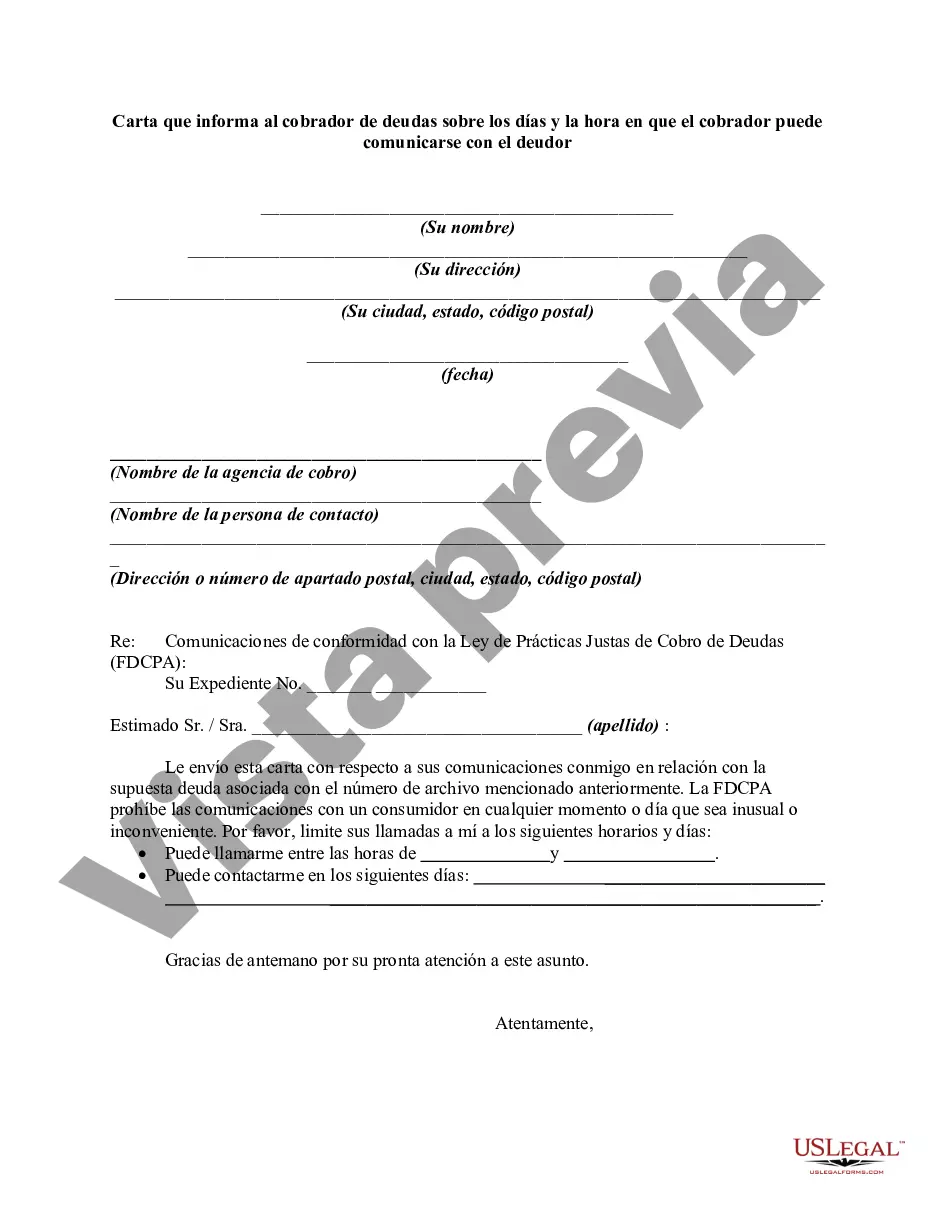

The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects. If the debtor tells the creditor the name of his attorney, any future contacts must be made with the attorney and not with the debtor.

