The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects. If the debtor tells the creditor the name of his attorney, any future contacts must be made with the attorney and not with the debtor.

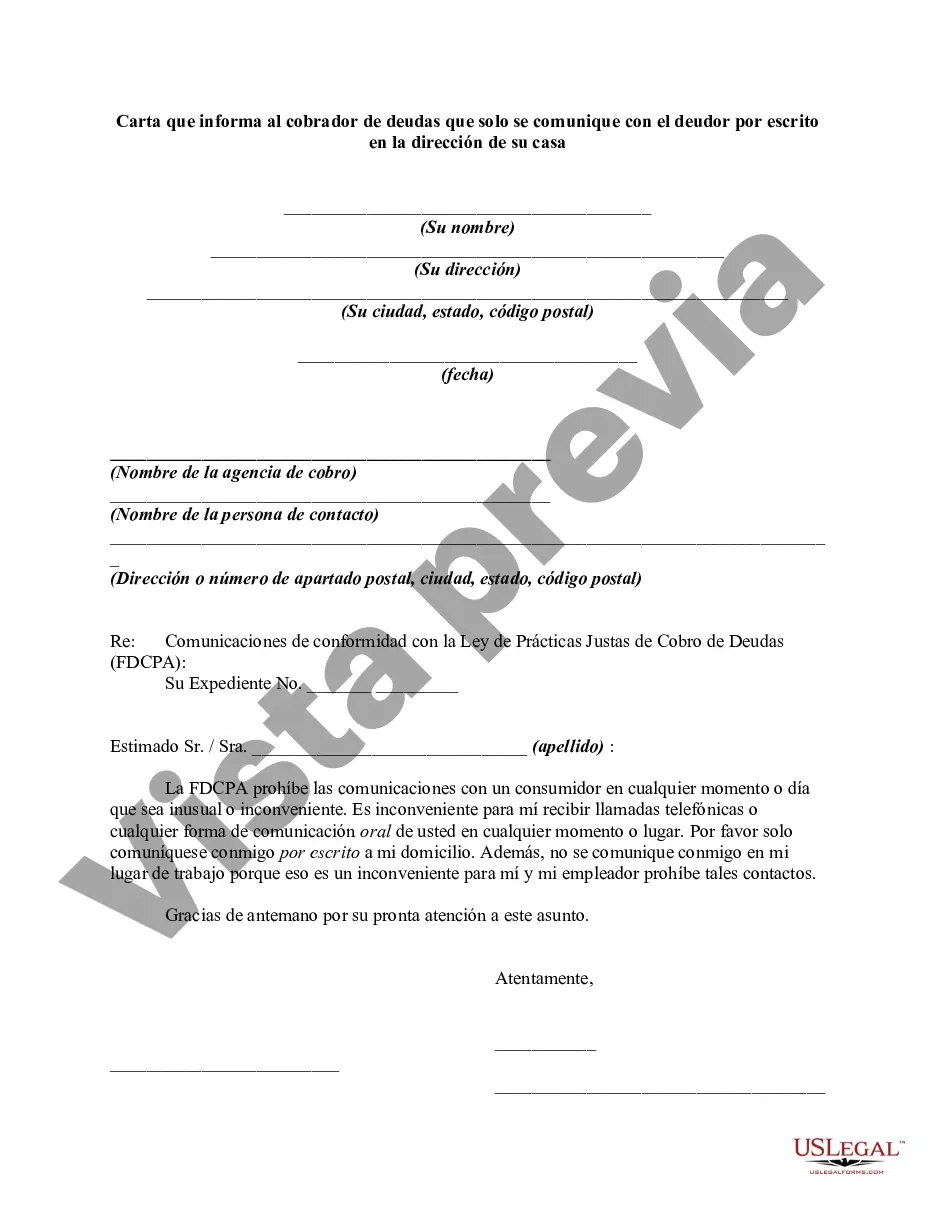

Title: Protecting Your Rights: Contra Costa California Letter Informing Debt Collector to Only Communicate with Debtor in Writing at Debtor's Home Address Introduction: When dealing with debt collection agencies, it is essential to be aware of your rights as a debtor. In Contra Costa, California, individuals have the right to insist that debt collectors communicate with them exclusively in writing at their designated home address. This detailed description will provide you with important information on how to draft a letter ensuring the debt collector complies with your request for written communication at your home address. Content: 1. Overview of Contra Costa California Debt Collection Laws: — Briefly explain the regulations governing debt collection practices in Contra Costa, California, emphasizing the rights of debtors regarding communication preferences. 2. Purpose and Importance of the Letter: — Clarify why it is crucial to notify the debt collector about your preference for written communications only at your home address. — Stress the significance of having a written record of all interactions to protect your rights and maintain accurate documentation. 3. Basic Format and Contents of the Letter: — Provide a general outline of the letter for convenience. — Highlight the main sections that the letter should include. 4. Salient Points to Include in the Letter: — Emphasize the importance of using specific language to assert your rights. — Include relevant keywords, such as "Cease and Desist," "Fair Debt Collection Practices Act (FD CPA)," "written communication only," etc., to ensure the letter is effective. 5. Supporting Legal Information: — Offer references to relevant state or federal laws such as the FD CPA, which protects consumers from unfair debt collection practices. — Mention additional local regulations or specific ordinances that may apply in Contra Costa, California. 6. Possible Variations of the Letter: — Discuss potential circumstances where different types of letters might be necessary, such as situations involving different debt collectors or telephone harassment. — Name and briefly explain each variation, such as "Alternative Letter for Multiple Debt Collectors" or "Letter Requesting Cease of all Telephone Communication." 7. Tips and Recommendations: — Provide practical guidance on how to write an effective and professional letter. — Suggest keeping copies of all correspondence for future reference. — Recommend sending the letter via certified mail with return receipt requested to ensure proof of delivery. 