The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects. If the debtor tells the creditor the name of his attorney, any future contacts must be made with the attorney and not with the debtor.

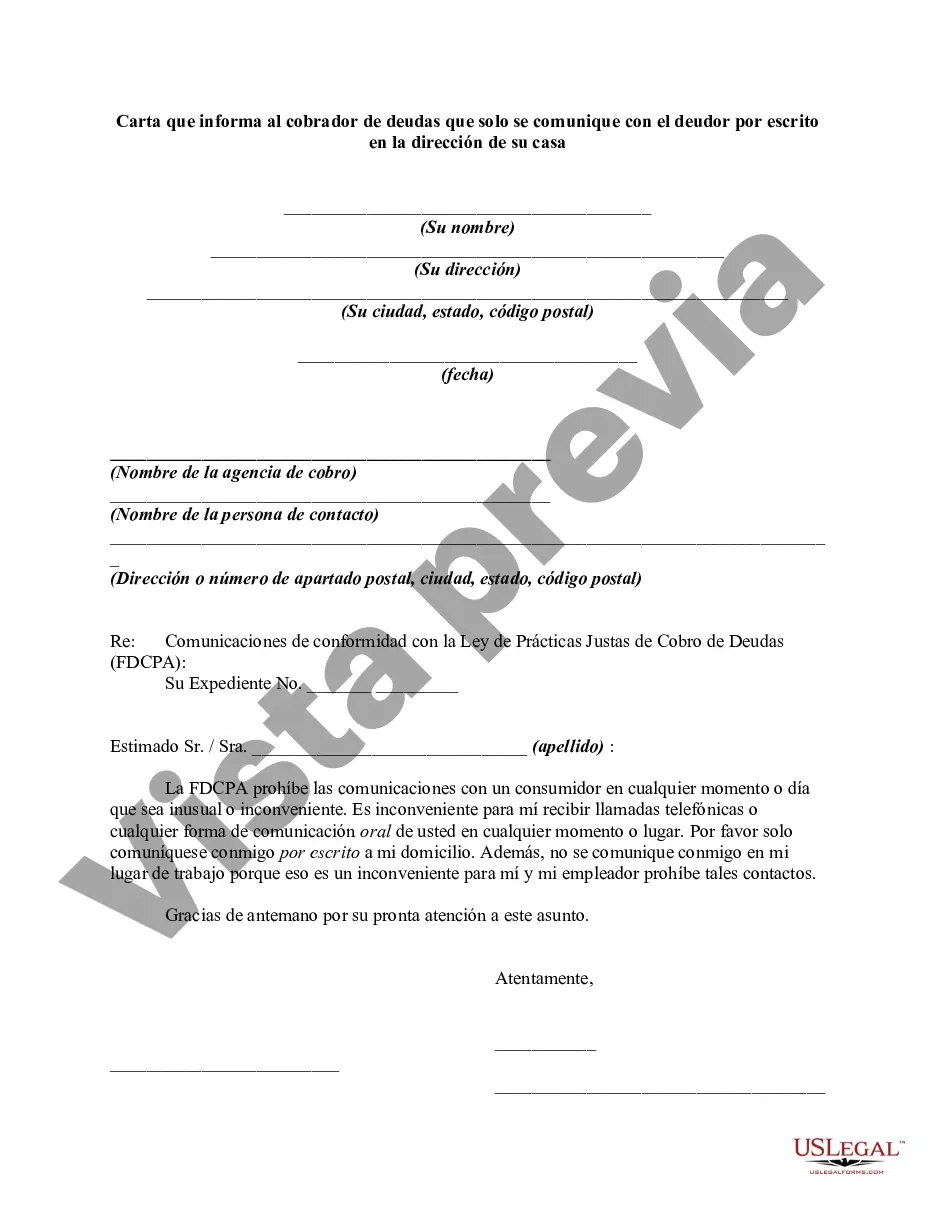

Title: Mecklenburg, North Carolina: Ensuring Debt Collection Communication Compliance Introduction: In Mecklenburg County, North Carolina, individuals have the right to control how debt collectors communicate with them. This detailed description will outline the contents of a letter that debtors can use to inform debt collectors to only communicate with them in writing at their home address. By utilizing relevant keywords, this article aims to provide a comprehensive understanding of this legal protection provided to Mecklenburg residents. Key Elements of a Mecklenburg, North Carolina Debt Collection Communication Letter: 1. Header: Clearly address the letter to the debt collector, including their full name, company name, and complete mailing address. Use the following format: [Debt Collector's Full Name] [Debt Collector's Company Name] [Debt Collector's Mailing Address] 2. Salutation: Begin the letter with a professional salutation, addressing the debt collector(s) by name, if available. Use "To whom it may concern," if the specific names are unknown. 3. Identifying Information: Provide your full legal name, address, and contact information. State the purpose of the communication in the first paragraph to ensure clarity. 4. Debt Validation Request: Request written verification of the debt being collected. Include the account or reference number if available. Use the following language as an example: "I am hereby requesting that you provide written verification of the debt you are attempting to collect. Please provide me with detailed information, including the original creditor's name, the amount owed, and any relevant documentation supporting the existence and validity of this debt." 5. Communication Restriction Statement: Assert your rights to control how debt collectors communicate with you. Use direct and explicit wording to prevent unwanted phone calls or in-person visits. Example statement: "I am invoking my rights under the Fair Debt Collection Practices Act (FD CPA) to request that all future communications regarding this debt be conducted exclusively in writing at my home address, as provided below. I prohibit any attempts to contact me through telephone calls or in-person visits." 6. Signature Block: Sign the letter with your full name and date of signing. Below your signature, include your printed name for clarity. 7. Enclosures: If applicable, reference any enclosed documentation related to the debt, such as copies of previous communications or a copy of the debt validation request. Different Types of Mecklenburg, North Carolina Debt Collection Communication Letters: 1. Initial Communication Restriction: A letter to be sent to debt collectors after the first communication received, asserting the debtor's communication preferences. 2. Cease and Desist: A letter to be used if the debtor wishes to entirely cease communication with the debt collector. This type of letter should be sent if the debtor believes the debt is invalid, outdated, or if communication is causing emotional distress. 