This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

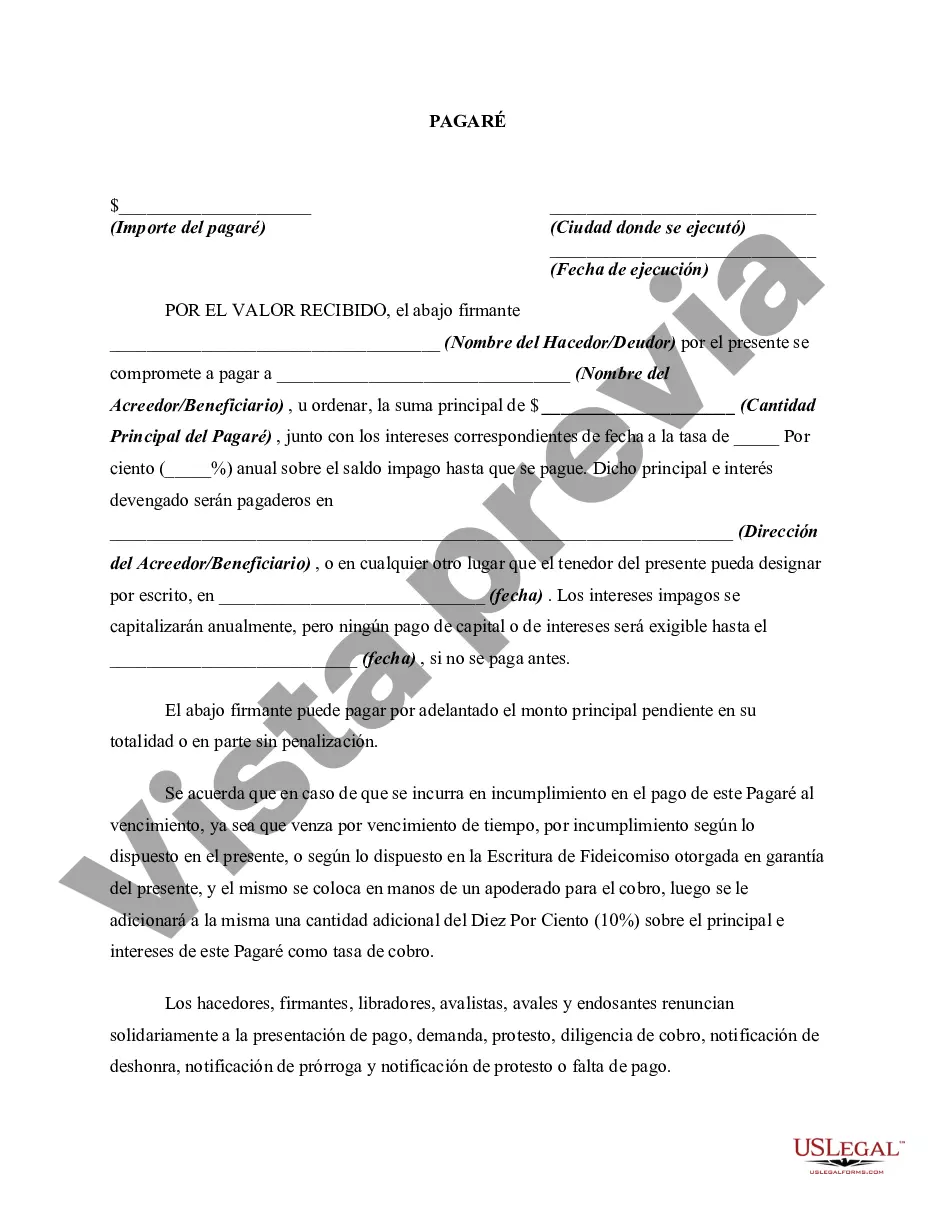

A Harris Texas promissory note with no payment due until maturity and interest compounding annually is a legally binding document that outlines the terms of a loan agreement between a lender and a borrower in Harris County, Texas. This type of promissory note specifies that the borrower is not required to make any payments towards the loan until the maturity date is reached. Additionally, the interest on this loan is compounded on an annual basis. The Harris Texas promissory note with no payment due until maturity and interest compounded annually offers several benefits for both parties involved. For the borrower, it provides a grace period during which they can use the funds without the burden of regular payments. This is especially beneficial for those who may need more time to generate income or accumulate funds to repay the loan. The lender, on the other hand, benefits from the interest compounding annually. This means that the interest on the loan increases each year based on the outstanding balance, helping to maximize returns. This type of promissory note is often used in scenarios where the lender believes that the borrower's ability to repay the loan will improve in the future or when the lender wants a longer-term investment opportunity. While a promissory note with no payment due until maturity and interest compounding annually is a common form, there might be variations based on the specific terms agreed upon by the parties involved. Some possible variations could include adjustable interest rates, balloon payments, or provisions for early repayment without penalty. It is important for both parties to carefully review the terms and conditions of the promissory note before signing it. Consulting with a legal professional experienced in financial matters can ensure that the note is drafted appropriately and protects the rights and interests of both parties involved. In summary, a Harris Texas promissory note with no payment due until maturity and interest compounding annually is an agreement that offers flexibility to borrowers and potential higher returns for lenders. It is crucial for both parties to thoroughly understand the terms outlined in the promissory note and seek legal advice if necessary.A Harris Texas promissory note with no payment due until maturity and interest compounding annually is a legally binding document that outlines the terms of a loan agreement between a lender and a borrower in Harris County, Texas. This type of promissory note specifies that the borrower is not required to make any payments towards the loan until the maturity date is reached. Additionally, the interest on this loan is compounded on an annual basis. The Harris Texas promissory note with no payment due until maturity and interest compounded annually offers several benefits for both parties involved. For the borrower, it provides a grace period during which they can use the funds without the burden of regular payments. This is especially beneficial for those who may need more time to generate income or accumulate funds to repay the loan. The lender, on the other hand, benefits from the interest compounding annually. This means that the interest on the loan increases each year based on the outstanding balance, helping to maximize returns. This type of promissory note is often used in scenarios where the lender believes that the borrower's ability to repay the loan will improve in the future or when the lender wants a longer-term investment opportunity. While a promissory note with no payment due until maturity and interest compounding annually is a common form, there might be variations based on the specific terms agreed upon by the parties involved. Some possible variations could include adjustable interest rates, balloon payments, or provisions for early repayment without penalty. It is important for both parties to carefully review the terms and conditions of the promissory note before signing it. Consulting with a legal professional experienced in financial matters can ensure that the note is drafted appropriately and protects the rights and interests of both parties involved. In summary, a Harris Texas promissory note with no payment due until maturity and interest compounding annually is an agreement that offers flexibility to borrowers and potential higher returns for lenders. It is crucial for both parties to thoroughly understand the terms outlined in the promissory note and seek legal advice if necessary.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.