The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects. If the debtor tells the creditor the name of his attorney, any future contacts must be made with the attorney and not with the debtor.

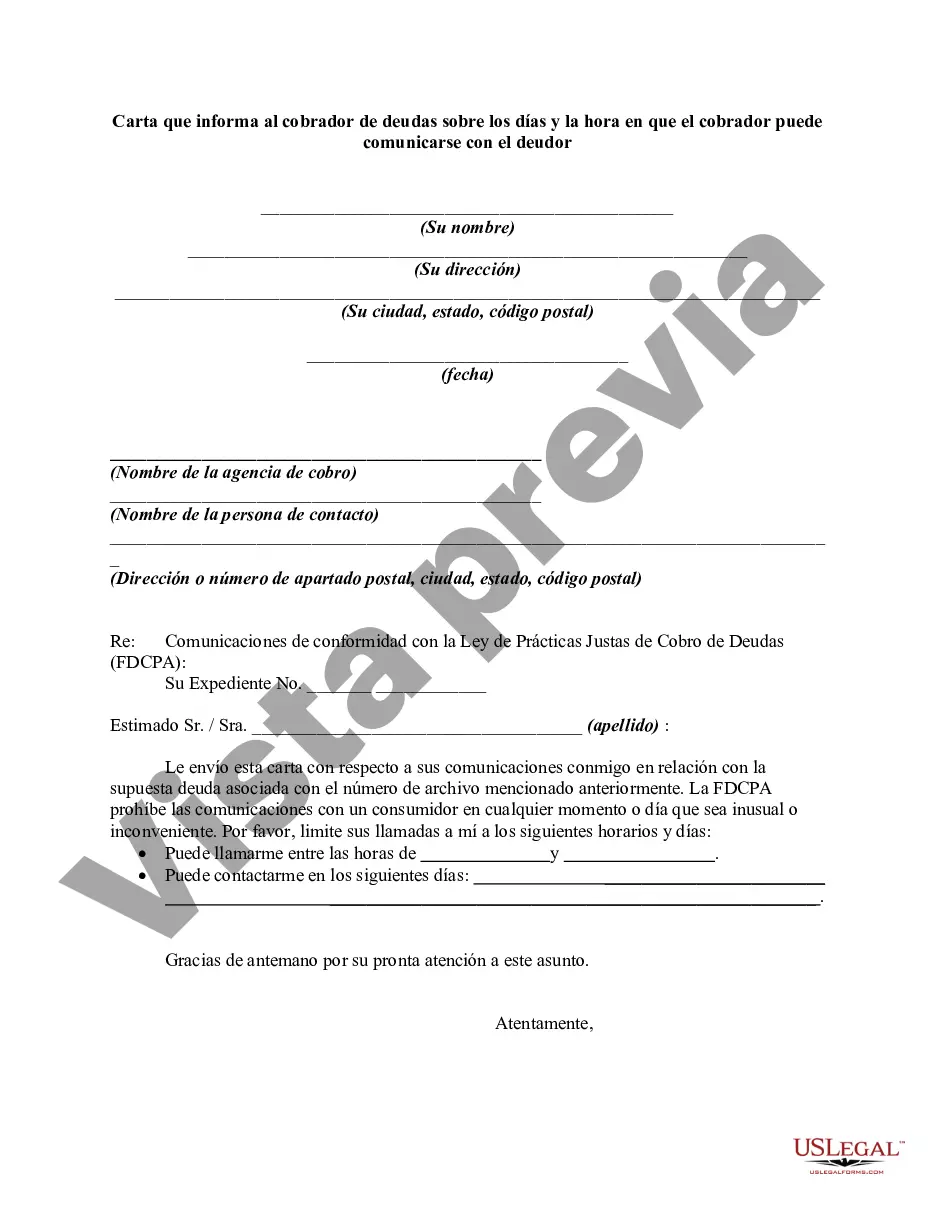

Title: All You Need to Know about Houston, Texas: Informing Debt Collectors about Contact Days and Time Description: Houston, Texas, is a vibrant city known for its rich culture, diverse population, and flourishing economy. This detailed article provides insightful information about Houston, along with guiding individuals on drafting a letter that informs debt collectors about the specific days and times they may contact a debtor. Keywords: Houston, Texas, debt collector, contact debtor, informing letter, collection guidelines Introduction: In this article, we will delve into the essence of Houston, Texas, and discuss the crucial process of informing debt collectors about the days and times they may contact a debtor. 1. Houston, Texas: A Brief Overview Discover the charm and significance of Houston, Texas. From its thriving business sector to its world-class arts scene, Houston has much to offer. 2. Understanding Debt Collectors Learn about the role and responsibilities of debt collectors. Gain insight into their communication methods and legal limitations. 3. Houston Texas Letter Informing Debt Collector This section provides readers with a step-by-step guide on how to draft an effective letter. It outlines the essential components that must be included, emphasizing the importance of accurately informing debt collectors about suitable contact days and times. 4. Key Elements of an Informing Letter Explore the crucial elements within the letter, including debtor identification, debt specifics, and the primary focus on specifying contact days and times. 5. Compliance with Collection Guidelines Debtor protection and compliance with collection guidelines are paramount. Understand the laws in Houston, Texas, pertaining to debt collection practices, and ensure the informing letter aligns with these regulations. 6. Types of Houston Texas Informing Letters While there may not be specific types of informing letters, various scenarios might require customization. Examples include informing debt collectors about non-conventional working hours, limitations due to medical conditions, or legal restrictions on contact attempts. 7. Addressing Time Zone Differences Houston, Texas, is located within the Central Time Zone. Acknowledge the significance of time zone differences, particularly when dealing with out-of-state or international debt collectors. Conclusion: By providing a comprehensive understanding of Houston, Texas, and delivering practical insights on drafting an informing letter, this article equips debtors with the necessary tools to handle debt collection professionally. Protecting debtors and ensuring compliance with collection guidelines are crucial factors when addressing debt-related issues. (Note: The different types of informing letters mentioned here are hypothetical scenarios that might occur when sending an informing letter to a debt