No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

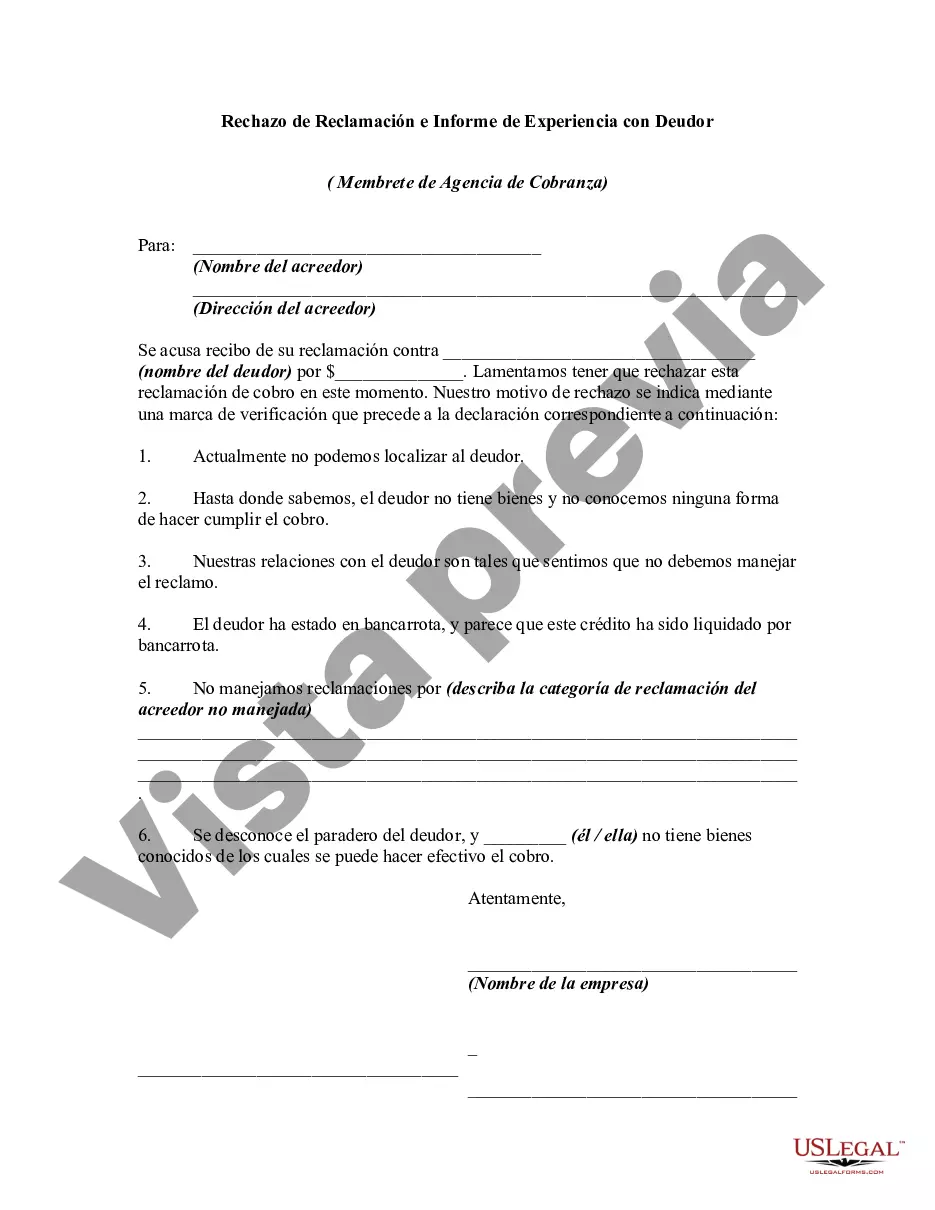

Wake North Carolina Rejection of Claim and Report of Experience with Debtor In Wake County, North Carolina, the Rejection of Claim and Report of Experience with Debtor is an essential legal process that allows creditors and individuals to formally reject a claim made against a debtor. This rejection serves as a crucial step in resolving disputes and protecting the rights of creditors and debtors alike. When a creditor or individual encounters a debtor who fails to meet their financial obligations, they can submit a claim against the debtor to assert their right to payment. However, in some situations, the claim may not be valid, or the creditor may have experienced difficulties in the collection process. In such cases, the Wake North Carolina Rejection of Claim and Report of Experience with Debtor comes into play. There are different types of Wake North Carolina Rejection of Claim and Report of Experience with Debtor, depending on the circumstances and nature of the claim. These include: 1. Disputed Claim Rejection: This type of rejection is used when the creditor contests the legitimacy or accuracy of the claim made by the debtor. It allows the creditor to provide evidence or arguments showing why the claim is not valid. 2. Non-Payment Rejection: When a debtor consistently fails to fulfill their financial obligations, the creditor can reject the claim based on the debtor's history of non-payment. This rejection helps protect the rights of the creditor and presents a clear record of the debtor's behavior. 3. Lack of Valid Documentation Rejection: If a claim lacks proper documentation or supporting evidence, the creditor can reject the claim. This type of rejection emphasizes the importance of thorough and credible documentation when making claims against a debtor. 4. Report of Experience with Debtor: Alongside the rejection of the claim, creditors and individuals can file a Report of Experience with Debtor. This report provides a detailed account of their experiences and interactions with the debtor, offering valuable insights into their financial conduct, payment history, and potential risks involved in future transactions. It is important to note that the Wake North Carolina Rejection of Claim and Report of Experience with Debtor must be filed in compliance with the state's legal procedures and requirements. Filling out the appropriate forms accurately, attaching necessary documents, and adhering to the specified timelines are critical aspects of this process. Overall, the Wake North Carolina Rejection of Claim and Report of Experience with Debtor plays a crucial role in maintaining fairness, transparency, and accountability within financial transactions. By allowing creditors and individuals to reject invalid claims and report their experiences with debtors, this process helps protect the rights of parties involved and contributes to the effective