The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects. If the debtor tells the creditor the name of his attorney, any future contacts must be made with the attorney and not with the debtor.

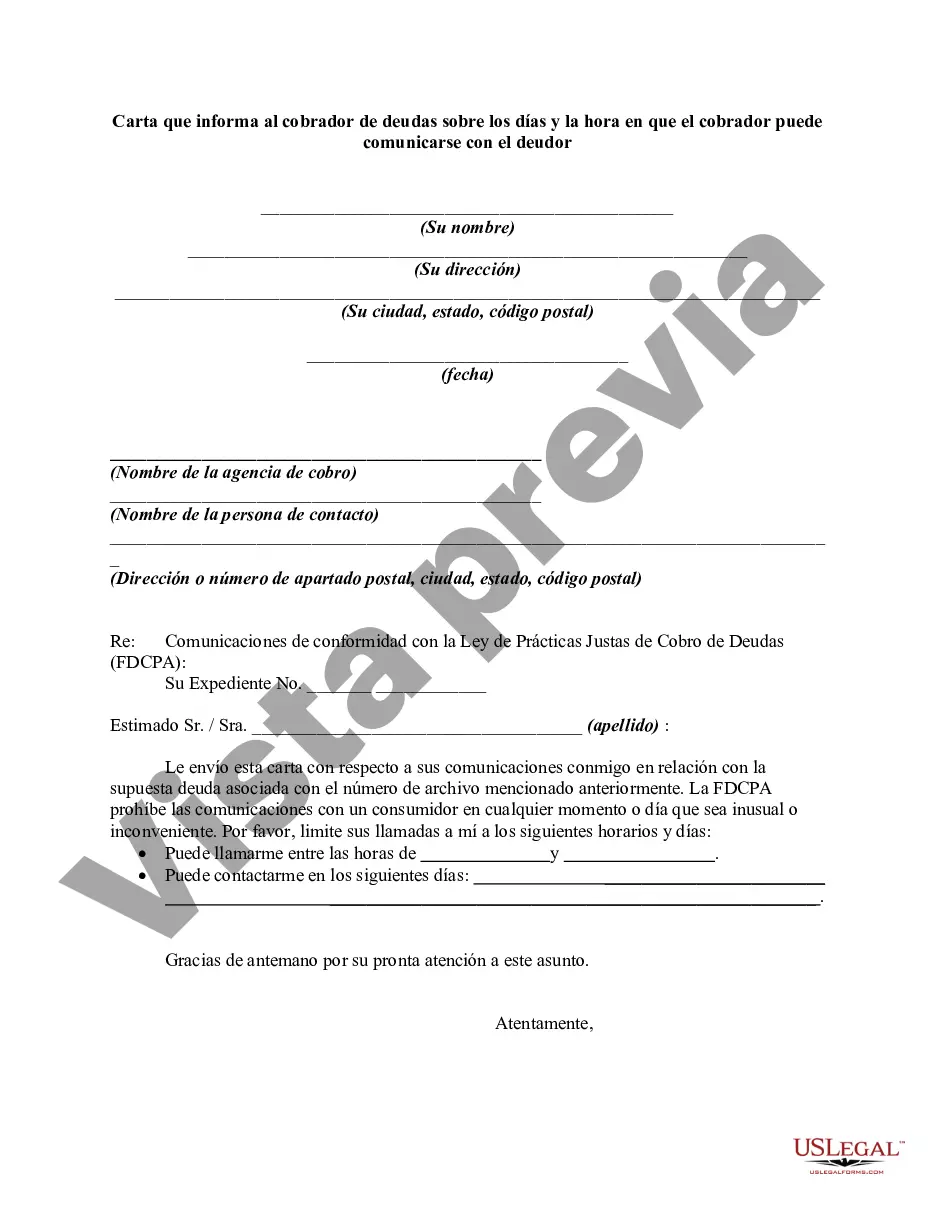

Title: Understanding King Washington's Letter Informing Debt Collector About Contact Days and Time for Debtors Keywords: King Washington, debt collector, letter informing, contact days, time, debtor Introduction: In the realm of debt collection, it is crucial to establish clear boundaries concerning when and how a debt collector can contact a debtor. King Washington, a prominent legal entity, has devised a standardized letter to inform debt collectors about the permissible days and times to contact debtors. This detailed description sheds light on the key features of the King Washington Letter Informing Debt Collector as to Days and Time Collector May Contact Debtor. 1. Standard King Washington Letter: The standard King Washington Letter constitutes a comprehensive template designed to inform debt collectors about the days and times they are allowed to contact debtors. This letter ensures that collectors adhere to legal requirements and protects debtors from undue harassment. 2. Personalized King Washington Letter: In certain cases, debtors may have specific limitations or preferences regarding contact days and times. King Washington acknowledges this variability and provides a personalized letter format, which allows debtors to articulate their preferred availability or exclusions within the legal framework. 3. Legal Compliance: The King Washington Letter aims to ensure that debt collectors respect the guidelines set forth by federal and state regulations. By following these guidelines, collectors may avoid potential legal complications and foster a fair and ethical interaction between themselves and debtors. 4. Setting Contact Days: The letter specifies the permissible days or weekdays during which the debt collector can reach out to the debtor. Debtors often have professional or personal commitments, and this provision enables collectors to operate within mutually agreed-upon timeframes. 5. Specifying Time Periods: In addition to the specific days, the King Washington Letter communicates the precise timeframes within which a debt collector can contact the debtor. This provision helps implement appropriate boundaries and ensures that debtors are not contacted outside reasonable hours. 6. Flexible Contact Options: Recognizing the diversity of communication preferences, the King Washington Letter suggests different contact methods, including phone calls, emails, or physical mail. Debtors have the option to specify which channels they prefer or exclude. 7. Frequency of Contact: To prevent excessive contact that may be considered harassing, the King Washington Letter outlines the permissible frequency of communications between the debt collector and debtor. This provision maintains a balanced approach, allowing for effective communication while avoiding undue pressure. Conclusion: The King Washington Letter Informing Debt Collector as to Days and Time Collector May Contact Debtor provides a structured framework for maintaining respectful debt collection practices. It ensures compliance with legal requirements, while also considering the debtor's availability and preferences. By utilizing this letter, collectors can build transparent