The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects. If the debtor tells the creditor the name of his attorney, any future contacts must be made with the attorney and not with the debtor.

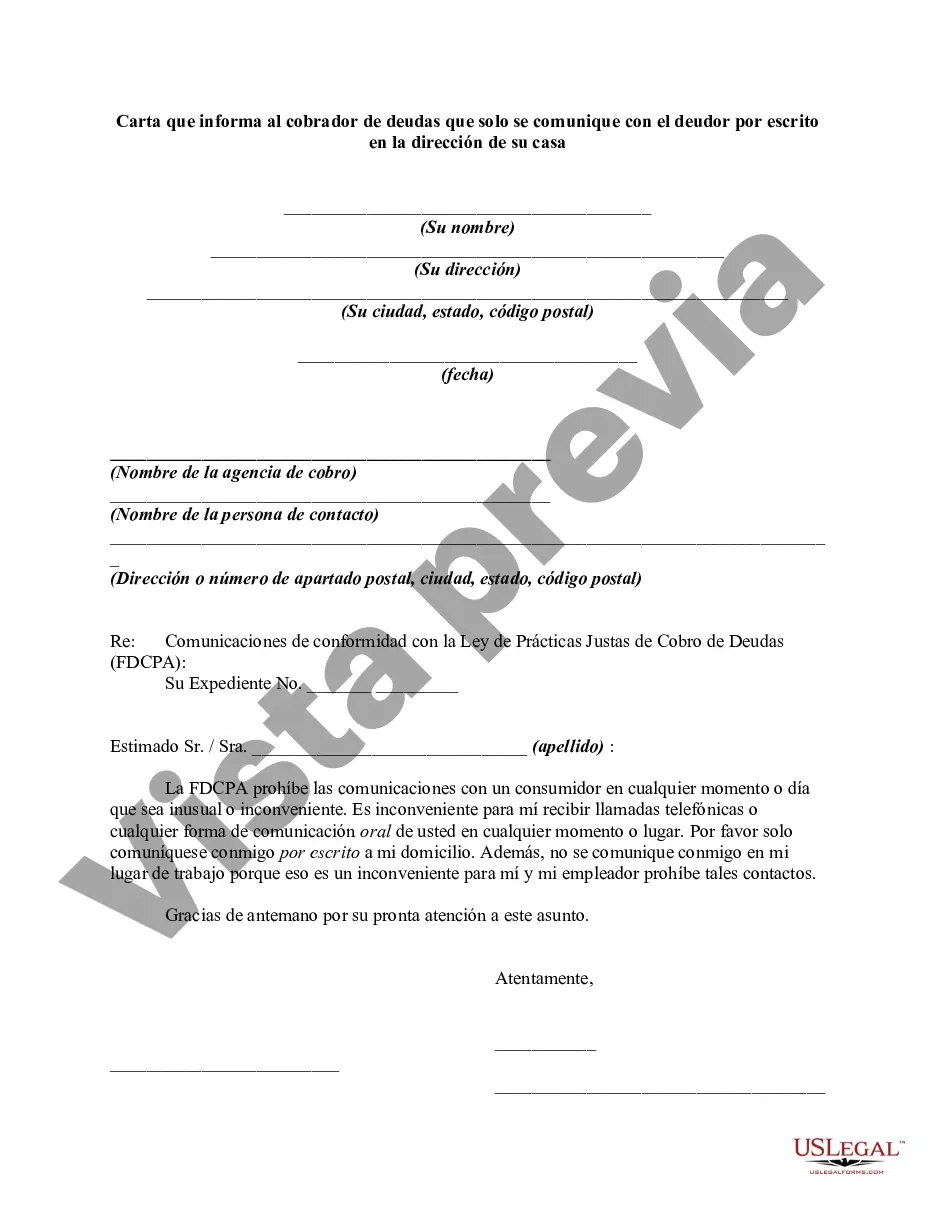

Miami-Dade Florida is a populous county in the southeastern part of the state, encompassing Miami and its surrounding areas. Known for its beautiful beaches, vibrant nightlife, and diverse culture, Miami-Dade is a popular destination for tourists and a melting pot of various ethnicities and nationalities. When it comes to managing debt collection, it is crucial for debtors in Miami-Dade to be aware of their rights and take appropriate actions to protect themselves. One effective way to exercise control over communication with debt collectors is by sending a letter instructing them to only communicate in writing and solely to the debtor's home address. The purpose of a "Miami-Dade Florida Letter Informing Debt Collector to only Communicate with Debtor in Writing at Debtor's Home Address" is to establish clear guidelines for debt collectors, emphasizing the debtor's preference for written communication and ensuring that all communication occurs exclusively through mail to the debtor's residence. Keywords: Miami-Dade Florida, debtor, debt collector, communication, writing, home address, letter, debt collection, rights, instruction, guidelines. Different types of "Miami-Dade Florida Letter Informing Debt Collector to only Communicate with Debtor in Writing at Debtor's Home Address" may include: 1. Standard Letter Template: A generic template that can be used by any debtor in Miami-Dade, allowing them to assert their preferences and inform debt collectors of their communication preferences from the comfort of their home. 2. Certified Mail Letter: This type of letter includes the added security of utilizing certified mail, providing proof of mailing and delivery. This ensures that the debtor has accurate records in case any disputes or legal issues arise. 3. Legal Assistance Letter: In some cases, debtors may require legal assistance when dealing with debt collectors. This type of letter can be drafted by a legal professional, ensuring that all necessary information is included and that the debtor's rights are protected throughout the communication process. 4. Cease and Desist Letter: If a debtor wishes to halt all communication with a particular debt collector, they may opt for a "Cease and Desist Letter." This type of letter demands that the debt collector immediately stop communicating with the debtor entirely. 5. Debt Validation Letter: A debt validation letter is sent by a debtor to a debt collector to request verification of the debt's legitimacy. This letter ensures that the debtor is not being wrongfully pursued for a debt they do not owe, and can also help in negotiating a settlement or payment plan. These various types of letters provide debtors in Miami-Dade Florida with the tools to assert their rights and take control of their communication with debt collectors. By exercising these