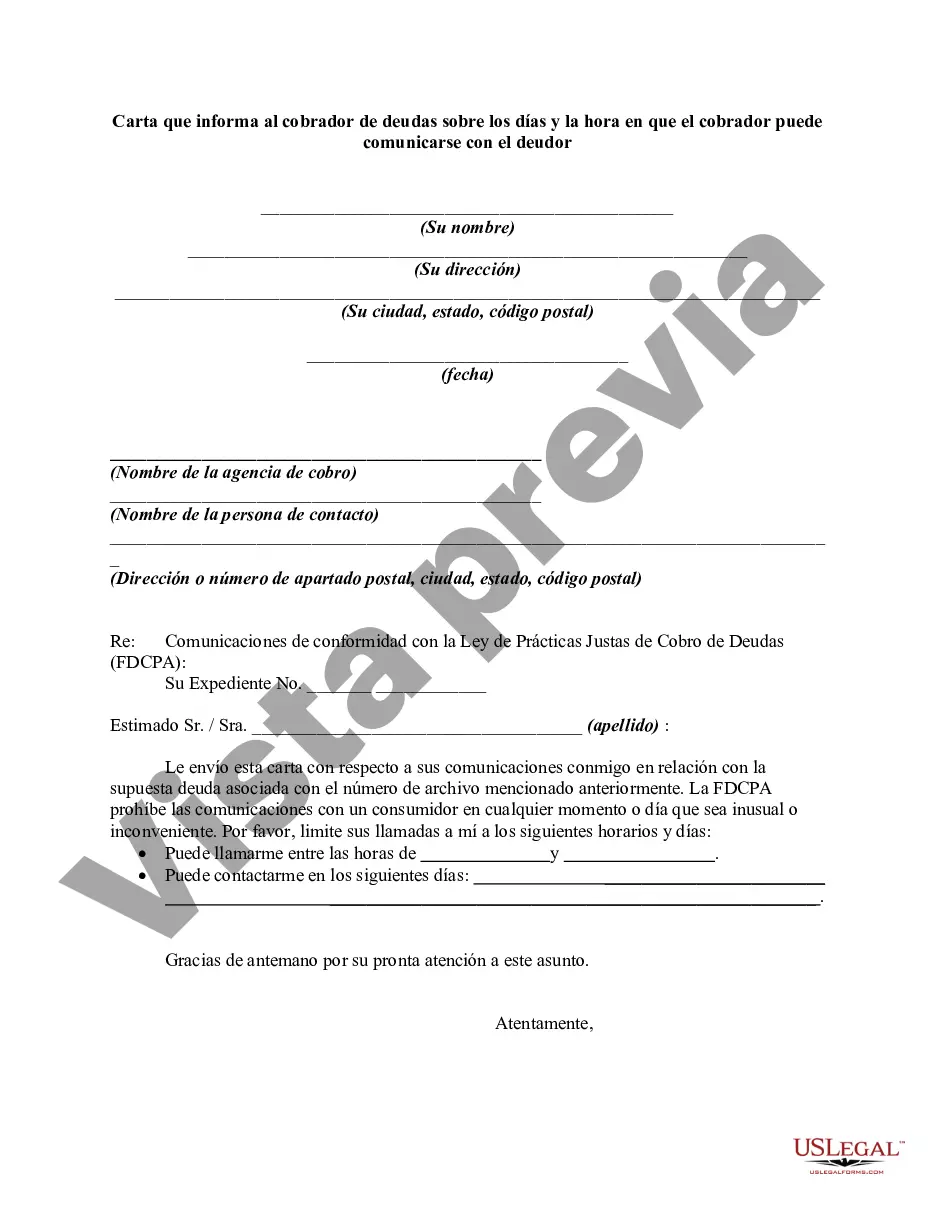

The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects. If the debtor tells the creditor the name of his attorney, any future contacts must be made with the attorney and not with the debtor.