and fair relationships with debtors, minimizing conflicts and promoting productive resolutions.Title: Understanding King Washington's Letter Informing Debt Collector About Contact Days and Time for Debtors Keywords: King Washington, debt collector, letter informing, contact days, time, debtor Introduction: In the realm of debt collection, it is crucial to establish clear boundaries concerning when and how a debt collector can contact a debtor. King Washington, a prominent legal entity, has devised a standardized letter to inform debt collectors about the permissible days and times to contact debtors. This detailed description sheds light on the key features of the King Washington Letter Informing Debt Collector as to Days and Time Collector May Contact Debtor. 1. Standard King Washington Letter: The standard King Washington Letter constitutes a comprehensive template designed to inform debt collectors about the days and times they are allowed to contact debtors. This letter ensures that collectors adhere to legal requirements and protects debtors from undue harassment. 2. Personalized King Washington Letter: In certain cases, debtors may have specific limitations or preferences regarding contact days and times. King Washington acknowledges this variability and provides a personalized letter format, which allows debtors to articulate their preferred availability or exclusions within the legal framework. 3. Legal Compliance: The King Washington Letter aims to ensure that debt collectors respect the guidelines set forth by federal and state regulations. By following these guidelines, collectors may avoid potential legal complications and foster a fair and ethical interaction between themselves and debtors. 4. Setting Contact Days: The letter specifies the permissible days or weekdays during which the debt collector can reach out to the debtor. Debtors often have professional or personal commitments, and this provision enables collectors to operate within mutually agreed-upon timeframes. 5. Specifying Time Periods: In addition to the specific days, the King Washington Letter communicates the precise timeframes within which a debt collector can contact the debtor. This provision helps implement appropriate boundaries and ensures that debtors are not contacted outside reasonable hours. 6. Flexible Contact Options: Recognizing the diversity of communication preferences, the King Washington Letter suggests different contact methods, including phone calls, emails, or physical mail. Debtors have the option to specify which channels they prefer or exclude. 7. Frequency of Contact: To prevent excessive contact that may be considered harassing, the King Washington Letter outlines the permissible frequency of communications between the debt collector and debtor. This provision maintains a balanced approach, allowing for effective communication while avoiding undue pressure. Conclusion: The King Washington Letter Informing Debt Collector as to Days and Time Collector May Contact Debtor provides a structured framework for maintaining respectful debt collection practices. It ensures compliance with legal requirements, while also considering the debtor's availability and preferences. By utilizing this letter, collectors can build transparent and fair relationships with debtors, minimizing conflicts and promoting productive resolutions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.