rights, debtors can minimize potential harassment and protect themselves from any unfair practices.Miami-Dade Florida is a populous county in the southeastern part of the state, encompassing Miami and its surrounding areas. Known for its beautiful beaches, vibrant nightlife, and diverse culture, Miami-Dade is a popular destination for tourists and a melting pot of various ethnicities and nationalities. When it comes to managing debt collection, it is crucial for debtors in Miami-Dade to be aware of their rights and take appropriate actions to protect themselves. One effective way to exercise control over communication with debt collectors is by sending a letter instructing them to only communicate in writing and solely to the debtor's home address. The purpose of a "Miami-Dade Florida Letter Informing Debt Collector to only Communicate with Debtor in Writing at Debtor's Home Address" is to establish clear guidelines for debt collectors, emphasizing the debtor's preference for written communication and ensuring that all communication occurs exclusively through mail to the debtor's residence. Keywords: Miami-Dade Florida, debtor, debt collector, communication, writing, home address, letter, debt collection, rights, instruction, guidelines. Different types of "Miami-Dade Florida Letter Informing Debt Collector to only Communicate with Debtor in Writing at Debtor's Home Address" may include: 1. Standard Letter Template: A generic template that can be used by any debtor in Miami-Dade, allowing them to assert their preferences and inform debt collectors of their communication preferences from the comfort of their home. 2. Certified Mail Letter: This type of letter includes the added security of utilizing certified mail, providing proof of mailing and delivery. This ensures that the debtor has accurate records in case any disputes or legal issues arise. 3. Legal Assistance Letter: In some cases, debtors may require legal assistance when dealing with debt collectors. This type of letter can be drafted by a legal professional, ensuring that all necessary information is included and that the debtor's rights are protected throughout the communication process. 4. Cease and Desist Letter: If a debtor wishes to halt all communication with a particular debt collector, they may opt for a "Cease and Desist Letter." This type of letter demands that the debt collector immediately stop communicating with the debtor entirely. 5. Debt Validation Letter: A debt validation letter is sent by a debtor to a debt collector to request verification of the debt's legitimacy. This letter ensures that the debtor is not being wrongfully pursued for a debt they do not owe, and can also help in negotiating a settlement or payment plan. These various types of letters provide debtors in Miami-Dade Florida with the tools to assert their rights and take control of their communication with debt collectors. By exercising these rights, debtors can minimize potential harassment and protect themselves from any unfair practices.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.