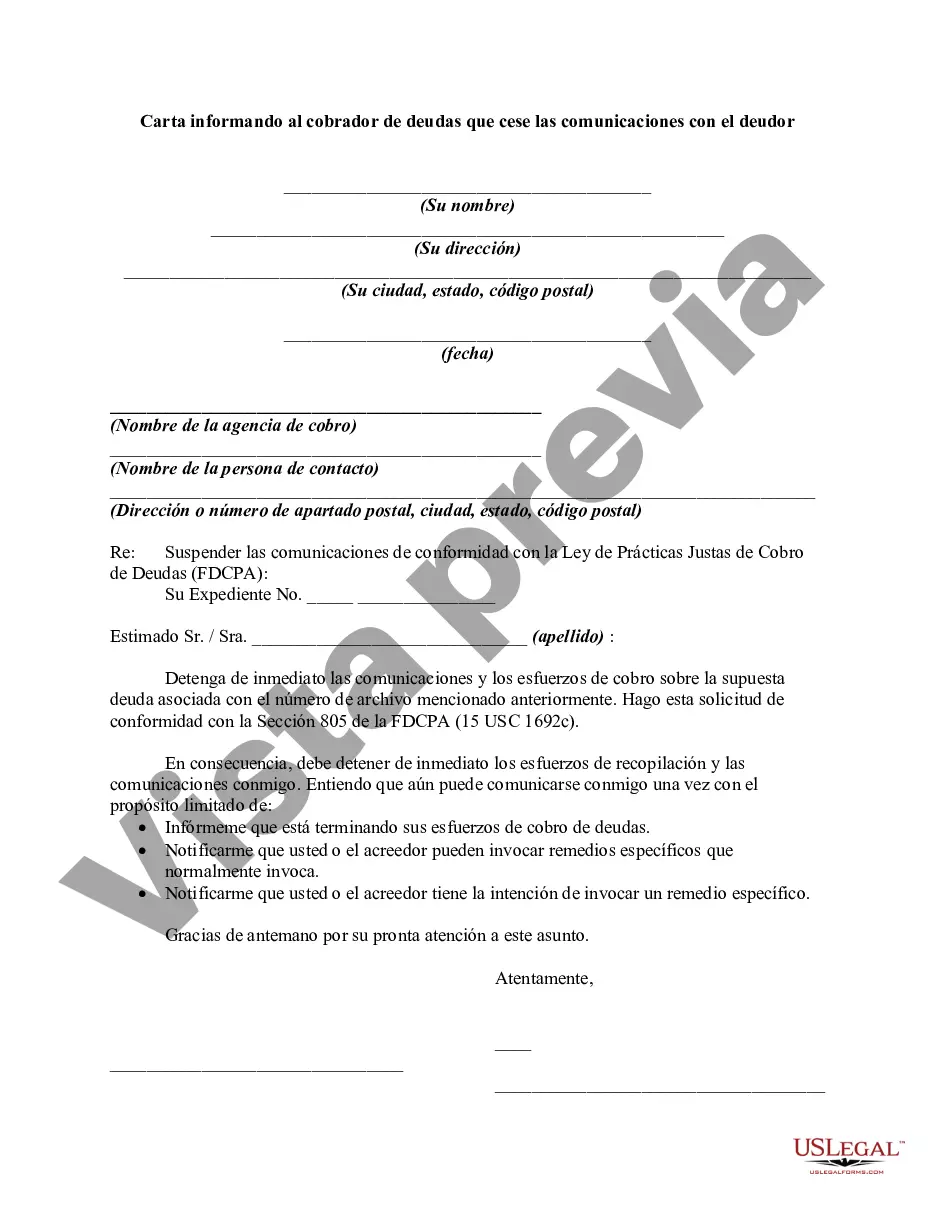

Once a debt collector receives written notice from a consumer that the consumer refuses to pay the debt or wants the collector to stop further collection efforts, the debt collector must cease communications with the consumer except:

To advise the consumer that they are terminating their debt collecting efforts;

To notify the consumer that the debt collector or creditor may invoke specified remedies which they ordinarily invoke; and

To notify the consumer that the debt collector or creditor intends to invoke a specified remedy.

Title: Miami-Dade Florida Letter Informing Debt Collector to Cease Communications with Debtor Introduction: In Miami-Dade County, Florida, individuals have the right to send a letter instructing debt collectors to cease communicating with them regarding a debt. This type of letter, commonly known as a "Cease Communications Letter," is a legal tool used by debtors to assert their rights and stop unwanted contact from debt collectors. In this article, we will provide a detailed description of what a Miami-Dade Florida Letter Informing to Debt Collector to Cease Communications with Debtor entails and how it can be written effectively. Keywords: — Miami-Dade Count— - Florida debt collection laws — Debt collector— - Cease and desist letter — Debt collectioharassmenten— - Fair Debt Collection Practices Act (FD CPA) — Consumer's right— - Consumer Financial Protection Bureau (CFPB) — Legal protection against debt collectors Types of Miami-Dade Florida Letters Informing Debt Collector to Cease Communications with Debtor: 1. Cease Communications Letter (General): This type of letter is a straightforward directive to debt collectors to stop contacting the debtor. It includes relevant information such as the debtor's name, address, contact details, information about the debt, and a request to cease all communication attempts. 2. Cease Communications Letter (Harassment): If the debtor has been experiencing constant and harassing communication from the debt collector, this type of letter can be sent to assert the debtor's rights to be free from abusive or intimidating behavior. It emphasizes the debt collector's violation of the Fair Debt Collection Practices Act (FD CPA) and demands an immediate cease in all communications. 3. Cease Communications Letter (Proof of Debt): Sometimes, debt collectors make contact without providing sufficient documentation to prove the existence of the debtor's alleged debt. In such cases, a letter can be written requesting the debt collector to provide evidence of the debt before any further communication is made. This type of letter helps protect the debtor from unauthorized collection attempts. How to Write a Miami-Dade Florida Letter Informing Debt Collector to Cease Communications with Debtor: 1. Begin with your personal information: Include your full name, current address, contact number, and email address to ensure that the debt collector can properly identify you. 2. Date the letter: Include the current date to establish a timeline of communication. 3. Address the debt collector: Provide the debt collector's full name, address, and contact information if available. This ensures that the letter is directed to the correct recipient. 4. Reference the debt: Specify the alleged debt's details, such as the account number, creditor's name, and any other crucial identifying information provided by the debt collector. 5. State your intention: Clearly state that you are requesting the debt collector to cease all communication attempts with you regarding the debt in question. 6. Mention appropriate laws and regulations: Reference legal protections such as the Fair Debt Collection Practices Act (FD CPA) and Miami-Dade County or Florida debt collection laws to strengthen your case. 7. Request written confirmation: Ask the debt collector to provide written confirmation acknowledging their receipt of your cease communications letter. 8. Maintain a professional tone: While it is essential to assert your rights, it is crucial to maintain a polite and professional tone throughout the letter. Conclusion: The Miami-Dade Florida Letter Informing Debt Collector to Cease Communications with Debtor is an effective means for individuals to protect themselves against unwanted debt collection attempts. It allows debtors to assert their rights and put a stop to harassment while ensuring compliance with the relevant laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.