The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects. If the debtor tells the creditor the name of his attorney, any future contacts must be made with the attorney and not with the debtor.

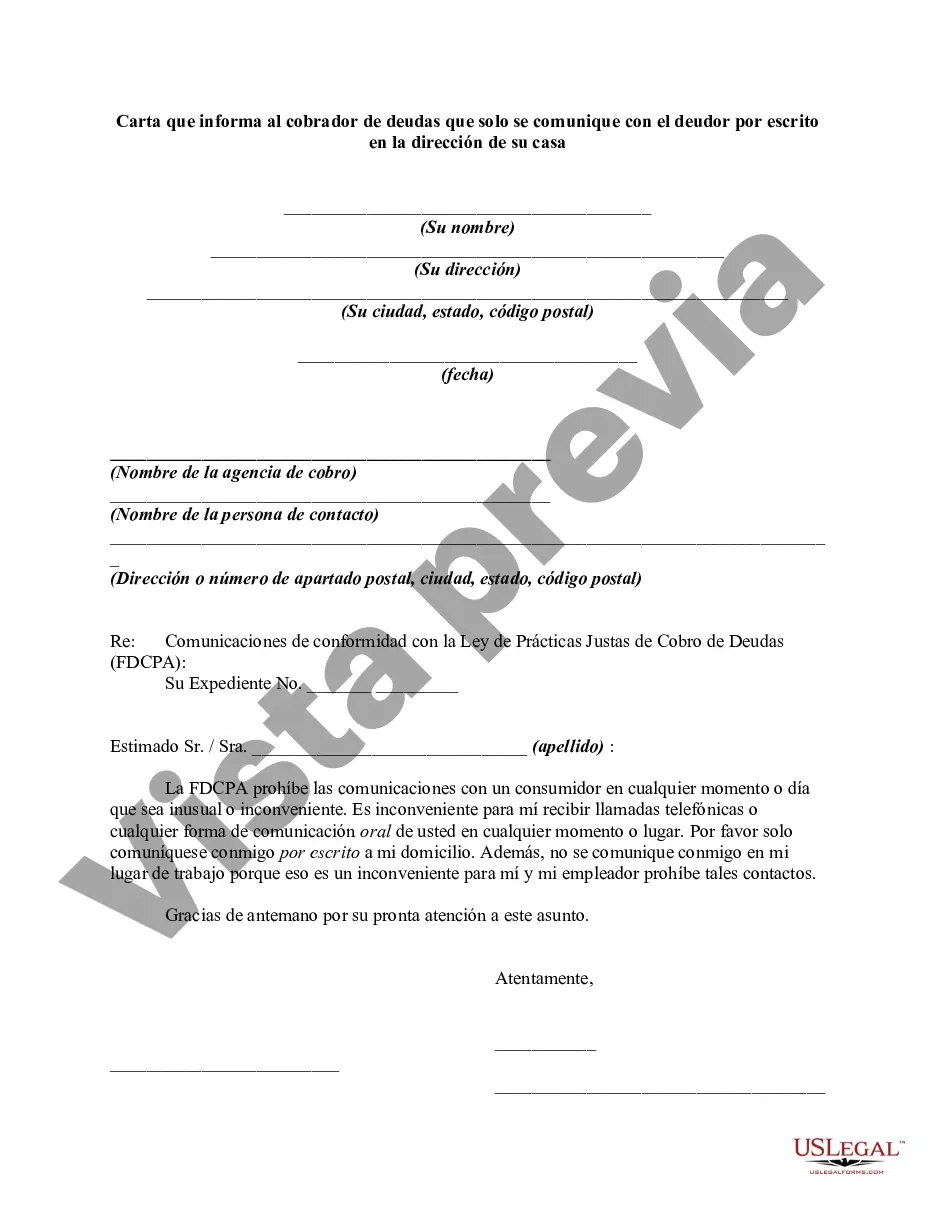

Title: Harris Texas Letter Informing Debt Collector to Only Communicate with Debtor in Writing at Debtor's Home Address Introduction: In the state of Texas, individuals have certain rights when it comes to debt collection practices. One such right is the ability to notify debt collectors in writing to communicate with the debtor solely through written means at their home address. This article aims to provide a detailed description of the Harris Texas Letter Informing Debt Collector to only Communicate with Debtor in Writing at Debtor's Home Address, including its purpose, key information to include, and potential variations of this letter. Purpose of the Letter: The Harris Texas Letter Informing Debt Collector to only Communicate with Debtor in Writing at Debtor's Home Address serves a vital purpose of notifying debt collectors of the debtor's preference to communicate solely through written means. By sending this letter, the debtor can exercise their legal right to prevent unwanted or harassing phone calls and ensure that all communication is done in writing, providing a documented record of interactions. Key Elements to Include in the Letter: 1. Debtor's Information: Begin by stating the debtor's full name, current address, and any additional contact information required to identify the debtor. 2. Debt Collector's Information: Identify the debt collection agency by providing their full name, address, and any relevant identification numbers associated with the debt. 3. Statement of Intention: Clearly state the debtor's intention to communicate exclusively through written means concerning the debt in question. Request a cessation of all forms of communication via telephone, text, or electronic means. 4. Home Address: Explicitly provide the exact home address where the debtor requests all future written communications to be sent. Double-check the accuracy of the address to avoid miscommunication. 5. Certification Statement: Include a statement where the debtor certifies that the information provided in the letter is accurate to the best of their knowledge. 6. Request for Confirmation: Ask the debt collector to acknowledge receipt of the letter and their agreement to adhere to the debtor's preferred method of communication. Potential Variations of the Letter: 1. Verification of Debt Variation: In cases where the debtor wishes to dispute the validity of the debt, it may be necessary to include a section requesting the debt collector to provide legal verification of the debt in question. This variation asserts the debtor's right to receive proper documentation and can protect them from potential unlawful practices. 2. Cease and Desist Variation: If the debtor is experiencing persistent harassment or unfair practices by a debt collector, a cease and desist variation can be included. This variation explicitly demands the debt collector to cease any form of communication with the debtor altogether. 3. Legal Representation Variation: In situations where the debtor has enlisted legal representation, it is crucial to inform the debt collector of this fact. This variation ensures that communication will be directed solely to the debtor's legal representative, preserving their client's rights within the legal process. Conclusion: The Harris Texas Letter Informing Debt Collector to only Communicate with Debtor in Writing at Debtor's Home Address allows debtors in Texas to exercise their rights and preferences concerning debt collection communication. By providing a thorough and detailed letter, debtors can protect themselves from unwanted