The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects. If the debtor tells the creditor the name of his attorney, any future contacts must be made with the attorney and not with the debtor.

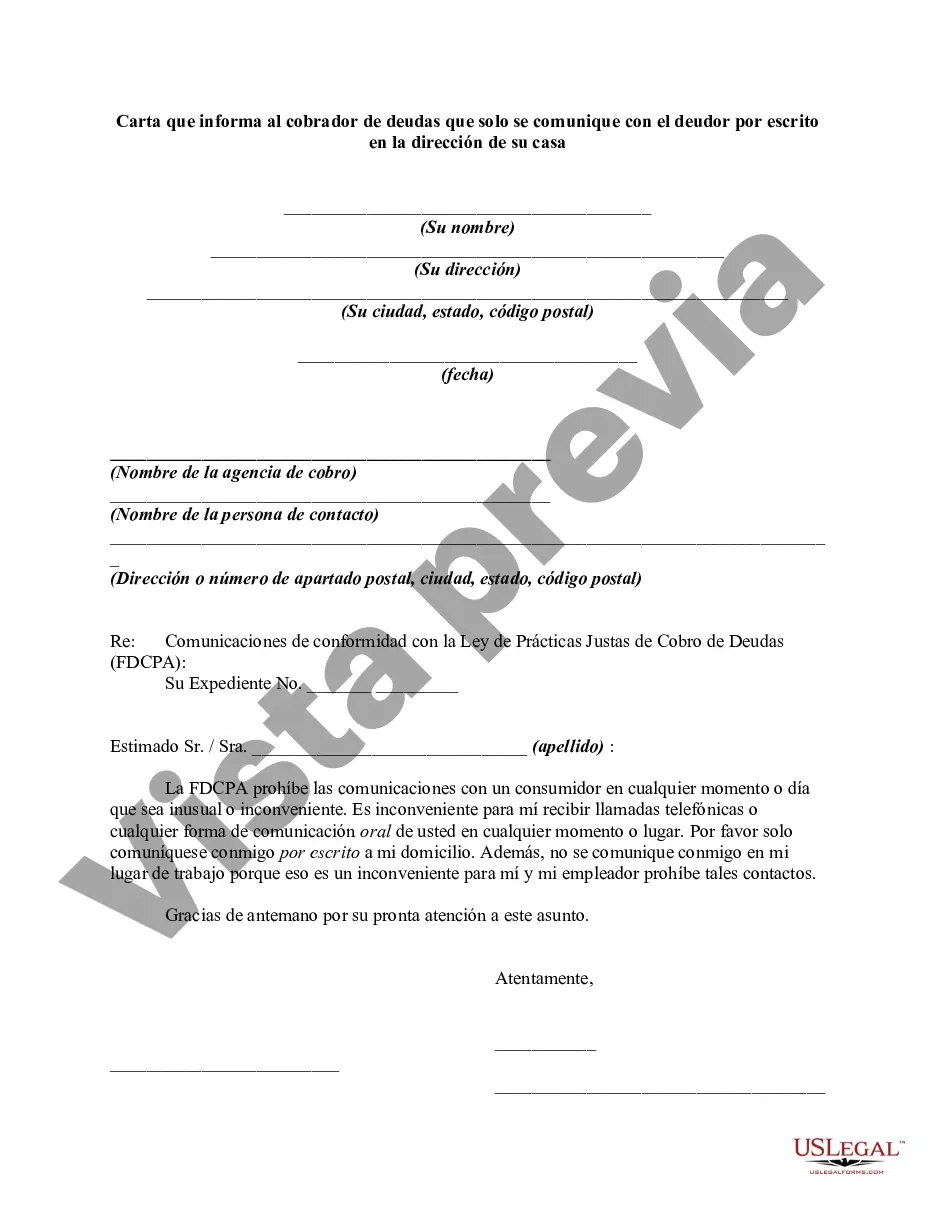

One type of Cook Illinois Letter Informing Debt Collector to only Communicate with Debtor in Writing at Debtor's Home Address is a formal written request made by an individual to a debt collector, specifying that all communication regarding their debt must be done in writing and sent exclusively to their home address. This letter is a common means for individuals to exercise their rights under the Fair Debt Collection Practices Act (FD CPA) and protect themselves from aggressive or frequent contact by debt collectors. In this regard, it is crucial to understand the purpose and importance of such a letter. When dealing with a debt collector, individuals have the right to control the frequency and method of communication. By restricting all communication to written form and designating their home address as the sole location for such correspondence, debtors can maintain better control over their interactions with the debt collector. In a Cook Illinois Letter Informing Debt Collector to only Communicate with Debtor in Writing at Debtor's Home Address, it is crucial to include specific details for clear communication and legal compliance. The letter should typically start with the debtor's name, address, and contact information. It should also mention the name of the debt collection agency, their contact information, and any relevant account or reference numbers associated with the debt. Additionally, the letter should explicitly state that the debtor wishes for all future communication regarding the debt to be in written form only. This can be emphasized by requesting that the debt collector cease all phone calls or personal visits. It is vital to demand that all letters be sent exclusively to the debtor's residential address. To ensure legal enforcement, the letter must include a statement referencing the FD CPA and its provisions that give the debtor the right to control communication methods. Debtors may include a mention of the specific section or provisions they are relying upon to support their request. Lastly, the debtor should request written confirmation of the debt collector's receipt of the letter and their agreement to comply with the requested communication preferences. This written acknowledgment serves as evidence and provides added protection for the debtor in case of any future violations. Overall, a Cook Illinois Letter Informing Debt Collector to only Communicate with Debtor in Writing at Debtor's Home Address empowers individuals to exercise their rights under the FD CPA and ensures they have more control over their financial and personal interactions. By communicating clearly and legally, debtors