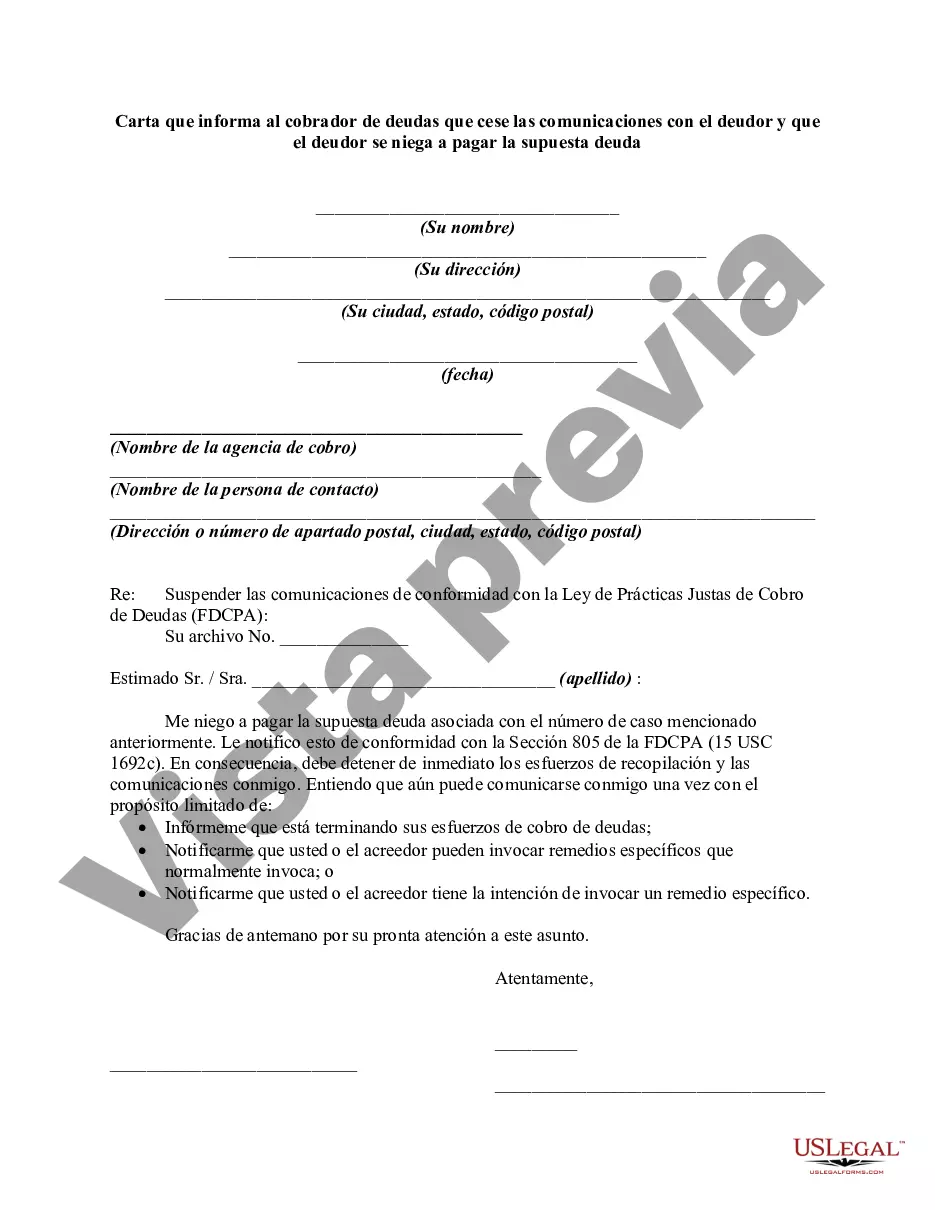

Once a debt collector receives written notice from a consumer that the consumer refuses to pay the debt or wants the collector to stop further collection efforts, the debt collector must cease communications with the consumer except:

To advise the consumer that they are terminating their debt collecting efforts;

To notify the consumer that the debt collector or creditor may invoke specified remedies which they ordinarily invoke; and

To notify the consumer that the debt collector or creditor intends to invoke a specified remedy.

Queens, New York — A bustling borough within the city, Queens is known for its diverse population, cultural attractions, and thriving economy. Home to approximately 2.4 million residents, Queens offers a vibrant mix of residential neighborhoods, commercial districts, and renowned institutions such as Flushing Meadows-Corona Park and the Queens Museum. A Letter Informing Debt Collector to Cease Communications with Debtor and that Debtor Refuses to Pay Alleged Debt is a crucial legal document that safeguards the rights of debtors in Queens, New York. This letter serves as a formal request to debt collectors to stop contacting the debtor regarding an alleged debt. By sending this letter, debtors assert their rights under the Fair Debt Collection Practices Act (FD CPA), which prohibits abusive, threatening, or misleading communication from debt collectors. There may be different types of Queens New York Letters Informing Debt Collectors to Cease Communications with Debtors and that Debtors Refuse to Pay Alleged Debt, including: 1. Simple Cease Communication Letter: This type of letter succinctly requests the debt collector to cease all communication with the debtor, providing a clear statement that the debtor refuses to pay the alleged debt. It includes relevant details such as the debtor's name, contact information, and the debt collector's details. 2. Certified Cease Communication Letter: Often used for important legal situations, a certified letter is sent via certified mail with a return receipt requested. This provides proof of receipt and ensures that the debt collector is aware of the debtor's request to cease communication. 3. Attorney Representation Cease Communication Letter: In some cases, debtors may choose to involve an attorney to handle their debt-related matters. This type of letter includes the debtor's attorney's information and explicitly states that all communication regarding the alleged debt must go through the attorney, thereby protecting the debtor's rights and streamlining the process. Keywords: Queens, New York, letter, debt collector, cease communications, debtor, alleged debt, Fair Debt Collection Practices Act (FD CPA), rights, formal request, abusive communication, threatening communication, misleading communication, cease communication letter, certified mail, return receipt, attorney representation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.