The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects.

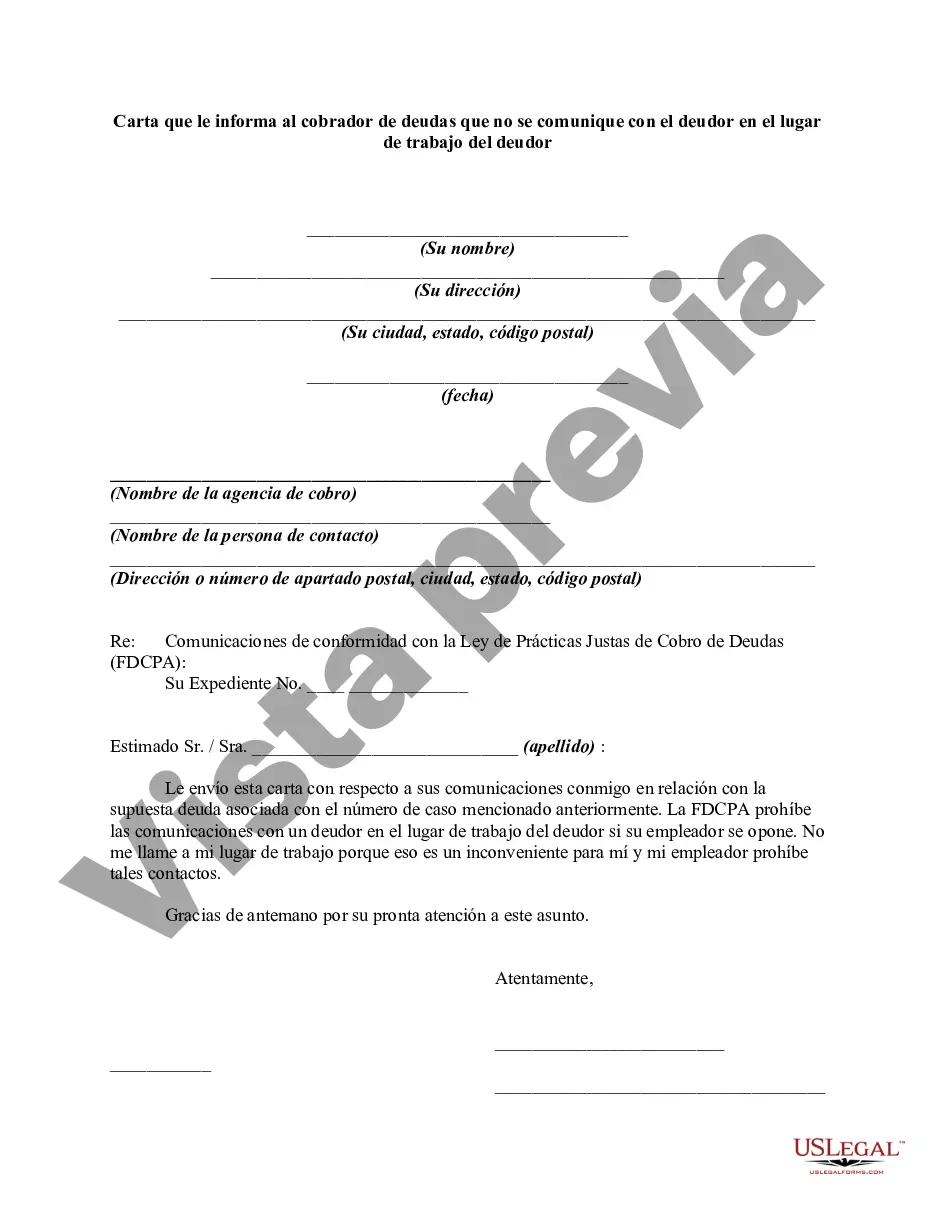

Title: San Antonio, Texas: Drafting an Effective Letter to Instruct Debt Collectors to Cease Communication at the Debtor's Workplace Introduction: In situations where debt collectors persistently contact debtors at their place of employment, it is crucial to assert one's rights and put an end to this unwanted harassment. This article will provide a detailed overview of what San Antonio, Texas residents need to know about drafting a compelling letter to instruct debt collectors to cease communication with debtors at their workplace. Additionally, we will briefly touch upon some types and key variations of such letters. 1. Understanding the Purpose of the Letter: The main objective of a letter informing a debt collector not to communicate with a debtor at their place of employment is to assert the debtor's rights provided by the Fair Debt Collection Practices Act (FD CPA). This federal law protects consumers from abusive debt collection practices, including unwanted contact at the workplace. Debtors can use this letter to request that all communication be redirected to a more appropriate setting. 2. Essential Elements of the Letter: — Heading: Include your name, address, and contact information at the top of the letter. — Date: Mention the date on the letter to establish a timeline. — Subject Line: Clearly state the purpose of your letter, such as "Letter to Cease Communication at Debtor's Workplace." — Recipient: Address the letter to the specific debt collection agency or creditor harassing you. — Account Information: Include relevant details about the debt, such as account number, creditor's name, and outstanding balance to help identify your case accurately. — Request to Cease Communication At the Workplace: Clearly state your instruction to cease all communication at your workplace, citing FD CPA regulations. — Preferred Contact Information: Specify your preferred method of communication, e.g., mailing address or phone number, and request that the debt collector use this information going forward. — Formal Closing and Signature: Close the letter with a professional closing (e.g., Sincerely) and sign it. — Send the Letter via Certified Mail: To ensure proof of delivery and time stamp, send the letter via certified mail with a return receipt. Types and Variations of the Letter: 1. General Letter to Cease Communication: A comprehensive letter requesting a debt collector to cease all workplace communication. 2. Sample Letter for Employer Notification: A specialized version, when necessary, to inform the debtor's employer about the harassment, ensuring they are aware of the situation. 3. Cease and Desist Letter: A legally stronger variant stating that continued communication may result in legal action. 4. Limited Communications Consent Letter: In specific cases, debtors may choose to grant limited consent for communication, such as allowing emails only, to preserve privacy. Conclusion: When dealing with debt collectors, it is within your rights to instruct them firmly to cease communication at your workplace. By drafting a well-crafted letter using the information provided above, you can assert your rights and achieve the peace of mind you deserve. Remember, it's critical to tailor the letter to your unique circumstances and consult with legal