harassment, maintain a clear record of communication, and assert their rights under Texas law.Title: Harris Texas Letter Informing Debt Collector to Only Communicate with Debtor in Writing at Debtor's Home Address Introduction: In the state of Texas, individuals have certain rights when it comes to debt collection practices. One such right is the ability to notify debt collectors in writing to communicate with the debtor solely through written means at their home address. This article aims to provide a detailed description of the Harris Texas Letter Informing Debt Collector to only Communicate with Debtor in Writing at Debtor's Home Address, including its purpose, key information to include, and potential variations of this letter. Purpose of the Letter: The Harris Texas Letter Informing Debt Collector to only Communicate with Debtor in Writing at Debtor's Home Address serves a vital purpose of notifying debt collectors of the debtor's preference to communicate solely through written means. By sending this letter, the debtor can exercise their legal right to prevent unwanted or harassing phone calls and ensure that all communication is done in writing, providing a documented record of interactions. Key Elements to Include in the Letter: 1. Debtor's Information: Begin by stating the debtor's full name, current address, and any additional contact information required to identify the debtor. 2. Debt Collector's Information: Identify the debt collection agency by providing their full name, address, and any relevant identification numbers associated with the debt. 3. Statement of Intention: Clearly state the debtor's intention to communicate exclusively through written means concerning the debt in question. Request a cessation of all forms of communication via telephone, text, or electronic means. 4. Home Address: Explicitly provide the exact home address where the debtor requests all future written communications to be sent. Double-check the accuracy of the address to avoid miscommunication. 5. Certification Statement: Include a statement where the debtor certifies that the information provided in the letter is accurate to the best of their knowledge. 6. Request for Confirmation: Ask the debt collector to acknowledge receipt of the letter and their agreement to adhere to the debtor's preferred method of communication. Potential Variations of the Letter: 1. Verification of Debt Variation: In cases where the debtor wishes to dispute the validity of the debt, it may be necessary to include a section requesting the debt collector to provide legal verification of the debt in question. This variation asserts the debtor's right to receive proper documentation and can protect them from potential unlawful practices. 2. Cease and Desist Variation: If the debtor is experiencing persistent harassment or unfair practices by a debt collector, a cease and desist variation can be included. This variation explicitly demands the debt collector to cease any form of communication with the debtor altogether. 3. Legal Representation Variation: In situations where the debtor has enlisted legal representation, it is crucial to inform the debt collector of this fact. This variation ensures that communication will be directed solely to the debtor's legal representative, preserving their client's rights within the legal process. Conclusion: The Harris Texas Letter Informing Debt Collector to only Communicate with Debtor in Writing at Debtor's Home Address allows debtors in Texas to exercise their rights and preferences concerning debt collection communication. By providing a thorough and detailed letter, debtors can protect themselves from unwanted harassment, maintain a clear record of communication, and assert their rights under Texas law.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.