This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

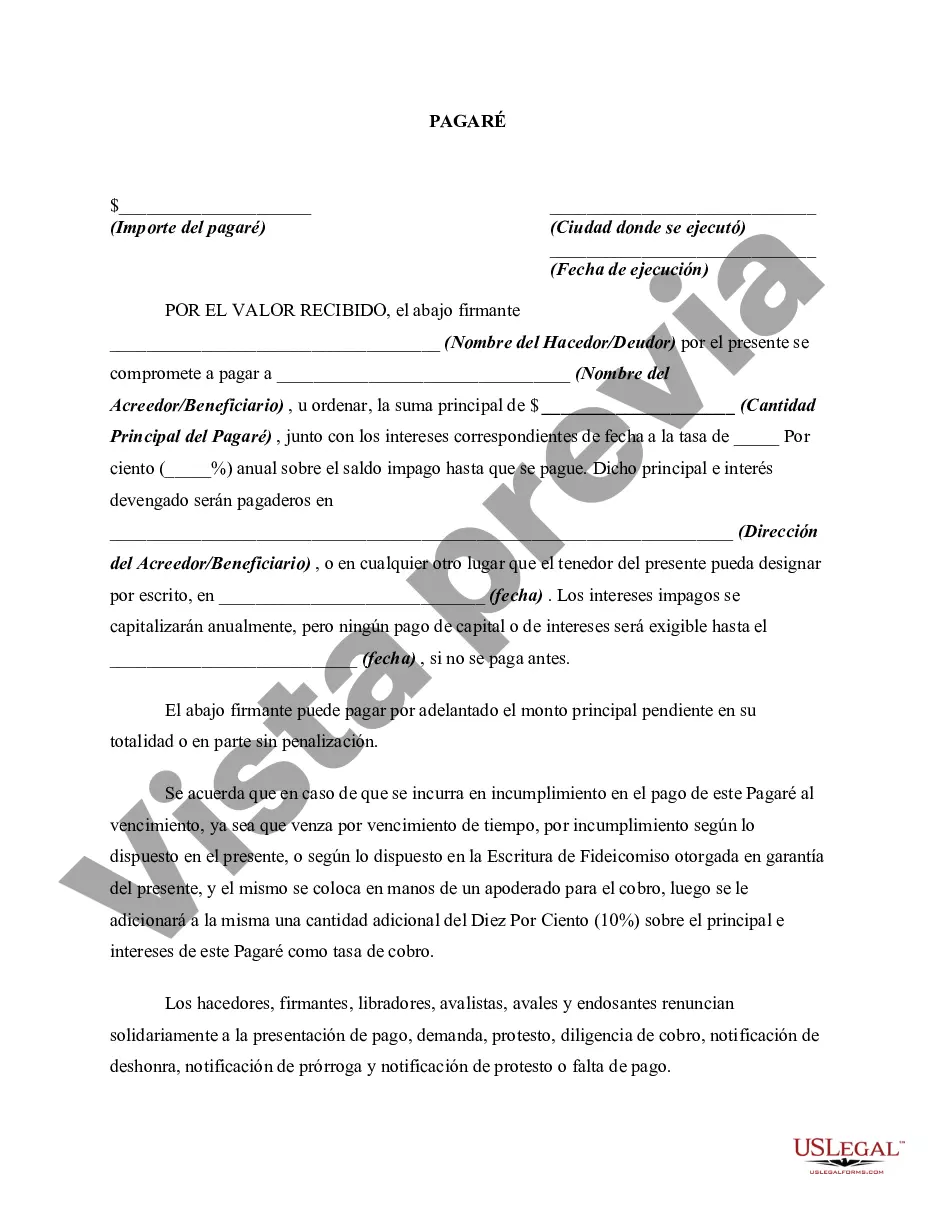

A Cuyahoga Ohio Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the Cuyahoga County, Ohio area. This type of promissory note offers flexibility to borrowers by allowing them to defer repayments until the loan matures and includes an annual compounding interest feature. The Cuyahoga Ohio Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is commonly used in various financial transactions, such as personal loans, business loans, and real estate transactions. By signing this promissory note, the borrower acknowledges their debt to the lender and commits to fulfilling their repayment obligations. The key features of this specific type of promissory note include the absence of regular payment installments throughout the loan term and the compounding of interest on an annual basis. This means that interest accrues and is added to the principal amount on a yearly basis, increasing the overall debt amount over time. The terms and conditions of the promissory note may vary depending on the agreement between the lender and borrower. However, some common elements typically included are: 1. Principal Amount: The initial loan amount borrowed by the borrower. 2. Interest Rate: The annual rate at which interest accrues on the unpaid principal amount. 3. Maturity Date: The date on which the loan matures, and the borrower is required to repay the entire outstanding amount. 4. No Payment Due Until Maturity: Unlike traditional promissory notes, this type allows the borrower to defer payments until the maturity date. 5. Compounding Interest: Annual compounding ensures that the interest accumulated is added to the principal amount, increasing the total repayment obligation. Different types of Cuyahoga Ohio Promissory Notes with no Payment Due Until Maturity and Interest to Compound Annually may exist to cater to specific loan agreements or unique financial circumstances. These different versions may vary in terms of loan purpose, lateralization, or specific repayment structures. Some variations could include: 1. Personal Loan Promissory Note: Used for personal financial transactions between individuals, where one party lends money to another. 2. Business Loan Promissory Note: Designed for commercial lending purposes, facilitating loans between businesses and individuals. 3. Real Estate Promissory Note: Customized for real estate transactions, such as mortgage loans or lease agreements with deferred payments until maturity. In conclusion, the Cuyahoga Ohio Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally binding document used to formalize loan agreements in Cuyahoga County, Ohio. It offers borrowers the advantage of deferring payments until the loan matures while ensuring that interest compounds annually, contributing to the overall repayment obligation. Different variations of this promissory note may exist based on specific loan purposes or unique