professionals if necessary.Title: San Antonio, Texas: Drafting an Effective Letter to Instruct Debt Collectors to Cease Communication at the Debtor's Workplace Introduction: In situations where debt collectors persistently contact debtors at their place of employment, it is crucial to assert one's rights and put an end to this unwanted harassment. This article will provide a detailed overview of what San Antonio, Texas residents need to know about drafting a compelling letter to instruct debt collectors to cease communication with debtors at their workplace. Additionally, we will briefly touch upon some types and key variations of such letters. 1. Understanding the Purpose of the Letter: The main objective of a letter informing a debt collector not to communicate with a debtor at their place of employment is to assert the debtor's rights provided by the Fair Debt Collection Practices Act (FD CPA). This federal law protects consumers from abusive debt collection practices, including unwanted contact at the workplace. Debtors can use this letter to request that all communication be redirected to a more appropriate setting. 2. Essential Elements of the Letter: — Heading: Include your name, address, and contact information at the top of the letter. — Date: Mention the date on the letter to establish a timeline. — Subject Line: Clearly state the purpose of your letter, such as "Letter to Cease Communication at Debtor's Workplace." — Recipient: Address the letter to the specific debt collection agency or creditor harassing you. — Account Information: Include relevant details about the debt, such as account number, creditor's name, and outstanding balance to help identify your case accurately. — Request to Cease Communication At the Workplace: Clearly state your instruction to cease all communication at your workplace, citing FD CPA regulations. — Preferred Contact Information: Specify your preferred method of communication, e.g., mailing address or phone number, and request that the debt collector use this information going forward. — Formal Closing and Signature: Close the letter with a professional closing (e.g., Sincerely) and sign it. — Send the Letter via Certified Mail: To ensure proof of delivery and time stamp, send the letter via certified mail with a return receipt. Types and Variations of the Letter: 1. General Letter to Cease Communication: A comprehensive letter requesting a debt collector to cease all workplace communication. 2. Sample Letter for Employer Notification: A specialized version, when necessary, to inform the debtor's employer about the harassment, ensuring they are aware of the situation. 3. Cease and Desist Letter: A legally stronger variant stating that continued communication may result in legal action. 4. Limited Communications Consent Letter: In specific cases, debtors may choose to grant limited consent for communication, such as allowing emails only, to preserve privacy. Conclusion: When dealing with debt collectors, it is within your rights to instruct them firmly to cease communication at your workplace. By drafting a well-crafted letter using the information provided above, you can assert your rights and achieve the peace of mind you deserve. Remember, it's critical to tailor the letter to your unique circumstances and consult with legal professionals if necessary.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.