The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects.

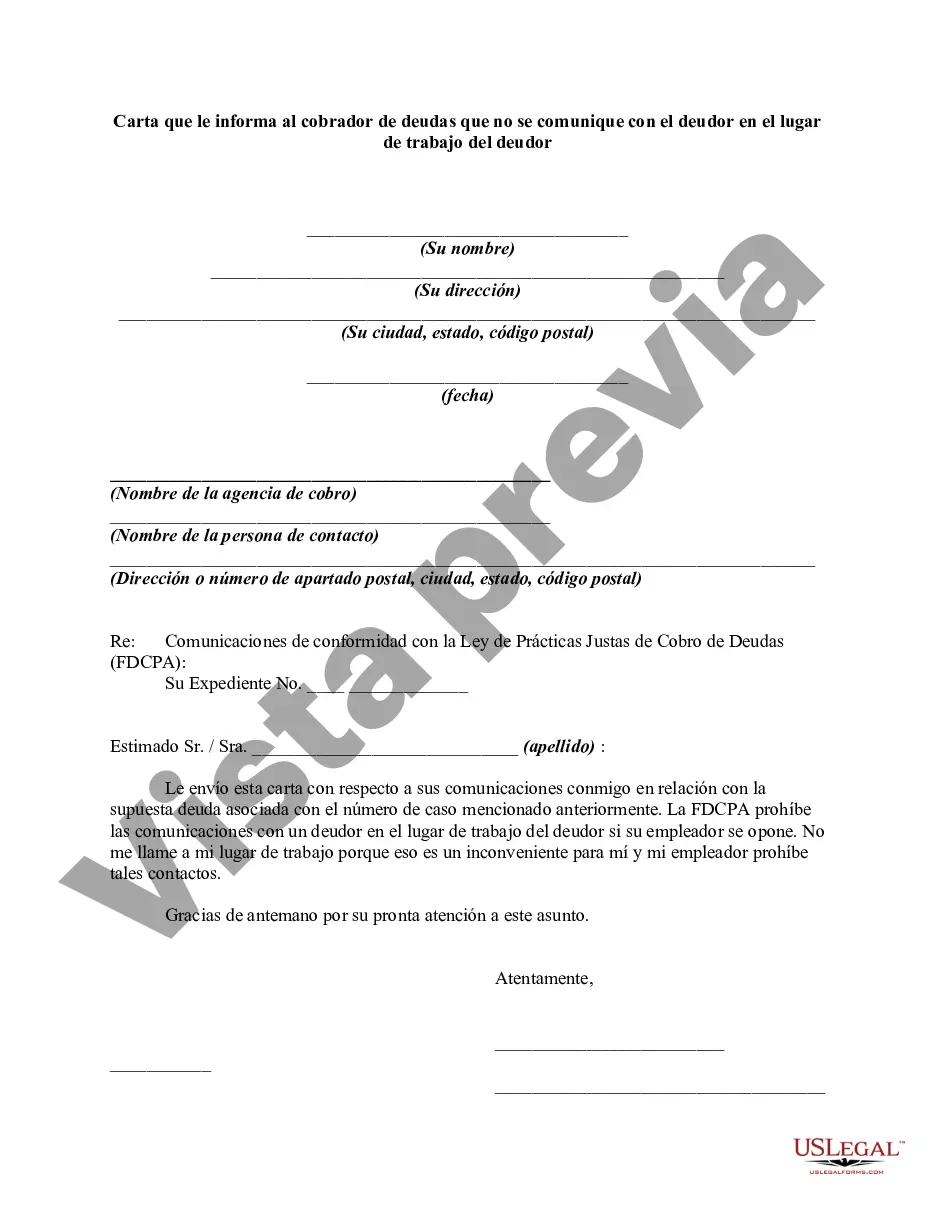

Title: Queens, New York: Letter Informing Debt Collector Not to Communicate with Debtor at Debtor's Place of Employment Introduction: In Queens, New York, debtors have specific rights when it comes to dealing with debt collectors. Among these rights is the ability to request that debt collectors stop communicating with them at their place of employment. This article provides a detailed description of the purpose, content, and procedures involved in a Queens, New York letter informing debt collectors not to communicate with debtors at their place of employment. Additionally, different types of such letters are outlined to match specific needs or scenarios. 1. Purpose of the Letter: The primary objective of this letter is to formally request debt collectors to refrain from contacting debtors at their place of employment, as mandated by the Fair Debt Collection Practices Act (FD CPA). This letter serves to protect debtors from potential embarrassment, disruption, or harassment while at work. 2. Content of the Letter: The letter consists of key elements, including: a. Debtor's Information: Begin the letter by clearly stating the debtor's complete name, current address, phone number, and account details (if available). b. Debt Collector's Information: Include the debt collector's name, address, and contact details. c. Request: Clearly express the debtor's desire to cease all communication at their place of employment. Emphasize that they prefer written communication through mail or email instead. d. Supporting Laws: Mention relevant legal provisions such as the FD CPA, which grants the right to request such action. e. Signature and Date: The letter should be signed and dated by the debtor to ensure its authenticity. 3. Types of Letters to Debt Collectors: a. Standard Letter: This type of letter is generally used to inform debt collectors not to contact the debtor at their place of employment without any particular specifications. b. Cease and Desist Letter: This more assertive letter is utilized when debt collectors continue to contact the debtor at their workplace despite previous requests to cease communication. c. Lawyer Representation Letter: In cases where the debtor has legal representation, this letter stress fully emphasizes the debtor's request and notifies debt collectors to direct all communication regarding the debt to their attorney. Conclusion: Given the rights provided to debtors in Queens, New York under the FD CPA, it is crucial for debtors to exercise their right to request that debt collectors refrain from contacting them at their place of employment. A well-crafted letter, as described above, ensures that debtors can protect their privacy, dignity, and avoid