The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects.

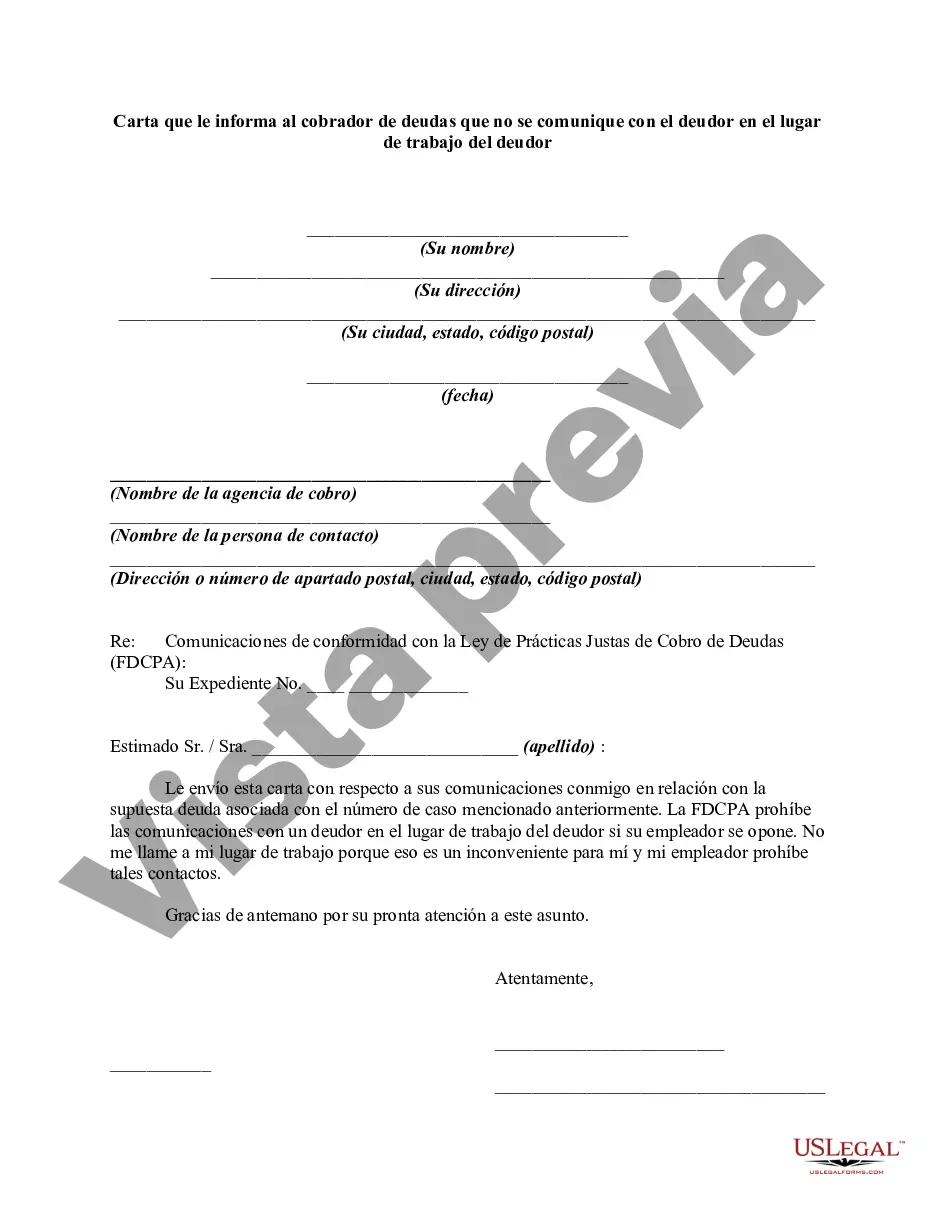

Alameda is a vibrant city located in the San Francisco Bay Area, California. Known for its picturesque waterfront views, diverse culture, and historical landmarks, Alameda offers its residents and visitors a unique mix of small-town charm and urban amenities. A "Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment" is a legally significant document that individuals can utilize to limit communication from debt collectors to their workplace in accordance with laws outlined in the Fair Debt Collections Practices Act (FD CPA). This letter acts as a formal request to halt any communication regarding the debtor's outstanding debt, including calls, emails, or visits from the debt collector, while the debtor is present at their place of employment. Keywords: Alameda, California, debt collector, communication, debtor, place of employment, letter, informing, Fair Debt Collections Practices Act, FD CPA, calls, emails, visits. Different types of "Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment" might include: 1. Standard Alameda California Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment: This letter is a general template that Alameda residents can use to inform debt collectors not to contact them at their workplace. 2. Certified Alameda California Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment: This letter is sent via certified mail to ensure proof of delivery, providing an additional layer of legal protection. 3. Attorney-Signed Alameda California Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment: This letter is endorsed by an attorney to emphasize the seriousness of the debtor's request and ensure compliance with legal regulations. 4. Alameda California Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment (Specific Debt): This type of letter specifies a particular debt that the debtor wishes to restrict communication about, providing a focused approach to address a specific issue. Remember to consult with legal professionals or use state-specific templates to ensure accuracy and compliance with local laws when drafting any legal document.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.