financial situations.A Cuyahoga Ohio Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the Cuyahoga County, Ohio area. This type of promissory note offers flexibility to borrowers by allowing them to defer repayments until the loan matures and includes an annual compounding interest feature. The Cuyahoga Ohio Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is commonly used in various financial transactions, such as personal loans, business loans, and real estate transactions. By signing this promissory note, the borrower acknowledges their debt to the lender and commits to fulfilling their repayment obligations. The key features of this specific type of promissory note include the absence of regular payment installments throughout the loan term and the compounding of interest on an annual basis. This means that interest accrues and is added to the principal amount on a yearly basis, increasing the overall debt amount over time. The terms and conditions of the promissory note may vary depending on the agreement between the lender and borrower. However, some common elements typically included are: 1. Principal Amount: The initial loan amount borrowed by the borrower. 2. Interest Rate: The annual rate at which interest accrues on the unpaid principal amount. 3. Maturity Date: The date on which the loan matures, and the borrower is required to repay the entire outstanding amount. 4. No Payment Due Until Maturity: Unlike traditional promissory notes, this type allows the borrower to defer payments until the maturity date. 5. Compounding Interest: Annual compounding ensures that the interest accumulated is added to the principal amount, increasing the total repayment obligation. Different types of Cuyahoga Ohio Promissory Notes with no Payment Due Until Maturity and Interest to Compound Annually may exist to cater to specific loan agreements or unique financial circumstances. These different versions may vary in terms of loan purpose, lateralization, or specific repayment structures. Some variations could include: 1. Personal Loan Promissory Note: Used for personal financial transactions between individuals, where one party lends money to another. 2. Business Loan Promissory Note: Designed for commercial lending purposes, facilitating loans between businesses and individuals. 3. Real Estate Promissory Note: Customized for real estate transactions, such as mortgage loans or lease agreements with deferred payments until maturity. In conclusion, the Cuyahoga Ohio Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally binding document used to formalize loan agreements in Cuyahoga County, Ohio. It offers borrowers the advantage of deferring payments until the loan matures while ensuring that interest compounds annually, contributing to the overall repayment obligation. Different variations of this promissory note may exist based on specific loan purposes or unique financial situations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.