potential undue stress.Title: Queens, New York: Letter Informing Debt Collector Not to Communicate with Debtor at Debtor's Place of Employment Introduction: In Queens, New York, debtors have specific rights when it comes to dealing with debt collectors. Among these rights is the ability to request that debt collectors stop communicating with them at their place of employment. This article provides a detailed description of the purpose, content, and procedures involved in a Queens, New York letter informing debt collectors not to communicate with debtors at their place of employment. Additionally, different types of such letters are outlined to match specific needs or scenarios. 1. Purpose of the Letter: The primary objective of this letter is to formally request debt collectors to refrain from contacting debtors at their place of employment, as mandated by the Fair Debt Collection Practices Act (FD CPA). This letter serves to protect debtors from potential embarrassment, disruption, or harassment while at work. 2. Content of the Letter: The letter consists of key elements, including: a. Debtor's Information: Begin the letter by clearly stating the debtor's complete name, current address, phone number, and account details (if available). b. Debt Collector's Information: Include the debt collector's name, address, and contact details. c. Request: Clearly express the debtor's desire to cease all communication at their place of employment. Emphasize that they prefer written communication through mail or email instead. d. Supporting Laws: Mention relevant legal provisions such as the FD CPA, which grants the right to request such action. e. Signature and Date: The letter should be signed and dated by the debtor to ensure its authenticity. 3. Types of Letters to Debt Collectors: a. Standard Letter: This type of letter is generally used to inform debt collectors not to contact the debtor at their place of employment without any particular specifications. b. Cease and Desist Letter: This more assertive letter is utilized when debt collectors continue to contact the debtor at their workplace despite previous requests to cease communication. c. Lawyer Representation Letter: In cases where the debtor has legal representation, this letter stress fully emphasizes the debtor's request and notifies debt collectors to direct all communication regarding the debt to their attorney. Conclusion: Given the rights provided to debtors in Queens, New York under the FD CPA, it is crucial for debtors to exercise their right to request that debt collectors refrain from contacting them at their place of employment. A well-crafted letter, as described above, ensures that debtors can protect their privacy, dignity, and avoid potential undue stress.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.