This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

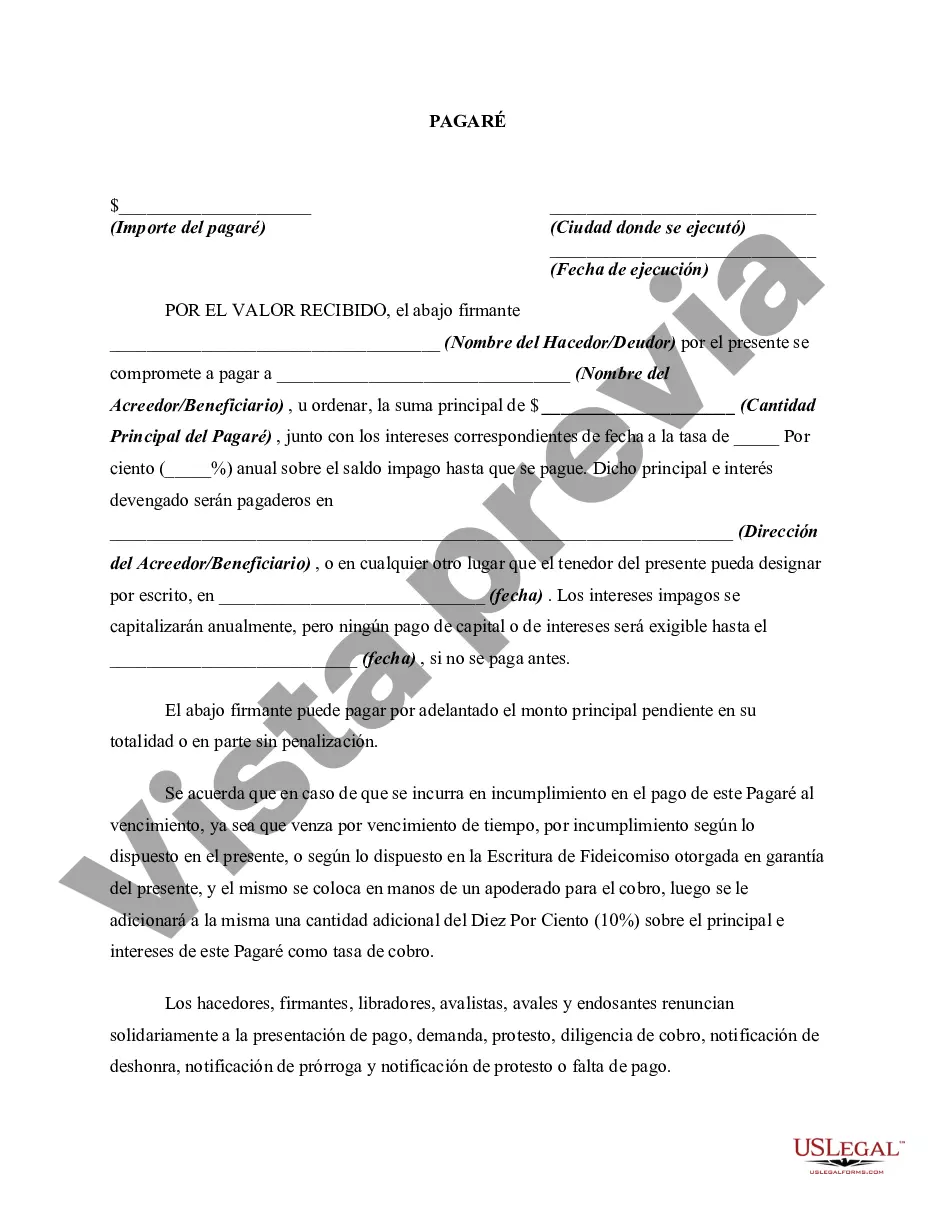

Allegheny Pennsylvania Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender in Allegheny, Pennsylvania. This type of promissory note offers specific features and conditions that are beneficial to both parties involved. Keywords: Allegheny Pennsylvania, Promissory Note, Payment Due, Maturity, Interest, Compound Annually, Loan Agreement, Borrower, Lender, Features, Conditions. This type of promissory note stands out due to its unique characteristics. Firstly, it states that no payment is required from the borrower until the maturity date of the loan. This means that the borrower is not obligated to make any periodic payments such as monthly or quarterly installments. Instead, the entire loan amount, along with the accrued interest, is due and payable on the maturity date specified in the promissory note. The note also specifies that the interest on the loan will compound annually. This means that the interest calculated on the outstanding loan amount will be added to the principal each year. As a result, the interest will continually grow, creating a larger repayment amount for the borrower upon maturity. It is important to note that there may be variations of this Allegheny Pennsylvania Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, depending on the specific requirements and agreements between the parties involved. Different types of promissory notes may have additional features, such as: 1. Variable Interest Rate: In some cases, the interest rate may be set to fluctuate over time based on market conditions or other predetermined factors. This allows for potential changes in the interest rate, affecting the overall repayment amount. 2. Conversion Option: This feature provides the borrower with the option to convert the debt into equity or another form of financial instrument at a future date. This adds flexibility and potential benefits to the borrower. 3. Collateral: The promissory note may specify the inclusion of collateral as security for the loan. This collateral can be a physical asset, such as real estate, inventory, or equipment, which the lender can claim in the event of default. 4. Guarantor: This type of promissory note may require a third-party guarantor who agrees to be responsible for repayment if the borrower fails to fulfill their obligations. The guarantor's assets can be used to satisfy the debt. It is crucial for borrowers and lenders to fully understand the terms and conditions of the Allegheny Pennsylvania Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. Seeking legal advice before entering into any financial agreement is recommended to ensure compliance with state regulations and to protect the rights and interests of all parties involved.Allegheny Pennsylvania Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender in Allegheny, Pennsylvania. This type of promissory note offers specific features and conditions that are beneficial to both parties involved. Keywords: Allegheny Pennsylvania, Promissory Note, Payment Due, Maturity, Interest, Compound Annually, Loan Agreement, Borrower, Lender, Features, Conditions. This type of promissory note stands out due to its unique characteristics. Firstly, it states that no payment is required from the borrower until the maturity date of the loan. This means that the borrower is not obligated to make any periodic payments such as monthly or quarterly installments. Instead, the entire loan amount, along with the accrued interest, is due and payable on the maturity date specified in the promissory note. The note also specifies that the interest on the loan will compound annually. This means that the interest calculated on the outstanding loan amount will be added to the principal each year. As a result, the interest will continually grow, creating a larger repayment amount for the borrower upon maturity. It is important to note that there may be variations of this Allegheny Pennsylvania Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, depending on the specific requirements and agreements between the parties involved. Different types of promissory notes may have additional features, such as: 1. Variable Interest Rate: In some cases, the interest rate may be set to fluctuate over time based on market conditions or other predetermined factors. This allows for potential changes in the interest rate, affecting the overall repayment amount. 2. Conversion Option: This feature provides the borrower with the option to convert the debt into equity or another form of financial instrument at a future date. This adds flexibility and potential benefits to the borrower. 3. Collateral: The promissory note may specify the inclusion of collateral as security for the loan. This collateral can be a physical asset, such as real estate, inventory, or equipment, which the lender can claim in the event of default. 4. Guarantor: This type of promissory note may require a third-party guarantor who agrees to be responsible for repayment if the borrower fails to fulfill their obligations. The guarantor's assets can be used to satisfy the debt. It is crucial for borrowers and lenders to fully understand the terms and conditions of the Allegheny Pennsylvania Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. Seeking legal advice before entering into any financial agreement is recommended to ensure compliance with state regulations and to protect the rights and interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.