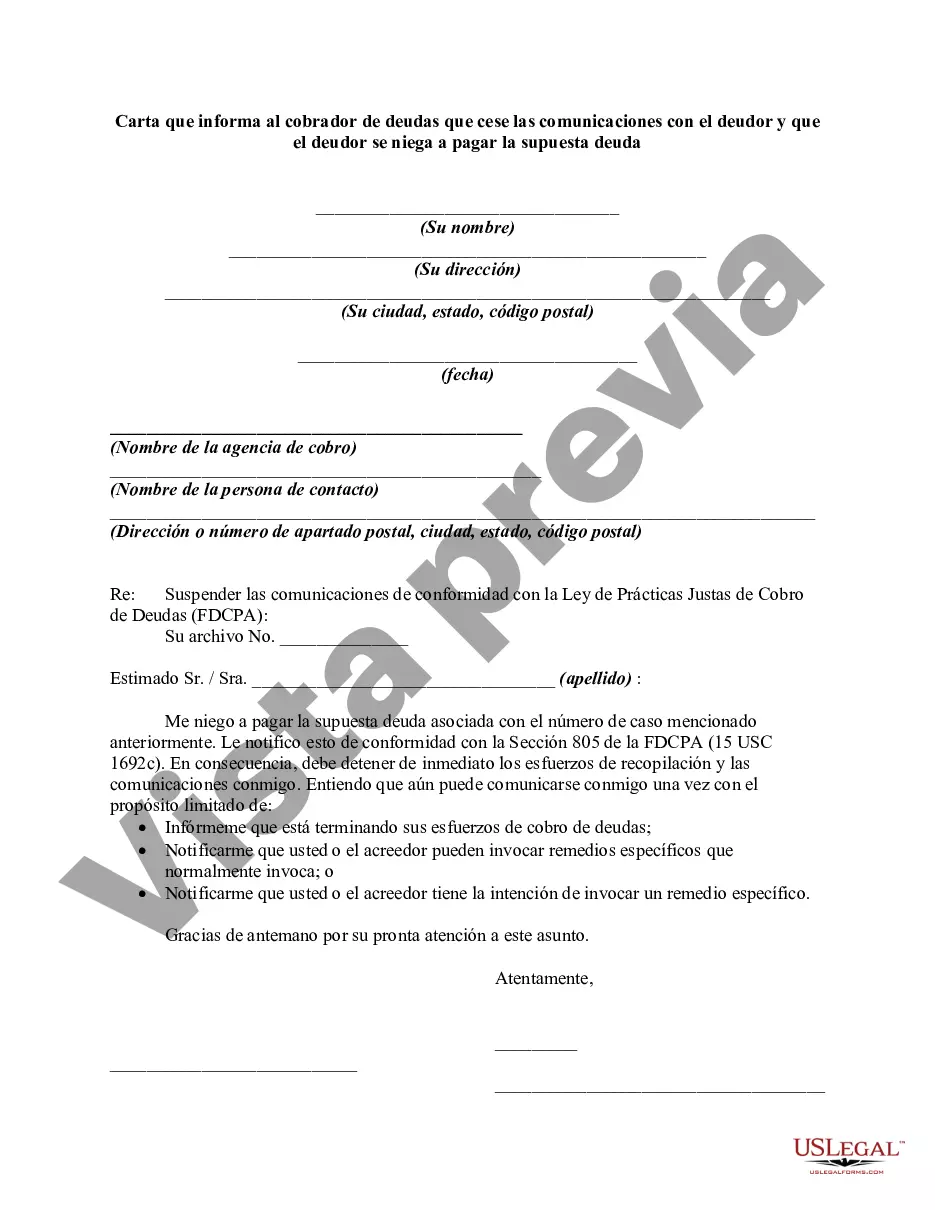

Once a debt collector receives written notice from a consumer that the consumer refuses to pay the debt or wants the collector to stop further collection efforts, the debt collector must cease communications with the consumer except:

To advise the consumer that they are terminating their debt collecting efforts;

To notify the consumer that the debt collector or creditor may invoke specified remedies which they ordinarily invoke; and

To notify the consumer that the debt collector or creditor intends to invoke a specified remedy.

Miami-Dade County is a vibrant and bustling region located in southeastern Florida. Known for its pristine beaches, diverse culture, and thriving tourism industry, Miami-Dade is home to over 2.7 million residents. As the most populous county in Florida, it encompasses many cities and towns, including the city of Miami, Coral Gables, Miami Beach, and many others. When it comes to financial matters, debt collection is a common issue faced by individuals in Miami-Dade County. In situations where a debtor refuses to pay an alleged debt but is being hounded by a debt collector, it may become necessary to send a letter informing the debt collector to cease communications. This letter serves as an official request for the debt collector to stop contacting the debtor regarding the alleged debt. Keywords: Miami-Dade County, Florida, debt collector, cease communications, debtor, alleged debt, letter, refuse to pay. Different types of Miami-Dade Florida letter informing debt collector to cease communications with the debtor and that debtor refuses to pay alleged debt may include: 1. Miami-Dade County Debt Dispute Letter: This type of letter is used when the debtor disputes the validity of the alleged debt and requests the debt collector to provide documentation or evidence supporting their claim. 2. Miami-Dade County Debt Validation Letter: If a debtor believes that the debt collector has provided insufficient or inaccurate information regarding the alleged debt, a debt validation letter can be sent. This letter requests the debt collector to provide proper documentation to validate the debt. 3. Miami-Dade County Cease and Desist Letter: In cases where the debtor believes they are being harassed or subjected to unfair debt collection practices, a cease and desist letter can be sent. This letter demands that the debt collector stops all communications regarding the alleged debt. 4. Miami-Dade County Debt Settlement Letter: If the debtor wants to negotiate a settlement or payment plan for the alleged debt, a debt settlement letter can be used. This letter outlines the debtor's proposed terms and conditions for resolving the debt. It is important to consult legal professionals or seek advice from debt relief agencies to ensure that the appropriate letter is used and to understand the legal rights and responsibilities associated with debt collection in Miami-Dade County, Florida.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.