The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects.

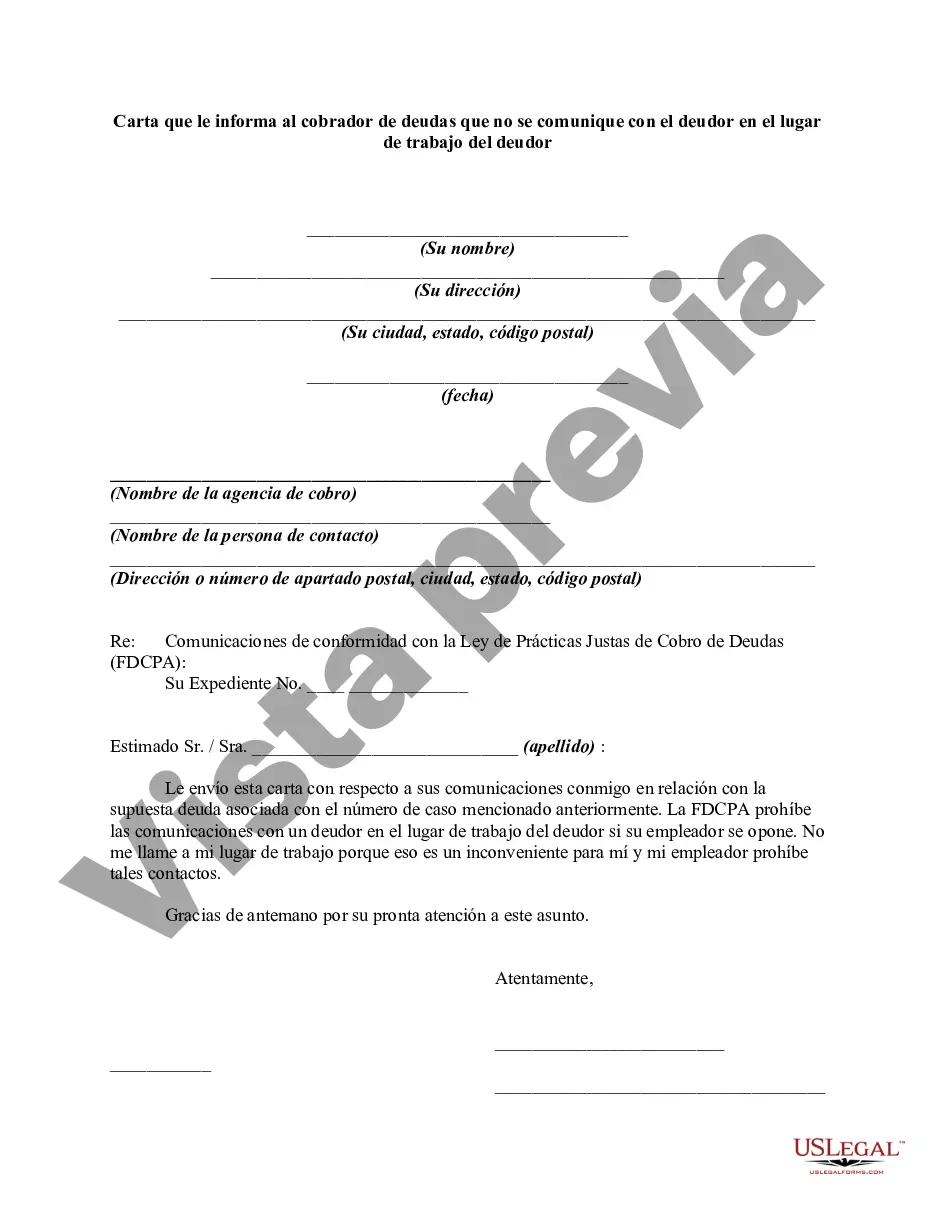

Title: Houston, Texas Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment Introduction: Houston is a vibrant city in Texas known for its diverse population, economic growth, and rich cultural heritage. Home to a thriving business district, it is not uncommon for debts to be collected by third-party debt collectors. However, debtors in Houston have rights ensuring fair treatment, including the ability to request debt collectors not to communicate with them at their place of employment. This article will provide a detailed description of how to draft a Houston, Texas Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment. Keywords: Houston, Texas, debt collector, debtor, employment, communication, rights, third-party, fair treatment, draft, letter, information. 1. Explaining the Purpose of the Letter: Start the letter by explaining the purpose, which is to inform the debt collector about the debtor's request to refrain from contacting them at their place of employment. Emphasize that this request is within the debtor's rights and should be respected to maintain a professional and respectful relationship. 2. Identifying the Parties Involved: Clearly identify both the debtor and the debt collector in the letter by including their full names, addresses, and contact information. This ensures the letter is directed to the correct person or organization and facilitates prompt action. 3. Stating the Legal Basis for the Request: Highlight the specific legal provision that grants debtors the right to request communication limitations at their place of employment. In Houston, this may include referencing relevant sections of the Texas Finance Code or the Fair Debt Collection Practices Act. 4. Detailed Request for Communication Restriction: Clearly state the debtor's request for the debt collector to cease all communication efforts at their place of employment. Encourage the debt collector to utilize alternative methods of communication such as postal mail or email to maintain contact. 5. Providing Supporting Evidence: If available, include any evidence supporting the debtor's claim, such as copies of past communication attempts at their workplace. This helps establish a record of previous unwanted communication and strengthens the legitimacy of the debtor's request. 6. Request for Acknowledgment: Ask the debt collector to confirm in writing that they have received and will comply with the debtor's request. This serves as evidence in case further action or legal steps need to be taken. 7. Consequences of Non-Compliance: Mention the consequences of the debt collector's failure to abide by the debtor's request. This may include legal action, filing a complaint with relevant authorities, or seeking assistance from a consumer protection agency. Types of Houston, Texas Letters Informing Debt Collectors not to Communicate with Debtors: 1. Initial Request Letter: This is the first written communication sent by the debtor to the debt collector, formally requesting limited communication at their place of employment. 