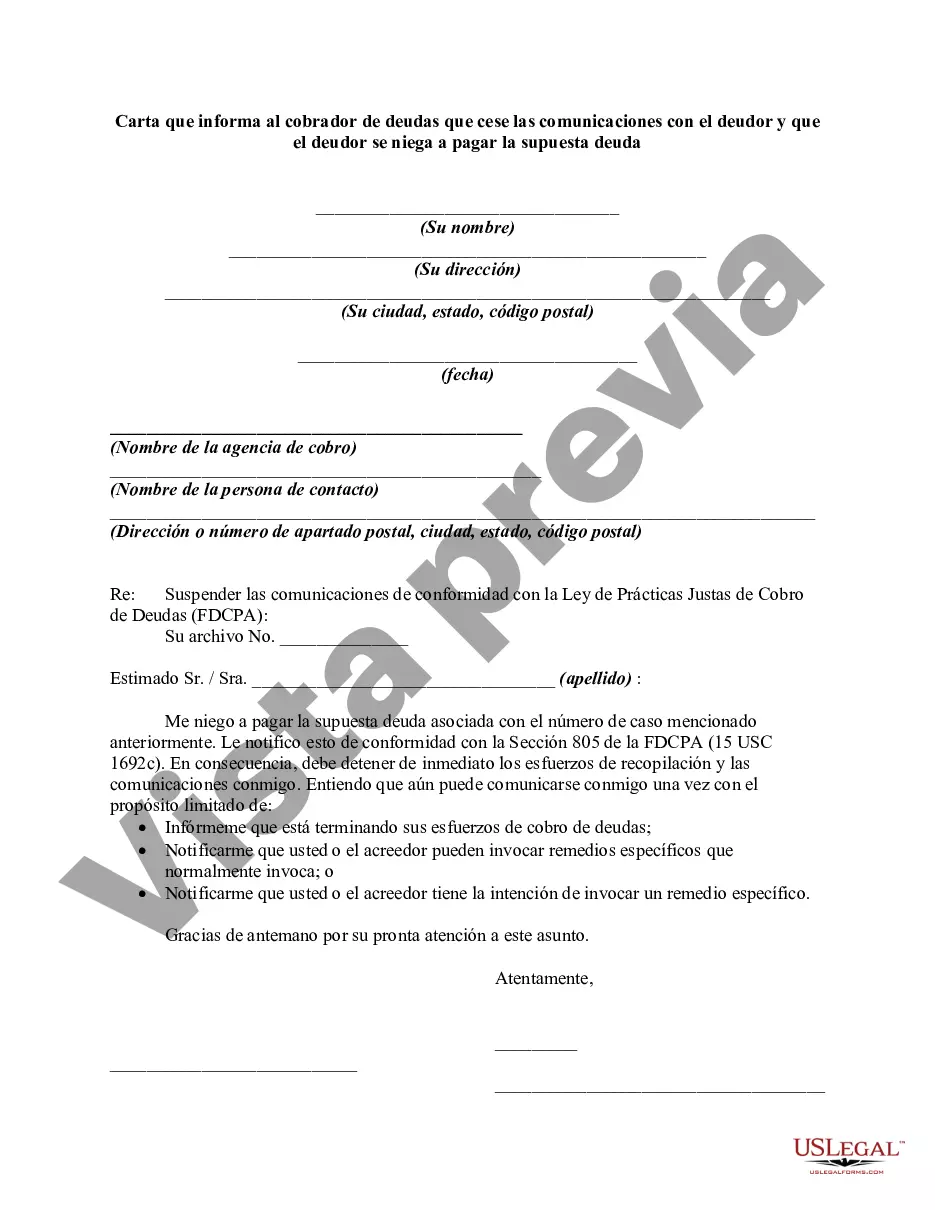

Once a debt collector receives written notice from a consumer that the consumer refuses to pay the debt or wants the collector to stop further collection efforts, the debt collector must cease communications with the consumer except:

To advise the consumer that they are terminating their debt collecting efforts;

To notify the consumer that the debt collector or creditor may invoke specified remedies which they ordinarily invoke; and

To notify the consumer that the debt collector or creditor intends to invoke a specified remedy.

Wake North Carolina Letter Informing Debt Collector to Cease Communications with Debtor and that Debtor Refuses to Pay Alleged Debt Description: A Wake North Carolina letter informing a debt collector to cease communications with a debtor and stating the debtor's refusal to pay an alleged debt is a written document sent by an individual residing in Wake, North Carolina, to assert their rights under the Fair Debt Collection Practices Act (FD CPA). This letter serves as a legal instrument to halt any further contact from a debt collector and to dispute the validity of the alleged debt. Keywords: — Wake NortCarolinain— - Debt collector - Cease communications Debtto— - Refusal to pay - Alleged debt — Fair Debt Collection Practices Ac— - FDCPA — Legal rights - Written documen— - Dispute — Validity Types of Wake North Carolina Letters Informing Debt Collector to Cease Communications with Debtor and that Debtor Refuses to Pay Alleged Debt: 1. Initial Cease Communication Letter: This type of letter is sent to a debt collector for the first time, expressing the debtor's refusal to pay the alleged debt and explicitly requesting that all communication from the collector ceases. It outlines the debtor's rights under the FD CPA, such as the right to dispute the debt and the consequences of further contact from the collector. 2. Follow-up Cease Communication Letter: If a debt collector continues to contact the debtor despite the initial cease communication letter, a follow-up letter can be sent to reiterate the debtor's refusal to pay and their demand for all communication to stop immediately. This letter may emphasize the legal consequences of non-compliance and may seek legal action if necessary. 3. Dispute of Alleged Debt Letter: This type of letter is used when the debtor disputes the validity of the alleged debt. It requires the debt collector to provide comprehensive documentation and evidence to substantiate the debt, failing which the debtor demands the cessation of further communication. The letter may also outline the debtor's rights and remind the collector of their obligations under the FD CPA. 4. Cease Communication with Third Parties Letter: In certain situations, debt collectors might contact third parties, such as family members or employers, regarding the alleged debt. This letter specifically instructs the collector to cease all communication with any third party and to only communicate directly with the debtor or their legal representative. It emphasizes the debtor's privacy rights and warns of potential legal actions for violations. Note: It is crucial to consult with an attorney or legal professional before drafting and sending any legal documents to ensure compliance with the applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.