Once a debt collector receives written notice from a consumer that the consumer refuses to pay the debt or wants the collector to stop further collection efforts, the debt collector must cease communications with the consumer except:

To advise the consumer that they are terminating their debt collecting efforts;

To notify the consumer that the debt collector or creditor may invoke specified remedies which they ordinarily invoke; and

To notify the consumer that the debt collector or creditor intends to invoke a specified remedy.

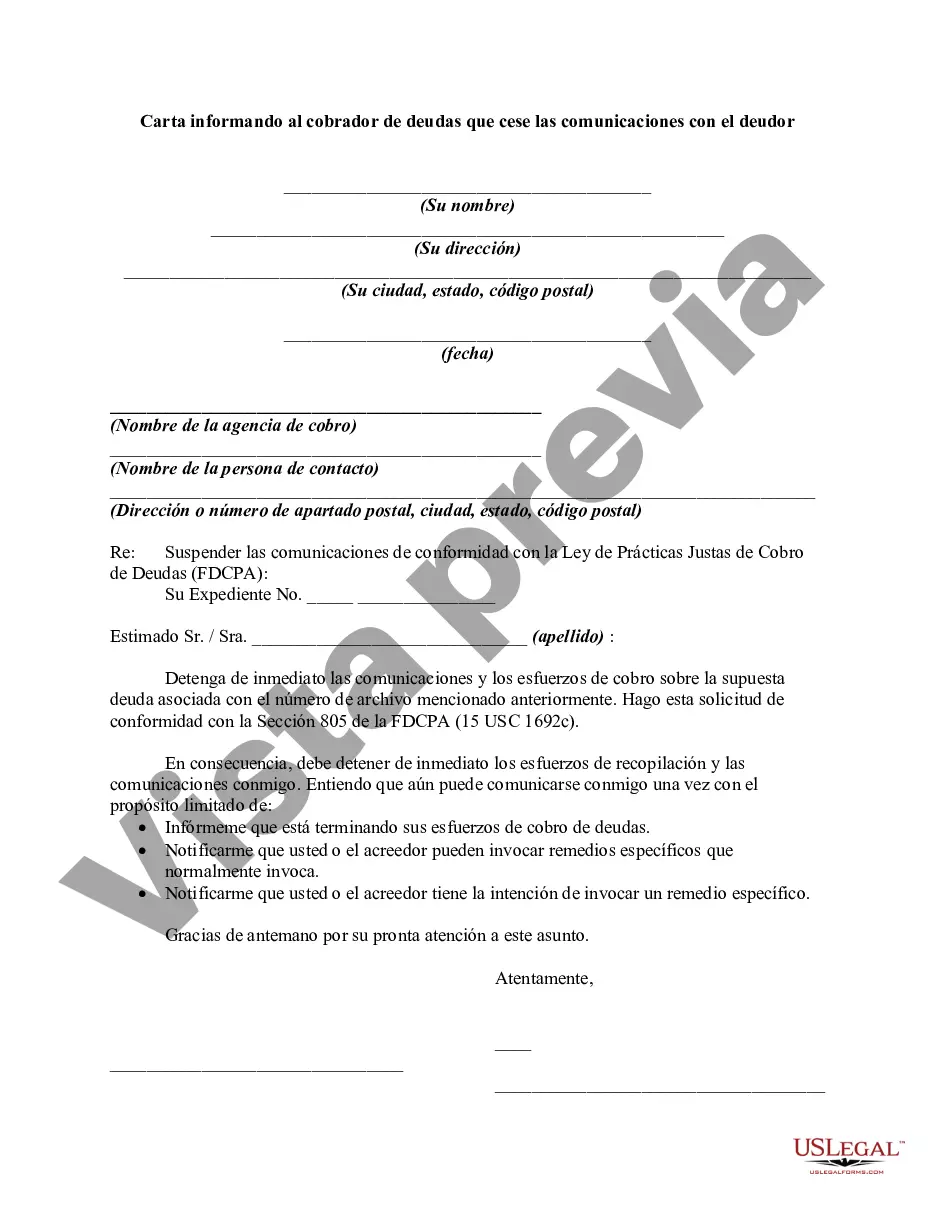

Title: Cease Communications with Debtor: Suffolk New York Letter Informing Debt Collector Introduction: In Suffolk County, New York, individuals who find themselves overwhelmed by debt have the legal right to request that debt collectors cease communication with them. This letter serves as an important tool for debtors to assert this right formally, preventing excessive harassment and providing relief from creditor interactions. This article will delve into the details of a Suffolk New York letter informing a debt collector to cease communications with the debtor, outlining its importance, content structure, and providing insights into different types of such letters. Content: 1. The Importance of a Cease Communications Letter: — Explaining the purpose of the letter: Informing the debt collector to halt all further communications with the debtor. — Providing relief from potential creditor harassment. — Asserting the debtor's rights under the Fair Debt Collection Practices Act (FD CPA) and other relevant legislation. — Reducing stress and facilitating a more manageable debt resolution process for both parties involved. 2. Structure of a Suffolk New York Cease Communications Letter: — Introduction: Clearly state the debtor's intention to cease all communication with the debt collector and their legal right to do so. — Debtor's contact details: Include the debtor's full name, address, telephone number, and any additional relevant information (e.g., account number, dates). — Debt collector's contact details: Include the full name of the debt collection agency, address, phone number, and any pertinent identifiers. — Request for cessation of communication: Politely and explicitly request that the debt collector immediately ceases all communications with the debtor. — Method of communication: Specify the preferred means of communication (e.g., mail) for any essential documents or information related to the debt. — Legal reference: Include references to applicable laws (such as the FD CPA and New York debt collection laws) to reinforce the debtor's rights. — Proof of receipt: Request that the debt collector confirms receipt and compliance with the letter's instructions within a specified timeframe. — Consequences of non-compliance: Clearly state the legal implications of failure to comply, potential monetary penalties, and legal action if necessary. — Copy retention: Keep a copy of the letter for personal records and potential future legal purposes. 3. Different Types of Suffolk New York Letters Informing Debt Collectors to Cease Communications: a) Initial Cease Communications Letter: — Sent when a debtor wishes to invoke their right to cease communications for the first time. — Provides the debt collector with the opportunity to rectify any improper or excessive communication. b) Follow-up Cease Communications Letter: — Sent if the debt collector continues to contact the debtor after receiving the initial letter. — Serves as a formal notice to the debt collector, reiterating the debtor's desire for communication cessation. c) Cease Communications Letter with Law Firm's Involvement: — For cases where debtors suspect violations of their rights or believe a legal intervention is necessary. — Drafted or reviewed by an attorney to ensure compliance with relevant laws and regulations. Conclusion: In Suffolk County, New York, debtors have the right to request debt collectors to stop contacting them through a formal Cease Communications Letter. By understanding the letter's importance, structure, and potential types, debtors can effectively assert their rights, reduce harassment, and bring about a more manageable debt resolution process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.