2. Follow-up or Reminder Letter: If the debt collector fails to acknowledge or reply to the initial request, a follow-up letter can be sent to remind them of the debtor's rights and request compliance. In conclusion, Houston, Texas allows debtors to assert their right to limit communication from debt collectors at their place of employment. Following the guidelines provided in this letter ensures debt collectors respect the debtor's rights while maintaining clear and professional communication throughout the debt collection process.Title: Houston, Texas Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment Introduction: Houston is a vibrant city in Texas known for its diverse population, economic growth, and rich cultural heritage. Home to a thriving business district, it is not uncommon for debts to be collected by third-party debt collectors. However, debtors in Houston have rights ensuring fair treatment, including the ability to request debt collectors not to communicate with them at their place of employment. This article will provide a detailed description of how to draft a Houston, Texas Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment. Keywords: Houston, Texas, debt collector, debtor, employment, communication, rights, third-party, fair treatment, draft, letter, information. 1. Explaining the Purpose of the Letter: Start the letter by explaining the purpose, which is to inform the debt collector about the debtor's request to refrain from contacting them at their place of employment. Emphasize that this request is within the debtor's rights and should be respected to maintain a professional and respectful relationship. 2. Identifying the Parties Involved: Clearly identify both the debtor and the debt collector in the letter by including their full names, addresses, and contact information. This ensures the letter is directed to the correct person or organization and facilitates prompt action. 3. Stating the Legal Basis for the Request: Highlight the specific legal provision that grants debtors the right to request communication limitations at their place of employment. In Houston, this may include referencing relevant sections of the Texas Finance Code or the Fair Debt Collection Practices Act. 4. Detailed Request for Communication Restriction: Clearly state the debtor's request for the debt collector to cease all communication efforts at their place of employment. Encourage the debt collector to utilize alternative methods of communication such as postal mail or email to maintain contact. 5. Providing Supporting Evidence: If available, include any evidence supporting the debtor's claim, such as copies of past communication attempts at their workplace. This helps establish a record of previous unwanted communication and strengthens the legitimacy of the debtor's request. 6. Request for Acknowledgment: Ask the debt collector to confirm in writing that they have received and will comply with the debtor's request. This serves as evidence in case further action or legal steps need to be taken. 7. Consequences of Non-Compliance: Mention the consequences of the debt collector's failure to abide by the debtor's request. This may include legal action, filing a complaint with relevant authorities, or seeking assistance from a consumer protection agency. Types of Houston, Texas Letters Informing Debt Collectors not to Communicate with Debtors: 1. Initial Request Letter: This is the first written communication sent by the debtor to the debt collector, formally requesting limited communication at their place of employment. 2. Follow-up or Reminder Letter: If the debt collector fails to acknowledge or reply to the initial request, a follow-up letter can be sent to remind them of the debtor's rights and request compliance. In conclusion, Houston, Texas allows debtors to assert their right to limit communication from debt collectors at their place of employment. Following the guidelines provided in this letter ensures debt collectors respect the debtor's rights while maintaining clear and professional communication throughout the debt collection process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.