The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects. If the debtor tells the creditor the name of his attorney, any future contacts must be made with the attorney and not with the debtor.

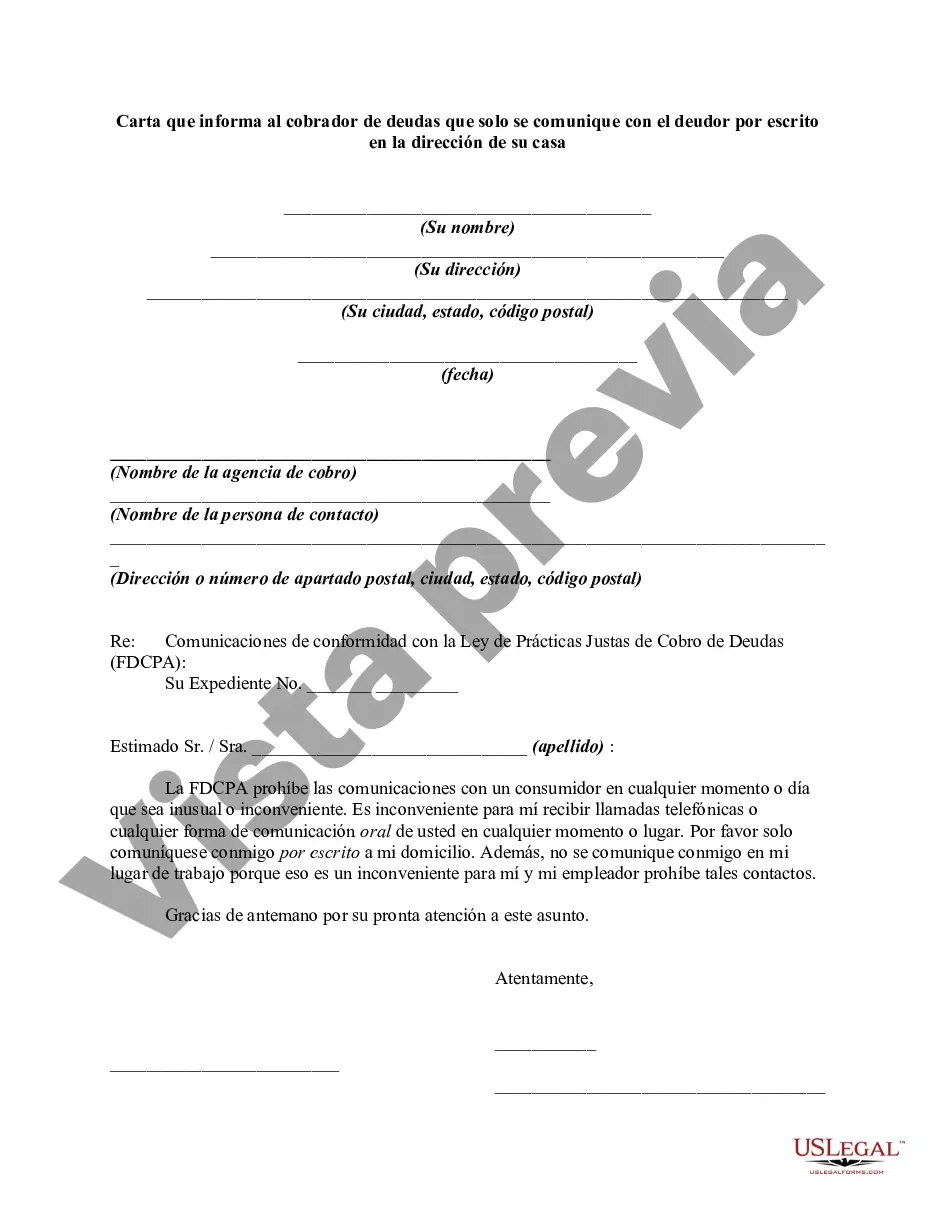

Subject: San Jose California — Letter Informing Debt Collector to Only Communicate with Debtor in Writing at Debtor's Home Address Dear [Debt Collector's Name], I am writing this letter to inform you, as a debt collector, of my request to only communicate with you in writing at my home address. This request is based on my rights as a debtor residing in San Jose, California, as provided by the Fair Debt Collection Practices Act (FD CPA) and the California Rosenthal Fair Debt Collection Practices Act (RFD CPA). It has come to my attention that debt collectors typically contact debtors through various means, such as phone calls and emails. However, I am exercising my right to request that all communication regarding the alleged debt be conducted solely in writing and directed to my home address mentioned below. Full Name: [Your Full Name] Home Address: [Your Home Address] City: San Jose, California ZIP Code: [Your ZIP Code] By requesting written communication only, I aim to ensure that all communication and documentation regarding this debt is clear, concise, and properly documented. Written communication provides an accurate record of conversations and helps to prevent any misunderstandings or disputes that may arise due to verbal communication. I understand that according to the FD CPA and RFD CPA, you should honor my request to only communicate in writing. Regardless, I advise you to update your records accordingly to reflect this preference and to avoid any unintended future communication discrepancies. Please note that any attempt to contact me through phone calls, emails, or any other means of verbal communication, apart from an initial written acknowledgment of this request, will be considered a violation of my rights under both federal and state laws governing debt collection practices. Any violation may lead to legal consequences. I kindly request that within 15 days of receiving this letter, you acknowledge my request in writing and confirm that all further communications will be conducted exclusively through written correspondence, sent to my provided home address. I appreciate your understanding and cooperation in this matter. Should you fail to comply with my request, I will have no choice but to take appropriate legal action to protect my rights as a debtor. Thank you for your attention to this matter. Sincerely, [Your Name] [Your Contact Information: Phone Number and Email Address] --- Different Types of San Jose, California, Letters Informing Debt Collectors to Only Communicate with Debtors in Writing at Debtors' Home Addresses: 1. Standard Letter: This is a basic letter template requesting debt collectors to communicate with the debtor exclusively through written means at the debtor's home address. 2. Cease and Desist Letter: In cases where there is evidence of creditor harassment or unfair debt collection practices, a stronger-worded cease and desist letter can be used to demand that the debt collector completely cease any and all communication attempts with the debtor. 3. Letter with Legal Consequences Mentioned: This type of letter warns debt collectors of the potential legal consequences they may face if they fail to comply with the debtor's request. It emphasizes the debtor's willingness to pursue legal action if necessary. 