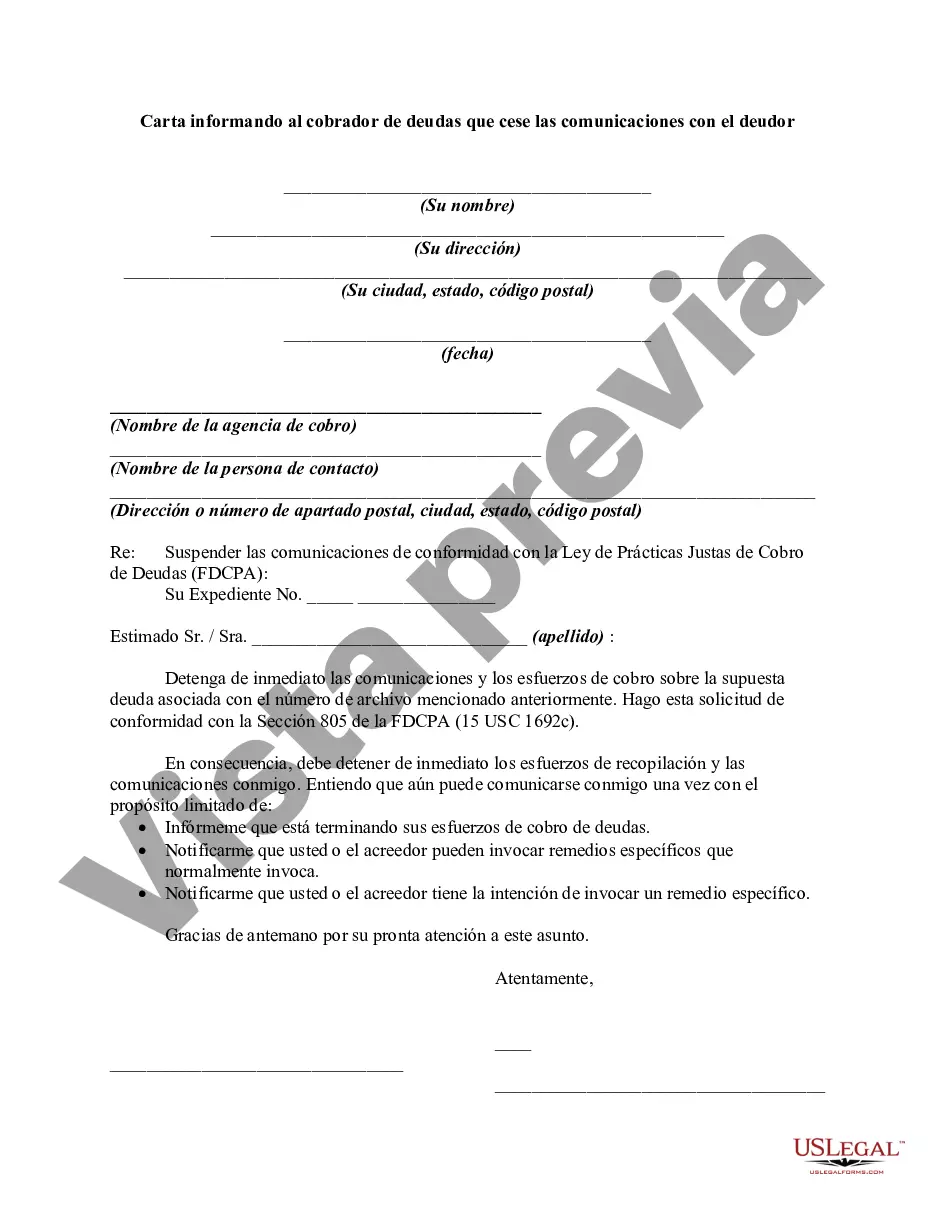

Once a debt collector receives written notice from a consumer that the consumer refuses to pay the debt or wants the collector to stop further collection efforts, the debt collector must cease communications with the consumer except:

To advise the consumer that they are terminating their debt collecting efforts;

To notify the consumer that the debt collector or creditor may invoke specified remedies which they ordinarily invoke; and

To notify the consumer that the debt collector or creditor intends to invoke a specified remedy.

Nassau, New York, is a picturesque town located on Long Island, approximately 19 miles east of Manhattan. Known for its rich history, vibrant community, and beautiful landscapes, Nassau offers a unique blend of suburban living and urban amenities. When it comes to an urgent matter involving debt collection, it is crucial to know how to handle the situation appropriately. If you find yourself in a position where you need to stop a debt collector from contacting you, a Nassau New York Letter Informing to Debt Collector to Cease Communications with Debtor can be a powerful tool. There are different types of letters that can be used in this situation. Here are a few examples: 1. Formal Letter to Cease Communication: This is a standard letter that politely requests the debt collector to stop contacting the debtor. It should include relevant information such as the debtor's full name, address, and account number. Additionally, the letter should clearly state the debtor's intention to halt further communication. 2. Cease and Desist Letter: This type of letter carries a stronger message, as it explicitly instructs the debt collector to cease all communication with the debtor. It may also highlight any violations of the Fair Debt Collection Practices Act (FD PCA) that the debtor believes the debt collector has committed. This letter should be concise, professional, and assertive. 3. Validation of Debt Request: This letter is designed to request the debt collector to provide detailed documentation and evidence supporting the validity of the debt owed. By exercising their rights under the Fair Debt Collection Practices Act, debtors can verify the accuracy of the alleged debt before considering any further communication. In any of the above letters, it is important to use strong yet polite language, clearly expressing the debtor's demands and making it clear that any violation of the request may result in legal actions. Additionally, it is crucial to include all necessary personal details, case numbers if applicable, and any supporting documentation to strengthen the letter's credibility. Lastly, it is highly recommended consulting with a legal professional or debt advisor who can guide and provide further assistance in preparing the Nassau New York Letter Informing to Debt Collector to Cease Communications with Debtor. This will help ensure that the content is accurate, lawful, and effective in protecting the debtor's rights.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.