resolution of disputes.Wake North Carolina Rejection of Claim and Report of Experience with Debtor In Wake County, North Carolina, the Rejection of Claim and Report of Experience with Debtor is an essential legal process that allows creditors and individuals to formally reject a claim made against a debtor. This rejection serves as a crucial step in resolving disputes and protecting the rights of creditors and debtors alike. When a creditor or individual encounters a debtor who fails to meet their financial obligations, they can submit a claim against the debtor to assert their right to payment. However, in some situations, the claim may not be valid, or the creditor may have experienced difficulties in the collection process. In such cases, the Wake North Carolina Rejection of Claim and Report of Experience with Debtor comes into play. There are different types of Wake North Carolina Rejection of Claim and Report of Experience with Debtor, depending on the circumstances and nature of the claim. These include: 1. Disputed Claim Rejection: This type of rejection is used when the creditor contests the legitimacy or accuracy of the claim made by the debtor. It allows the creditor to provide evidence or arguments showing why the claim is not valid. 2. Non-Payment Rejection: When a debtor consistently fails to fulfill their financial obligations, the creditor can reject the claim based on the debtor's history of non-payment. This rejection helps protect the rights of the creditor and presents a clear record of the debtor's behavior. 3. Lack of Valid Documentation Rejection: If a claim lacks proper documentation or supporting evidence, the creditor can reject the claim. This type of rejection emphasizes the importance of thorough and credible documentation when making claims against a debtor. 4. Report of Experience with Debtor: Alongside the rejection of the claim, creditors and individuals can file a Report of Experience with Debtor. This report provides a detailed account of their experiences and interactions with the debtor, offering valuable insights into their financial conduct, payment history, and potential risks involved in future transactions. It is important to note that the Wake North Carolina Rejection of Claim and Report of Experience with Debtor must be filed in compliance with the state's legal procedures and requirements. Filling out the appropriate forms accurately, attaching necessary documents, and adhering to the specified timelines are critical aspects of this process. Overall, the Wake North Carolina Rejection of Claim and Report of Experience with Debtor plays a crucial role in maintaining fairness, transparency, and accountability within financial transactions. By allowing creditors and individuals to reject invalid claims and report their experiences with debtors, this process helps protect the rights of parties involved and contributes to the effective resolution of disputes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.