4. Letter Sent via Certified Mail: To ensure proof of delivery and receipt, the letter can be sent via certified mail with a return receipt requested. This adds an extra layer of documentation and serves as evidence of the debtor's attempt to communicate their preferences to the debt collector. Remember to modify the provided letter template to suit your specific circumstances and consult with a legal professional or debt counseling agency for personalized advice.Subject: San Jose California — Letter Informing Debt Collector to Only Communicate with Debtor in Writing at Debtor's Home Address Dear [Debt Collector's Name], I am writing this letter to inform you, as a debt collector, of my request to only communicate with you in writing at my home address. This request is based on my rights as a debtor residing in San Jose, California, as provided by the Fair Debt Collection Practices Act (FD CPA) and the California Rosenthal Fair Debt Collection Practices Act (RFD CPA). It has come to my attention that debt collectors typically contact debtors through various means, such as phone calls and emails. However, I am exercising my right to request that all communication regarding the alleged debt be conducted solely in writing and directed to my home address mentioned below. Full Name: [Your Full Name] Home Address: [Your Home Address] City: San Jose, California ZIP Code: [Your ZIP Code] By requesting written communication only, I aim to ensure that all communication and documentation regarding this debt is clear, concise, and properly documented. Written communication provides an accurate record of conversations and helps to prevent any misunderstandings or disputes that may arise due to verbal communication. I understand that according to the FD CPA and RFD CPA, you should honor my request to only communicate in writing. Regardless, I advise you to update your records accordingly to reflect this preference and to avoid any unintended future communication discrepancies. Please note that any attempt to contact me through phone calls, emails, or any other means of verbal communication, apart from an initial written acknowledgment of this request, will be considered a violation of my rights under both federal and state laws governing debt collection practices. Any violation may lead to legal consequences. I kindly request that within 15 days of receiving this letter, you acknowledge my request in writing and confirm that all further communications will be conducted exclusively through written correspondence, sent to my provided home address. I appreciate your understanding and cooperation in this matter. Should you fail to comply with my request, I will have no choice but to take appropriate legal action to protect my rights as a debtor. Thank you for your attention to this matter. Sincerely, [Your Name] [Your Contact Information: Phone Number and Email Address] --- Different Types of San Jose, California, Letters Informing Debt Collectors to Only Communicate with Debtors in Writing at Debtors' Home Addresses: 1. Standard Letter: This is a basic letter template requesting debt collectors to communicate with the debtor exclusively through written means at the debtor's home address. 2. Cease and Desist Letter: In cases where there is evidence of creditor harassment or unfair debt collection practices, a stronger-worded cease and desist letter can be used to demand that the debt collector completely cease any and all communication attempts with the debtor. 3. Letter with Legal Consequences Mentioned: This type of letter warns debt collectors of the potential legal consequences they may face if they fail to comply with the debtor's request. It emphasizes the debtor's willingness to pursue legal action if necessary. 4. Letter Sent via Certified Mail: To ensure proof of delivery and receipt, the letter can be sent via certified mail with a return receipt requested. This adds an extra layer of documentation and serves as evidence of the debtor's attempt to communicate their preferences to the debt collector. Remember to modify the provided letter template to suit your specific circumstances and consult with a legal professional or debt counseling agency for personalized advice.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.