The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects. If the debtor tells the creditor the name of his attorney, any future contacts must be made with the attorney and not with the debtor.

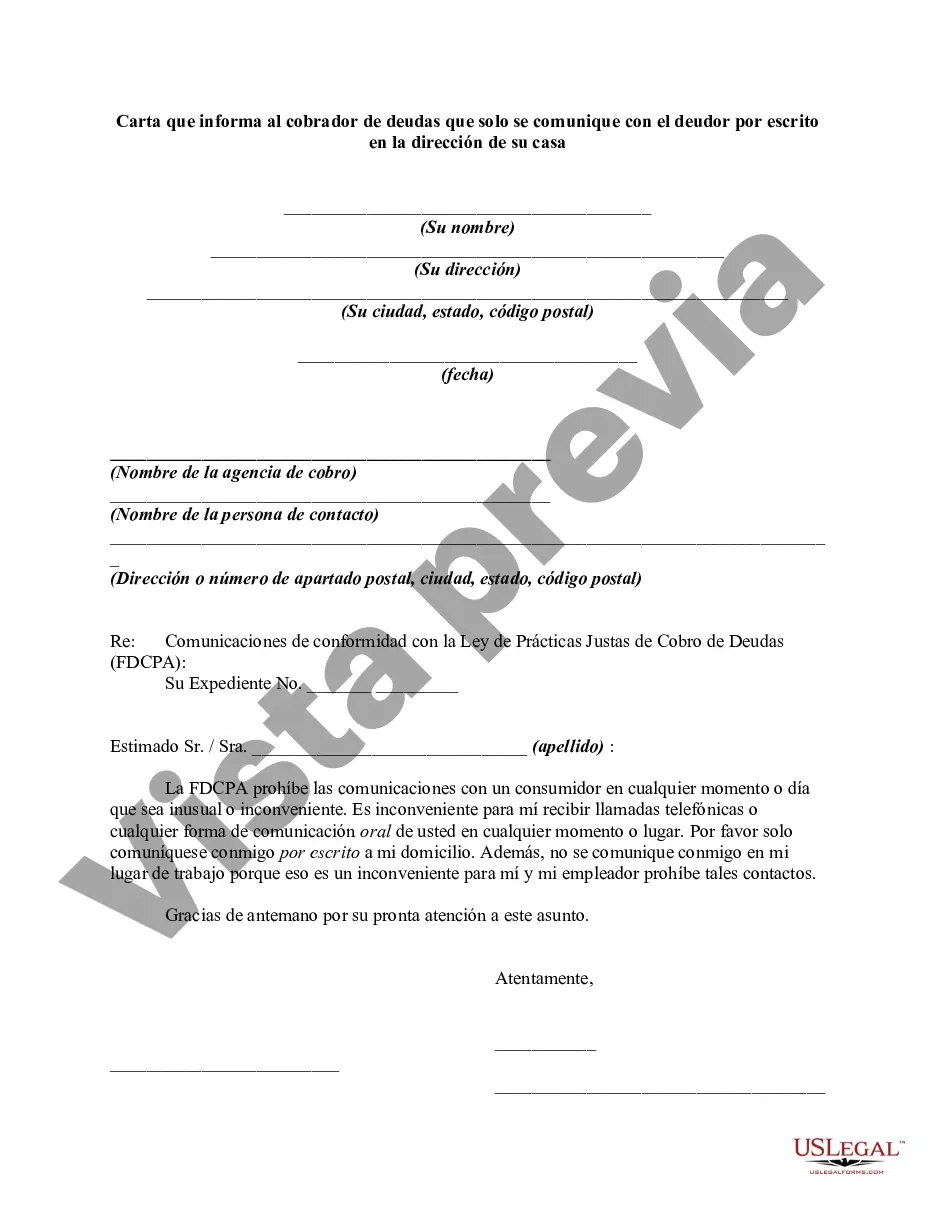

Montgomery, Maryland, the county seat of Montgomery County, is a vibrant and diverse community located just outside of Washington, D.C. Known for its rich history, beautiful parks, excellent schools, and thriving economy, Montgomery offers a high quality of life for its residents. If you find yourself in a situation where a debt collector is continuously contacting you, and you prefer to communicate with them only in writing at your home address, it is important to assert your rights. Written communication can provide clarity and documentation, ensuring that both parties understand each other and can maintain accurate records of discussions. To make your intentions clear to the debt collector, consider sending a "Letter Informing Debt Collector to Only Communicate with Debtor in Writing at Debtor's Home Address." This letter, also known as a cease and desist letter, should contain specific information to protect your rights as a debtor. Here are some relevant keywords that may be useful in structuring your letter: 1. Debt collector: Clearly state the name and contact information of the debt collector you wish to communicate with only in writing. 2. Debtor: Identify yourself as the debtor, mentioning your legal name and any relevant account numbers or reference numbers provided by the debt collector. 3. Communication preferences: Emphasize that you want all future communication to be in writing and that you do not wish to be contacted via phone calls or in-person visits. 4. Home address: Provide your complete residential address to ensure the debt collector knows where to send all written communications. 5. Legal rights: Mention that your request is in accordance with your rights under the Fair Debt Collections Practices Act (FD CPA) and any state-specific debt collection laws applicable in Montgomery, Maryland. 6. Proof of delivery: Request that the debt collector acknowledges receipt of your letter through a return receipt or a signed delivery confirmation. 7. Deadline: Specify a reasonable timeframe within which the debt collector should comply with your request, typically around 30 days from the date of the letter. Remember to keep a copy of the letter for your records and send it via certified mail with a return receipt requested. This will provide proof that the debt collector received your letter and show that you have been proactive in asserting your rights. By sending a "Letter Informing Debt Collector to Only Communicate with Debtor in Writing at Debtor's Home Address," you are taking control of your communication preferences and protecting yourself from any potential harassment or misunderstandings. It is crucial