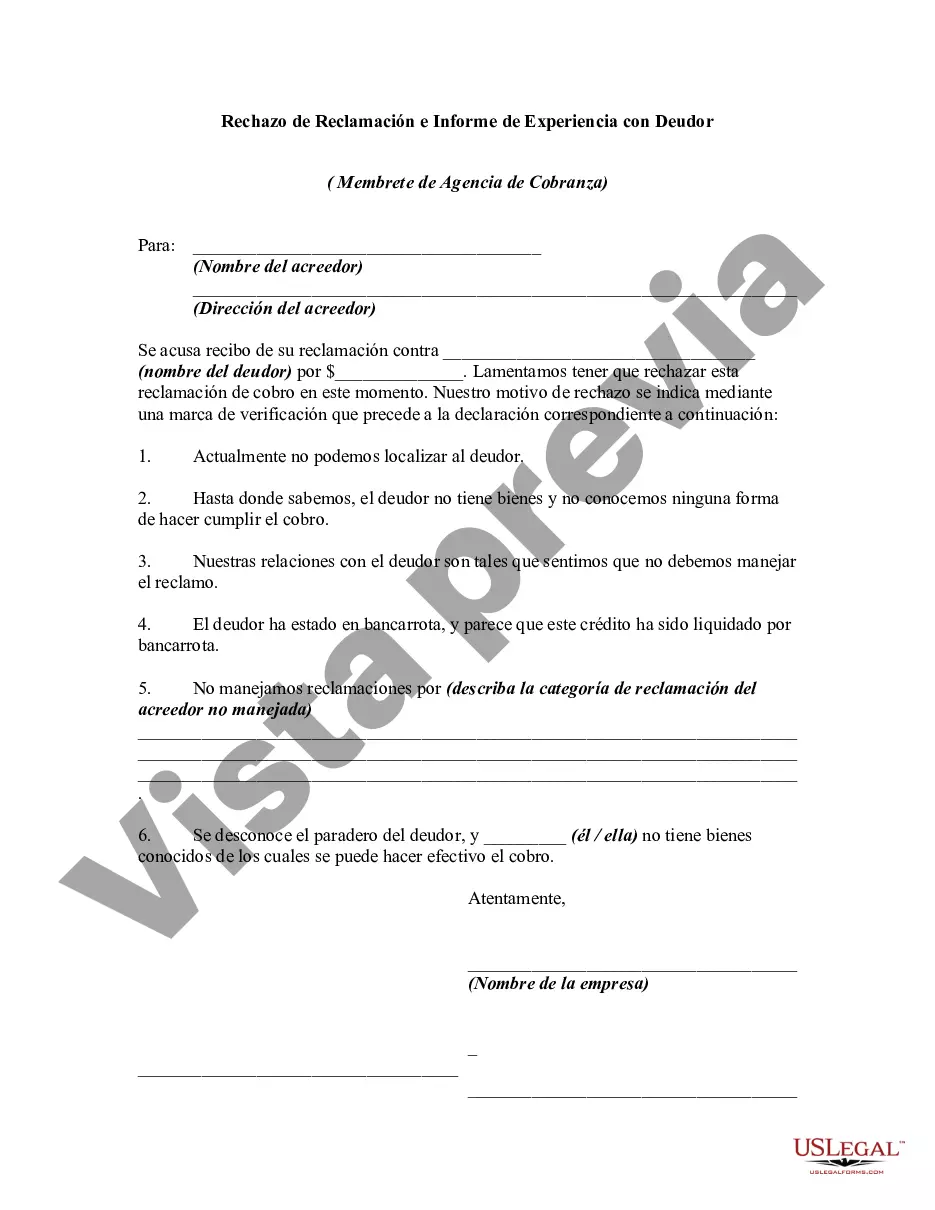

No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

Orange California Rejection of Claim and Report of Experience with Debtor provides a comprehensive framework for individuals or businesses to address and document claim rejections and negative experiences with debtors. These legal processes aim to protect the interests of creditors, ensuring they have a transparent and fair channel to report and resolve issues related to unpaid debts. 1. Orange California Rejection of Claim: The Orange California Rejection of Claim is a formal legal document used to dispute or reject a claim made by a creditor against a debtor. By submitting this document, creditors can outline their reasons for rejecting a claim, often due to insufficient evidence, lack of contractual agreement, or other valid justification. This process ensures that only valid claims are considered for debt resolution. 2. Orange California Report of Experience with Debtor: The Orange California Report of Experience with Debtor is a documentation tool used by creditors to report negative experiences they have had with a debtor. Creditors can express concerns regarding the debtor's financial practices, payment history, credibility, or any other relevant information that may be valuable for others who may extend credit to the same debtor in the future. This report helps fellow creditors make informed decisions about potential business relationships and mitigate potential losses. By utilizing these processes, creditors in Orange, California, can protect their interests and prevent potential financial risks associated with defaulting debtors. Such protocols help maintain transparency within the community, enabling creditors to share their experiences and assist others in making informed decisions about debt recovery. Keywords: Orange California, Rejection of Claim, Report of Experience with Debtor, creditors, claim rejection, unpaid debts, legal document, dispute, evidence, contractual agreement, justification, debt resolution, negative experiences, financial practices, payment history, credibility, potential business relationships, financial risks, defaulting debtors, transparency.Orange California Rejection of Claim and Report of Experience with Debtor provides a comprehensive framework for individuals or businesses to address and document claim rejections and negative experiences with debtors. These legal processes aim to protect the interests of creditors, ensuring they have a transparent and fair channel to report and resolve issues related to unpaid debts. 1. Orange California Rejection of Claim: The Orange California Rejection of Claim is a formal legal document used to dispute or reject a claim made by a creditor against a debtor. By submitting this document, creditors can outline their reasons for rejecting a claim, often due to insufficient evidence, lack of contractual agreement, or other valid justification. This process ensures that only valid claims are considered for debt resolution. 2. Orange California Report of Experience with Debtor: The Orange California Report of Experience with Debtor is a documentation tool used by creditors to report negative experiences they have had with a debtor. Creditors can express concerns regarding the debtor's financial practices, payment history, credibility, or any other relevant information that may be valuable for others who may extend credit to the same debtor in the future. This report helps fellow creditors make informed decisions about potential business relationships and mitigate potential losses. By utilizing these processes, creditors in Orange, California, can protect their interests and prevent potential financial risks associated with defaulting debtors. Such protocols help maintain transparency within the community, enabling creditors to share their experiences and assist others in making informed decisions about debt recovery. Keywords: Orange California, Rejection of Claim, Report of Experience with Debtor, creditors, claim rejection, unpaid debts, legal document, dispute, evidence, contractual agreement, justification, debt resolution, negative experiences, financial practices, payment history, credibility, potential business relationships, financial risks, defaulting debtors, transparency.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.