can establish boundaries and protect themselves from unnecessary stress and harassment.One type of Cook Illinois Letter Informing Debt Collector to only Communicate with Debtor in Writing at Debtor's Home Address is a formal written request made by an individual to a debt collector, specifying that all communication regarding their debt must be done in writing and sent exclusively to their home address. This letter is a common means for individuals to exercise their rights under the Fair Debt Collection Practices Act (FD CPA) and protect themselves from aggressive or frequent contact by debt collectors. In this regard, it is crucial to understand the purpose and importance of such a letter. When dealing with a debt collector, individuals have the right to control the frequency and method of communication. By restricting all communication to written form and designating their home address as the sole location for such correspondence, debtors can maintain better control over their interactions with the debt collector. In a Cook Illinois Letter Informing Debt Collector to only Communicate with Debtor in Writing at Debtor's Home Address, it is crucial to include specific details for clear communication and legal compliance. The letter should typically start with the debtor's name, address, and contact information. It should also mention the name of the debt collection agency, their contact information, and any relevant account or reference numbers associated with the debt. Additionally, the letter should explicitly state that the debtor wishes for all future communication regarding the debt to be in written form only. This can be emphasized by requesting that the debt collector cease all phone calls or personal visits. It is vital to demand that all letters be sent exclusively to the debtor's residential address. To ensure legal enforcement, the letter must include a statement referencing the FD CPA and its provisions that give the debtor the right to control communication methods. Debtors may include a mention of the specific section or provisions they are relying upon to support their request. Lastly, the debtor should request written confirmation of the debt collector's receipt of the letter and their agreement to comply with the requested communication preferences. This written acknowledgment serves as evidence and provides added protection for the debtor in case of any future violations. Overall, a Cook Illinois Letter Informing Debt Collector to only Communicate with Debtor in Writing at Debtor's Home Address empowers individuals to exercise their rights under the FD CPA and ensures they have more control over their financial and personal interactions. By communicating clearly and legally, debtors can establish boundaries and protect themselves from unnecessary stress and harassment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.