to stay informed about your rights as a borrower and take appropriate action when necessary.Montgomery, Maryland, the county seat of Montgomery County, is a vibrant and diverse community located just outside of Washington, D.C. Known for its rich history, beautiful parks, excellent schools, and thriving economy, Montgomery offers a high quality of life for its residents. If you find yourself in a situation where a debt collector is continuously contacting you, and you prefer to communicate with them only in writing at your home address, it is important to assert your rights. Written communication can provide clarity and documentation, ensuring that both parties understand each other and can maintain accurate records of discussions. To make your intentions clear to the debt collector, consider sending a "Letter Informing Debt Collector to Only Communicate with Debtor in Writing at Debtor's Home Address." This letter, also known as a cease and desist letter, should contain specific information to protect your rights as a debtor. Here are some relevant keywords that may be useful in structuring your letter: 1. Debt collector: Clearly state the name and contact information of the debt collector you wish to communicate with only in writing. 2. Debtor: Identify yourself as the debtor, mentioning your legal name and any relevant account numbers or reference numbers provided by the debt collector. 3. Communication preferences: Emphasize that you want all future communication to be in writing and that you do not wish to be contacted via phone calls or in-person visits. 4. Home address: Provide your complete residential address to ensure the debt collector knows where to send all written communications. 5. Legal rights: Mention that your request is in accordance with your rights under the Fair Debt Collections Practices Act (FD CPA) and any state-specific debt collection laws applicable in Montgomery, Maryland. 6. Proof of delivery: Request that the debt collector acknowledges receipt of your letter through a return receipt or a signed delivery confirmation. 7. Deadline: Specify a reasonable timeframe within which the debt collector should comply with your request, typically around 30 days from the date of the letter. Remember to keep a copy of the letter for your records and send it via certified mail with a return receipt requested. This will provide proof that the debt collector received your letter and show that you have been proactive in asserting your rights. By sending a "Letter Informing Debt Collector to Only Communicate with Debtor in Writing at Debtor's Home Address," you are taking control of your communication preferences and protecting yourself from any potential harassment or misunderstandings. It is crucial to stay informed about your rights as a borrower and take appropriate action when necessary.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.