3. Restriction Modification: A letter to be sent if the debtor wishes to modify their communication preferences or allow alternative means of communication, such as email or fax. Conclusion: Living in Mecklenburg, North Carolina grants individuals the right to control debt collectors' communication methods. By utilizing a well-crafted letter, debtors can assert their preferences to only communicate in writing at their home address, ensuring compliance with their legal protections. Choose the appropriate letter type based on your specific circumstances to effectively handle debt collection communications.Title: Mecklenburg, North Carolina: Ensuring Debt Collection Communication Compliance Introduction: In Mecklenburg County, North Carolina, individuals have the right to control how debt collectors communicate with them. This detailed description will outline the contents of a letter that debtors can use to inform debt collectors to only communicate with them in writing at their home address. By utilizing relevant keywords, this article aims to provide a comprehensive understanding of this legal protection provided to Mecklenburg residents. Key Elements of a Mecklenburg, North Carolina Debt Collection Communication Letter: 1. Header: Clearly address the letter to the debt collector, including their full name, company name, and complete mailing address. Use the following format: [Debt Collector's Full Name] [Debt Collector's Company Name] [Debt Collector's Mailing Address] 2. Salutation: Begin the letter with a professional salutation, addressing the debt collector(s) by name, if available. Use "To whom it may concern," if the specific names are unknown. 3. Identifying Information: Provide your full legal name, address, and contact information. State the purpose of the communication in the first paragraph to ensure clarity. 4. Debt Validation Request: Request written verification of the debt being collected. Include the account or reference number if available. Use the following language as an example: "I am hereby requesting that you provide written verification of the debt you are attempting to collect. Please provide me with detailed information, including the original creditor's name, the amount owed, and any relevant documentation supporting the existence and validity of this debt." 5. Communication Restriction Statement: Assert your rights to control how debt collectors communicate with you. Use direct and explicit wording to prevent unwanted phone calls or in-person visits. Example statement: "I am invoking my rights under the Fair Debt Collection Practices Act (FD CPA) to request that all future communications regarding this debt be conducted exclusively in writing at my home address, as provided below. I prohibit any attempts to contact me through telephone calls or in-person visits." 6. Signature Block: Sign the letter with your full name and date of signing. Below your signature, include your printed name for clarity. 7. Enclosures: If applicable, reference any enclosed documentation related to the debt, such as copies of previous communications or a copy of the debt validation request. Different Types of Mecklenburg, North Carolina Debt Collection Communication Letters: 1. Initial Communication Restriction: A letter to be sent to debt collectors after the first communication received, asserting the debtor's communication preferences. 2. Cease and Desist: A letter to be used if the debtor wishes to entirely cease communication with the debt collector. This type of letter should be sent if the debtor believes the debt is invalid, outdated, or if communication is causing emotional distress. 3. Restriction Modification: A letter to be sent if the debtor wishes to modify their communication preferences or allow alternative means of communication, such as email or fax. Conclusion: Living in Mecklenburg, North Carolina grants individuals the right to control debt collectors' communication methods. By utilizing a well-crafted letter, debtors can assert their preferences to only communicate in writing at their home address, ensuring compliance with their legal protections. Choose the appropriate letter type based on your specific circumstances to effectively handle debt collection communications.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.