This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

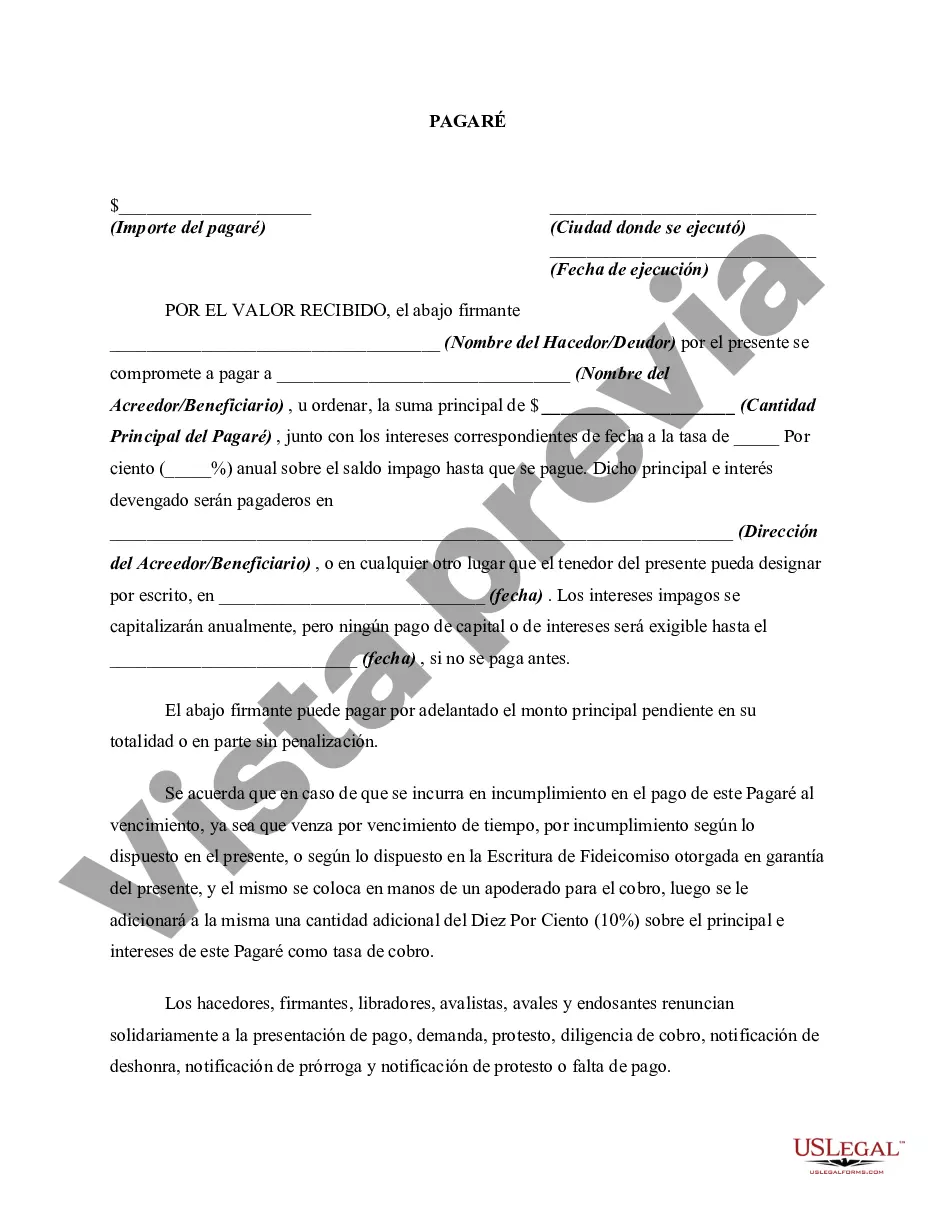

Contra Costa California Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally binding agreement between a lender and a borrower in Contra Costa County, California. This type of promissory note offers specific terms and conditions that allow the borrower to defer any payments until the note's maturity date. Additionally, interest on the loan amount compounds annually, which means that it accumulates and is added to the principal amount each year. Promissory notes of this nature are commonly used in various financial transactions, including loans for real estate, business ventures, personal loans, and more. They provide a clear outline of repayment obligations, interest rates, and specific loan terms, protecting both parties involved. Different types of Contra Costa California Promissory Notes with no Payment Due Until Maturity and Interest to Compound Annually can be categorized based on the purpose of the loan or specific clauses added to the note. Some variations include: 1. Real Estate Promissory Note: This type of promissory note is specifically used for real estate transactions, such as purchasing or refinancing a property in Contra Costa County. The note outlines the loan amount, interest rate, repayment terms, and any additional clauses related to the property. 2. Business Promissory Note: These promissory notes are utilized for loans related to business operations. They may include terms such as funding for business expansions, acquisitions, or working capital requirements. The note describes the loan terms, interest rate, and maturity date. 3. Personal Promissory Note: This type of promissory note is utilized for personal loans between individuals, friends, or family members. It establishes the terms of the loan, including the loan amount, interest rate, repayment schedule, and maturity date. 4. Student Loan Promissory Note: Student loan promissory notes are specifically designed for educational purposes, including tuition fees, books, and other educational expenses. These notes outline the loan amount, repayment terms, interest rate, and deferment options for students until they finish their education. It is crucial for both lenders and borrowers to understand the terms and conditions mentioned in a Contra Costa California Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. Seeking legal advice before signing such agreements is highly recommended ensuring a comprehensive understanding of the obligations involved.Contra Costa California Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally binding agreement between a lender and a borrower in Contra Costa County, California. This type of promissory note offers specific terms and conditions that allow the borrower to defer any payments until the note's maturity date. Additionally, interest on the loan amount compounds annually, which means that it accumulates and is added to the principal amount each year. Promissory notes of this nature are commonly used in various financial transactions, including loans for real estate, business ventures, personal loans, and more. They provide a clear outline of repayment obligations, interest rates, and specific loan terms, protecting both parties involved. Different types of Contra Costa California Promissory Notes with no Payment Due Until Maturity and Interest to Compound Annually can be categorized based on the purpose of the loan or specific clauses added to the note. Some variations include: 1. Real Estate Promissory Note: This type of promissory note is specifically used for real estate transactions, such as purchasing or refinancing a property in Contra Costa County. The note outlines the loan amount, interest rate, repayment terms, and any additional clauses related to the property. 2. Business Promissory Note: These promissory notes are utilized for loans related to business operations. They may include terms such as funding for business expansions, acquisitions, or working capital requirements. The note describes the loan terms, interest rate, and maturity date. 3. Personal Promissory Note: This type of promissory note is utilized for personal loans between individuals, friends, or family members. It establishes the terms of the loan, including the loan amount, interest rate, repayment schedule, and maturity date. 4. Student Loan Promissory Note: Student loan promissory notes are specifically designed for educational purposes, including tuition fees, books, and other educational expenses. These notes outline the loan amount, repayment terms, interest rate, and deferment options for students until they finish their education. It is crucial for both lenders and borrowers to understand the terms and conditions mentioned in a Contra Costa California Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. Seeking legal advice before signing such agreements is highly recommended ensuring a comprehensive understanding of the obligations involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.