Los Angeles California, often referred to as simply Los Angeles or LA, is a vibrant and diverse city located in Southern California. It is the largest city in California and the second-largest city in the United States, known for its iconic landmarks, beautiful beaches, and thriving entertainment industry. LA is home to numerous famous neighborhoods such as Hollywood, Beverly Hills, Santa Monica, and Venice Beach. It boasts a Mediterranean climate with warm summers and mild winters, making it an attractive destination for tourists and residents alike. When it comes to a letter informing debt collectors about the days and times they may contact a debtor in Los Angeles, there are specific guidelines that should be followed in accordance with the Fair Debt Collection Practices Act (FD CPA). These guidelines aim to protect the rights of debtors and ensure that the collection process is fair and respectful. There are different types of letters that debt collectors can send to debtors in Los Angeles, California, to inform them about the days and times they may be contacted. Some of these letters include: 1. Initial Notification Letter: This letter serves as a first communication to inform the debtor of their outstanding debt and their rights under the FD CPA. It provides information about the days and times the collector may contact the debtor, ensuring compliance with the law. 2. Cease and Desist Letter: Debtors have the right to request that debt collectors cease contacting them. A cease and desist letter specifically instructs the collector to stop all communication attempts. Once this letter is received, the debt collector must refrain from further contact, except to inform the debtor of any specific actions they may take. 3. Time-Limited Communication Letter: This type of letter grants permission for debt collectors to communicate with the debtor during specific days and times, limiting the frequency and duration of contact. Debtors can set specific restrictions and designate convenient days and times for contact in this letter. It is important to note that the content of these letters should clearly state the purpose, provide debtor information, include reference numbers, and outline the days and times for contact as agreed upon by the debtor and the collector. In conclusion, Los Angeles California is a diverse and culturally rich city in Southern California. When sending a letter to a debt collector regarding the designated days and times for contact, it is essential to follow the guidelines set by the FD CPA. Some types of letters that can be used include the initial notification letter, cease and desist letter, and time-limited communication letter. These letters ensure transparency in debt collection practices and protect the rights of debtors in Los Angeles, California.Los Angeles California, often referred to as simply Los Angeles or LA, is a vibrant and diverse city located in Southern California. It is the largest city in California and the second-largest city in the United States, known for its iconic landmarks, beautiful beaches, and thriving entertainment industry. LA is home to numerous famous neighborhoods such as Hollywood, Beverly Hills, Santa Monica, and Venice Beach. It boasts a Mediterranean climate with warm summers and mild winters, making it an attractive destination for tourists and residents alike. When it comes to a letter informing debt collectors about the days and times they may contact a debtor in Los Angeles, there are specific guidelines that should be followed in accordance with the Fair Debt Collection Practices Act (FD CPA). These guidelines aim to protect the rights of debtors and ensure that the collection process is fair and respectful. There are different types of letters that debt collectors can send to debtors in Los Angeles, California, to inform them about the days and times they may be contacted. Some of these letters include: 1. Initial Notification Letter: This letter serves as a first communication to inform the debtor of their outstanding debt and their rights under the FD CPA. It provides information about the days and times the collector may contact the debtor, ensuring compliance with the law. 2. Cease and Desist Letter: Debtors have the right to request that debt collectors cease contacting them. A cease and desist letter specifically instructs the collector to stop all communication attempts. Once this letter is received, the debt collector must refrain from further contact, except to inform the debtor of any specific actions they may take. 3. Time-Limited Communication Letter: This type of letter grants permission for debt collectors to communicate with the debtor during specific days and times, limiting the frequency and duration of contact. Debtors can set specific restrictions and designate convenient days and times for contact in this letter. It is important to note that the content of these letters should clearly state the purpose, provide debtor information, include reference numbers, and outline the days and times for contact as agreed upon by the debtor and the collector. In conclusion, Los Angeles California is a diverse and culturally rich city in Southern California. When sending a letter to a debt collector regarding the designated days and times for contact, it is essential to follow the guidelines set by the FD CPA. Some types of letters that can be used include the initial notification letter, cease and desist letter, and time-limited communication letter. These letters ensure transparency in debt collection practices and protect the rights of debtors in Los Angeles, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.