The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects.

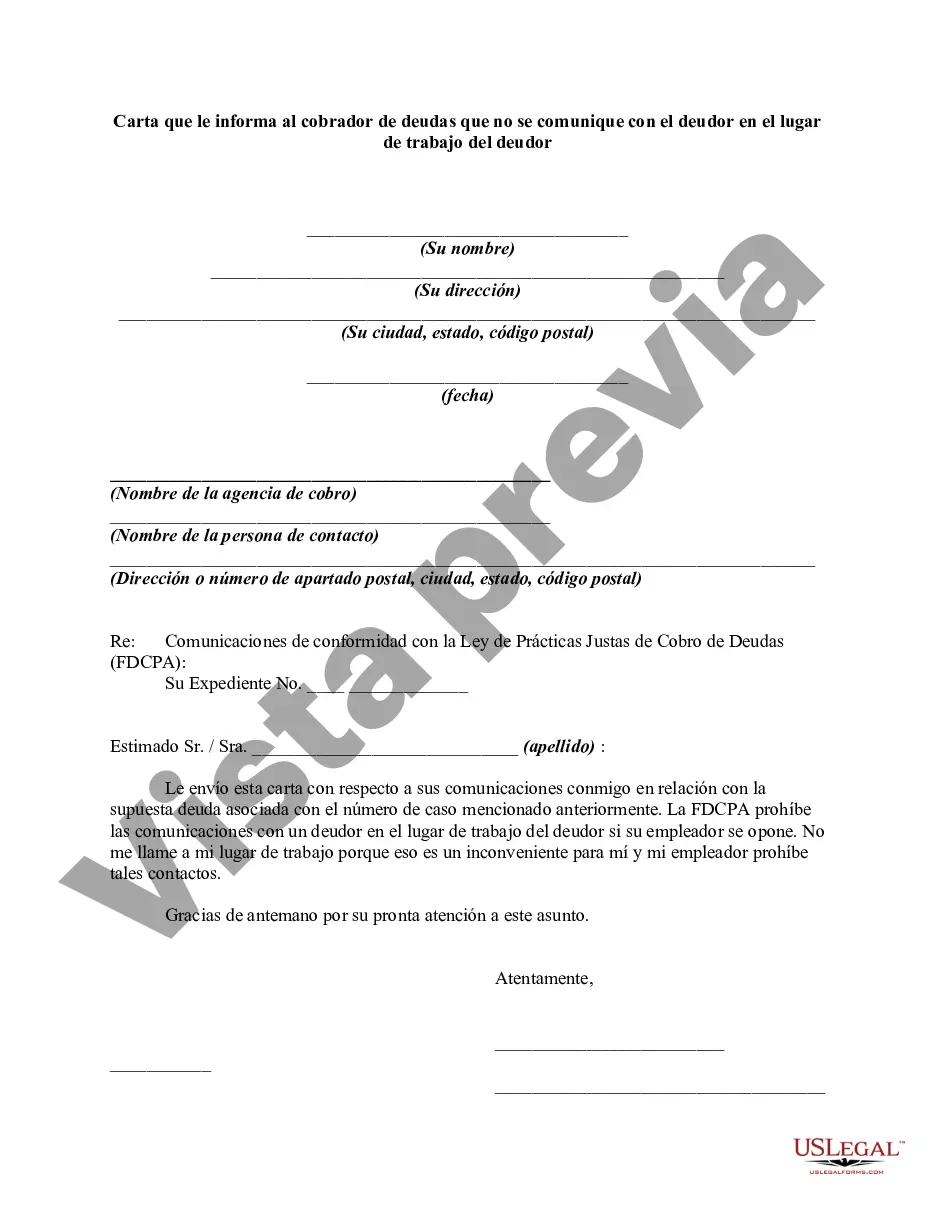

Chicago, Illinois is a vibrant city located in the Midwest region of the United States. Known for its stunning architecture, thriving arts scene, diverse neighborhoods, and rich history, Chicago attracts millions of visitors every year. Chicago is often referred to as the "Windy City" and is famous for its iconic landmarks such as the Willis Tower (formerly known as the Sears Tower), Millennium Park, Navy Pier, and the Art Institute of Chicago. The city also boasts a world-class food scene, offering a wide range of international cuisine as well as famous dishes like deep-dish pizza and Chicago-style hot dogs. In terms of its economy, Chicago is a major hub for business and commerce. It is home to numerous Fortune 500 companies and has a strong presence in sectors such as finance, manufacturing, technology, healthcare, and transportation. The city's central location and excellent transportation infrastructure make it an ideal place for companies to establish their headquarters or expand their operations. When it comes to writing a letter informing a debt collector not to communicate with a debtor at their place of employment, there are a few different types of letters that can be utilized. These types may include: 1. Standard Request Letter: This is a basic letter informing the debt collector that the debtor wishes to restrict communication regarding the debt to methods other than the debtor's place of employment. It typically includes the debtor's personal information, account details, and a clear request to cease communication at their workplace. 2. Cease and Desist Letter: A cease and desist letter is a more formal and legally binding document. It demands that the debt collector immediately stops all communication with the debtor at their place of employment, emphasizing that further attempts to contact the debtor there may result in legal action. 3. Attorney Representation Letter: If the debtor has legal representation, an attorney representation letter can be sent to inform the debt collector about the debtor's new legal representation. This letter requests that all future communication regarding the debt be directed to the attorney's office instead of the debtor's workplace. Regardless of the specific type of letter used, it is important to include relevant keywords to ensure the searchability and relevance of the content. Some keywords to consider could include Chicago, Illinois, debt collector, debtor's place of employment, letter informing, communication restriction, cease and desist, attorney representation, and debt collection laws.Chicago, Illinois is a vibrant city located in the Midwest region of the United States. Known for its stunning architecture, thriving arts scene, diverse neighborhoods, and rich history, Chicago attracts millions of visitors every year. Chicago is often referred to as the "Windy City" and is famous for its iconic landmarks such as the Willis Tower (formerly known as the Sears Tower), Millennium Park, Navy Pier, and the Art Institute of Chicago. The city also boasts a world-class food scene, offering a wide range of international cuisine as well as famous dishes like deep-dish pizza and Chicago-style hot dogs. In terms of its economy, Chicago is a major hub for business and commerce. It is home to numerous Fortune 500 companies and has a strong presence in sectors such as finance, manufacturing, technology, healthcare, and transportation. The city's central location and excellent transportation infrastructure make it an ideal place for companies to establish their headquarters or expand their operations. When it comes to writing a letter informing a debt collector not to communicate with a debtor at their place of employment, there are a few different types of letters that can be utilized. These types may include: 1. Standard Request Letter: This is a basic letter informing the debt collector that the debtor wishes to restrict communication regarding the debt to methods other than the debtor's place of employment. It typically includes the debtor's personal information, account details, and a clear request to cease communication at their workplace. 2. Cease and Desist Letter: A cease and desist letter is a more formal and legally binding document. It demands that the debt collector immediately stops all communication with the debtor at their place of employment, emphasizing that further attempts to contact the debtor there may result in legal action. 3. Attorney Representation Letter: If the debtor has legal representation, an attorney representation letter can be sent to inform the debt collector about the debtor's new legal representation. This letter requests that all future communication regarding the debt be directed to the attorney's office instead of the debtor's workplace. Regardless of the specific type of letter used, it is important to include relevant keywords to ensure the searchability and relevance of the content. Some keywords to consider could include Chicago, Illinois, debt collector, debtor's place of employment, letter informing, communication restriction, cease and desist, attorney representation, and debt collection laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.