collector. The key focus is on the essential elements and guidelines for drafting such a letter.)Title: All You Need to Know about Houston, Texas: Informing Debt Collectors about Contact Days and Time Description: Houston, Texas, is a vibrant city known for its rich culture, diverse population, and flourishing economy. This detailed article provides insightful information about Houston, along with guiding individuals on drafting a letter that informs debt collectors about the specific days and times they may contact a debtor. Keywords: Houston, Texas, debt collector, contact debtor, informing letter, collection guidelines Introduction: In this article, we will delve into the essence of Houston, Texas, and discuss the crucial process of informing debt collectors about the days and times they may contact a debtor. 1. Houston, Texas: A Brief Overview Discover the charm and significance of Houston, Texas. From its thriving business sector to its world-class arts scene, Houston has much to offer. 2. Understanding Debt Collectors Learn about the role and responsibilities of debt collectors. Gain insight into their communication methods and legal limitations. 3. Houston Texas Letter Informing Debt Collector This section provides readers with a step-by-step guide on how to draft an effective letter. It outlines the essential components that must be included, emphasizing the importance of accurately informing debt collectors about suitable contact days and times. 4. Key Elements of an Informing Letter Explore the crucial elements within the letter, including debtor identification, debt specifics, and the primary focus on specifying contact days and times. 5. Compliance with Collection Guidelines Debtor protection and compliance with collection guidelines are paramount. Understand the laws in Houston, Texas, pertaining to debt collection practices, and ensure the informing letter aligns with these regulations. 6. Types of Houston Texas Informing Letters While there may not be specific types of informing letters, various scenarios might require customization. Examples include informing debt collectors about non-conventional working hours, limitations due to medical conditions, or legal restrictions on contact attempts. 7. Addressing Time Zone Differences Houston, Texas, is located within the Central Time Zone. Acknowledge the significance of time zone differences, particularly when dealing with out-of-state or international debt collectors. Conclusion: By providing a comprehensive understanding of Houston, Texas, and delivering practical insights on drafting an informing letter, this article equips debtors with the necessary tools to handle debt collection professionally. Protecting debtors and ensuring compliance with collection guidelines are crucial factors when addressing debt-related issues. (Note: The different types of informing letters mentioned here are hypothetical scenarios that might occur when sending an informing letter to a debt collector. The key focus is on the essential elements and guidelines for drafting such a letter.)

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.