Chicago, Illinois is the largest city in the state of Illinois and the third-largest city in the United States. Known for its iconic skyline, vibrant culture, and diverse population, Chicago is a bustling metropolis that attracts millions of visitors each year. In terms of finance, debt collection is a common practice in Chicago, and there are specific guidelines that debt collectors must follow when contacting debtors. To ensure compliance with these regulations, debt collectors in Chicago are required to send a letter informing debtors of the days and times they may be contacted. One type of letter informing debt collectors as to the days and time they may contact debtors is the "Initial Communication Letter." This letter is typically sent at the beginning of the debt collection process and includes essential information such as the debt amount, the name of the creditor, and the days and times the debt collector is allowed to contact the debtor. Another type of letter is the "Cease and Desist Letter." This letter is sent by the debtor to the debt collector, requesting that all communication regarding the debt cease. In such cases, the debt collector is legally obligated to stop contacting the debtor, except to acknowledge receipt of the "Cease and Desist Letter" or inform the debtor of any legal actions being taken. Additionally, there may be variations of these letters depending on the specific debt collection agency or state requirements. For example, some debt collectors may modify the content of the letters or include additional information specific to their agency's policies. When drafting a "Letter Informing Debt Collector as to Days and Time Collector May Contact Debtor" in Chicago, it is vital to key in on relevant keywords such as debt collection, Chicago, Illinois, debt collector guidelines, debt collection process, Initial Communication Letter, Cease and Desist Letter, legal actions, creditor, and debtor rights. By incorporating these keywords, the letter becomes tailored to the specific context of debt collection in Chicago, emphasizing the importance of compliance with regulations and debtor protection. Overall, debt collection is a crucial aspect of financial practices in Chicago, and both debt collectors and debtors must be aware of their rights and responsibilities. The various types of letters informing debt collectors of the days and times they may contact debtors help establish clear communication guidelines and ensure fair treatment for all parties involved in the debt collection process.Chicago, Illinois is the largest city in the state of Illinois and the third-largest city in the United States. Known for its iconic skyline, vibrant culture, and diverse population, Chicago is a bustling metropolis that attracts millions of visitors each year. In terms of finance, debt collection is a common practice in Chicago, and there are specific guidelines that debt collectors must follow when contacting debtors. To ensure compliance with these regulations, debt collectors in Chicago are required to send a letter informing debtors of the days and times they may be contacted. One type of letter informing debt collectors as to the days and time they may contact debtors is the "Initial Communication Letter." This letter is typically sent at the beginning of the debt collection process and includes essential information such as the debt amount, the name of the creditor, and the days and times the debt collector is allowed to contact the debtor. Another type of letter is the "Cease and Desist Letter." This letter is sent by the debtor to the debt collector, requesting that all communication regarding the debt cease. In such cases, the debt collector is legally obligated to stop contacting the debtor, except to acknowledge receipt of the "Cease and Desist Letter" or inform the debtor of any legal actions being taken. Additionally, there may be variations of these letters depending on the specific debt collection agency or state requirements. For example, some debt collectors may modify the content of the letters or include additional information specific to their agency's policies. When drafting a "Letter Informing Debt Collector as to Days and Time Collector May Contact Debtor" in Chicago, it is vital to key in on relevant keywords such as debt collection, Chicago, Illinois, debt collector guidelines, debt collection process, Initial Communication Letter, Cease and Desist Letter, legal actions, creditor, and debtor rights. By incorporating these keywords, the letter becomes tailored to the specific context of debt collection in Chicago, emphasizing the importance of compliance with regulations and debtor protection. Overall, debt collection is a crucial aspect of financial practices in Chicago, and both debt collectors and debtors must be aware of their rights and responsibilities. The various types of letters informing debt collectors of the days and times they may contact debtors help establish clear communication guidelines and ensure fair treatment for all parties involved in the debt collection process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.