8. Conclusion: — Restate the importance of protecting your rights by requesting written communication only at your home address. — Reiterate the significance of understanding debt collection laws and regulations in Contra Costa, California. Remember, this content aims to educate individuals in Contra Costa, California, about their rights when it comes to debt collection practices and offers guidance on drafting a letter to establish written communication preferences.Title: Protecting Your Rights: Contra Costa California Letter Informing Debt Collector to Only Communicate with Debtor in Writing at Debtor's Home Address Introduction: When dealing with debt collection agencies, it is essential to be aware of your rights as a debtor. In Contra Costa, California, individuals have the right to insist that debt collectors communicate with them exclusively in writing at their designated home address. This detailed description will provide you with important information on how to draft a letter ensuring the debt collector complies with your request for written communication at your home address. Content: 1. Overview of Contra Costa California Debt Collection Laws: — Briefly explain the regulations governing debt collection practices in Contra Costa, California, emphasizing the rights of debtors regarding communication preferences. 2. Purpose and Importance of the Letter: — Clarify why it is crucial to notify the debt collector about your preference for written communications only at your home address. — Stress the significance of having a written record of all interactions to protect your rights and maintain accurate documentation. 3. Basic Format and Contents of the Letter: — Provide a general outline of the letter for convenience. — Highlight the main sections that the letter should include. 4. Salient Points to Include in the Letter: — Emphasize the importance of using specific language to assert your rights. — Include relevant keywords, such as "Cease and Desist," "Fair Debt Collection Practices Act (FD CPA)," "written communication only," etc., to ensure the letter is effective. 5. Supporting Legal Information: — Offer references to relevant state or federal laws such as the FD CPA, which protects consumers from unfair debt collection practices. — Mention additional local regulations or specific ordinances that may apply in Contra Costa, California. 6. Possible Variations of the Letter: — Discuss potential circumstances where different types of letters might be necessary, such as situations involving different debt collectors or telephone harassment. — Name and briefly explain each variation, such as "Alternative Letter for Multiple Debt Collectors" or "Letter Requesting Cease of all Telephone Communication." 7. Tips and Recommendations: — Provide practical guidance on how to write an effective and professional letter. — Suggest keeping copies of all correspondence for future reference. — Recommend sending the letter via certified mail with return receipt requested to ensure proof of delivery. 8. Conclusion: — Restate the importance of protecting your rights by requesting written communication only at your home address. — Reiterate the significance of understanding debt collection laws and regulations in Contra Costa, California. Remember, this content aims to educate individuals in Contra Costa, California, about their rights when it comes to debt collection practices and offers guidance on drafting a letter to establish written communication preferences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.