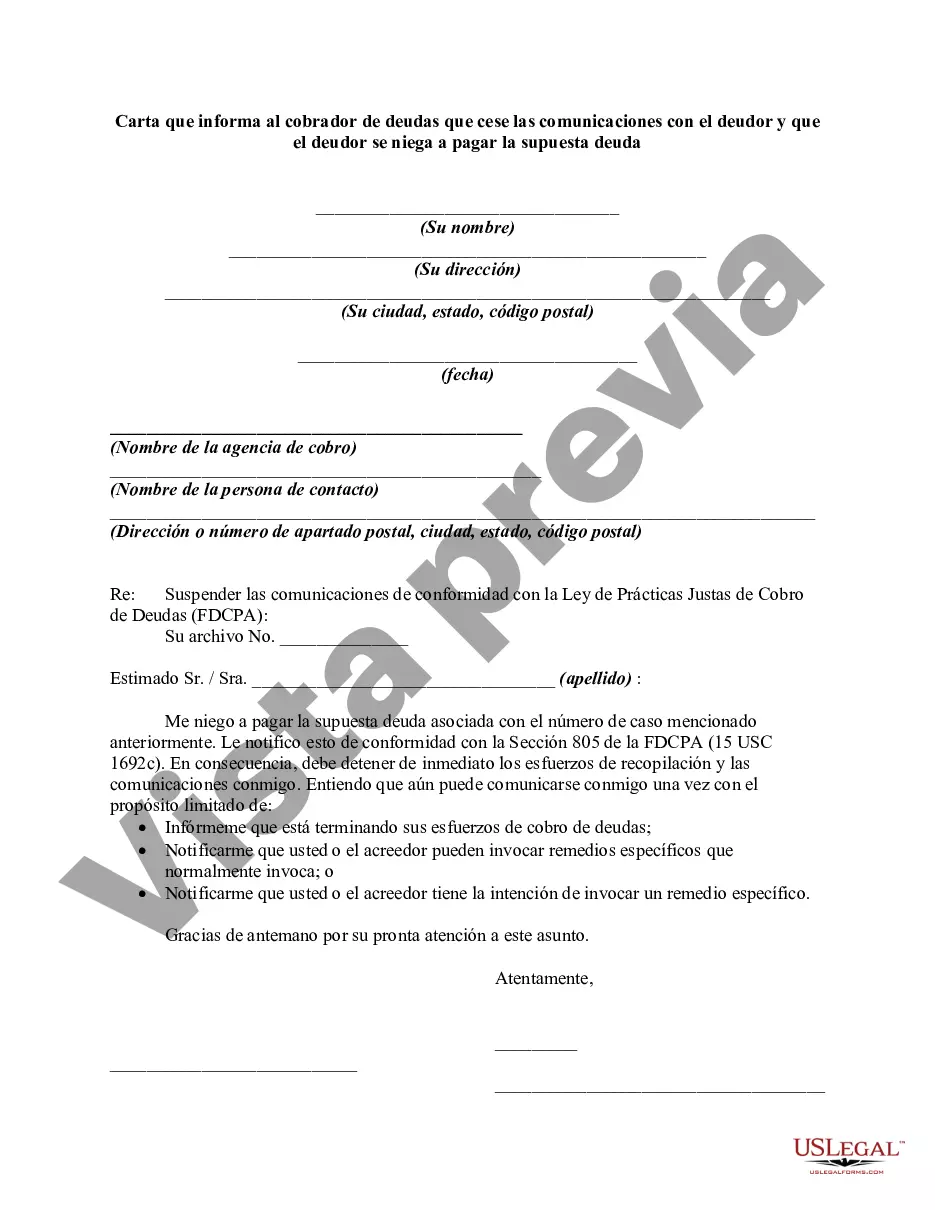

Once a debt collector receives written notice from a consumer that the consumer refuses to pay the debt or wants the collector to stop further collection efforts, the debt collector must cease communications with the consumer except:

To advise the consumer that they are terminating their debt collecting efforts;

To notify the consumer that the debt collector or creditor may invoke specified remedies which they ordinarily invoke; and

To notify the consumer that the debt collector or creditor intends to invoke a specified remedy.

Houston, Texas is a vibrant city located in southeast Texas and is the fourth largest city in the United States. It is renowned for its diverse culture, thriving economy, and rich history. Houston is home to multiple Fortune 500 companies, world-class museums, renowned medical facilities, and a lively arts and entertainment scene. With its vast green spaces, vibrant downtown area, and excellent dining experiences, Houston offers something for everyone. In regard to the specific topic of a "Letter Informing Debt Collector to Cease Communications with Debtor and that Debtor Refuses to Pay Alleged Debt", there are various types of letters that can be used in this context. One such letter is a "Cease and Desist" letter, which formally informs the debt collector to stop all contact with the debtor. This type of communication is typically sent when a debtor believes that they are being harassed by the debt collector or if the debtor disputes the validity of the alleged debt. Another type of letter that can be used is a "Refusal to Pay Alleged Debt" letter. This letter is sent by the debtor to the debt collector to formally communicate the debtor's refusal to pay the alleged debt. The letter usually includes reasons for the debtor's refusal, such as lack of evidence supporting the debt or disputes regarding the debt's validity. If you are a debtor in Houston, Texas, facing financial challenges and dealing with harassing debt collection attempts, it is essential to understand and exercise your rights. You have the right to request that a debt collector ceases communication with you, especially if you believe you are being subjected to unfair or illegal practices. By sending a well-crafted letter informing the debt collector to stop contacting you or expressing your refusal to pay the alleged debt, you can take the first step in addressing the situation and protecting your rights. It is important to consult legal advice or utilize templates provided by consumer protection agencies to ensure the letter is proper and includes relevant information. By doing so, you can effectively communicate your stance to the debt collector and work towards resolving the matter in a fair and appropriate manner. Remember, it is crucial to keep copies of all correspondence and document any further attempts made by the debt collector, as this will help you in case you need to take further legal action to protect your rights.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.