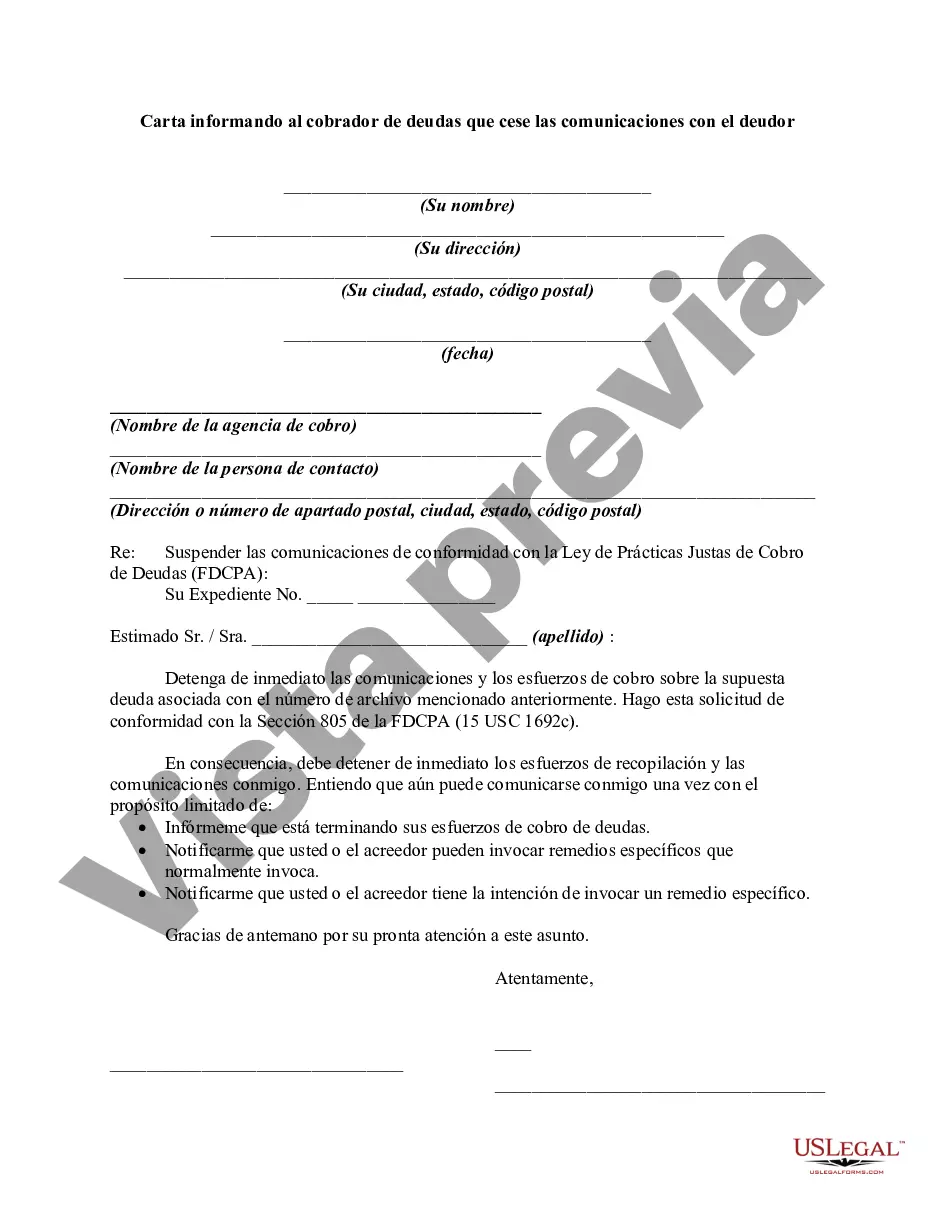

Once a debt collector receives written notice from a consumer that the consumer refuses to pay the debt or wants the collector to stop further collection efforts, the debt collector must cease communications with the consumer except:

To advise the consumer that they are terminating their debt collecting efforts;

To notify the consumer that the debt collector or creditor may invoke specified remedies which they ordinarily invoke; and

To notify the consumer that the debt collector or creditor intends to invoke a specified remedy.

Cook Illinois is a transportation company based in Illinois, offering various services such as school bus transportation, tour and charter bus transportation, and transit services. As a reputable company serving a wide range of customers, Cook Illinois understands the importance of maintaining clear and effective communication with its clients. In certain instances, individuals may find themselves in debt and face communication from debt collectors. Cook Illinois recognizes the need to protect the rights and privacy of its clients, and hence has formulated a specific letter to inform debt collectors to cease communications with debtors. This letter serves as an official document, requesting immediate action to halt any further contact by debt collectors. The Cook Illinois Letter Informing to Debt Collector to Cease Communications with Debtor includes specific keywords and details to ensure its effectiveness. These may include: 1. Contact Information: The letter will begin by providing the contact information of the debtor, including their full name, current address, and phone number. This information serves to clearly identify the debtor and enable the debt collector to locate the relevant account. 2. Debt Account Details: The letter will proceed to include specific details about the debt account, such as the account number, amount owed, and any relevant supporting documentation (e.g., invoices, bills, or statements). These details help in verifying the legitimacy of the debt and establishing a clear understanding of the situation. 3. Legal Protection Statement: Cook Illinois may include a section that emphasizes the debtor's legal rights, highlighting the debtor's entitlement to protection under the Fair Debt Collection Practices Act (FD CPA) and other applicable laws. This statement serves to assert the debtor's rights and discourage any potential harassment or abusive behavior from the debt collector. 4. Request to Cease Communication: The core purpose of the letter is to formally request the debt collector to immediately stop all communications with the debtor. This request should be clearly stated and conspicuously highlighted within the letter, indicating the debtor's strong desire to halt any further contact. 5. Consequences of Non-Compliance: Cook Illinois may outline the potential consequences if the debt collector fails to adhere to the request. These consequences may include reporting violations of the FD CPA to relevant regulatory bodies, pursuing legal action against the debt collector, or seeking compensation for any damages suffered as a result of non-compliance. Different types of Cook Illinois Letter Informing to Debt Collector to Cease Communications with Debtor may vary depending on the specific situation or debt account parameters. For example, if the debt account is in dispute or is facing legal proceedings, Cook Illinois may adapt the letter accordingly to add relevant details or legal references. Additionally, the letter may also differ based on the intended recipient, such as a specific debt collector agency or individual collector.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.