This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

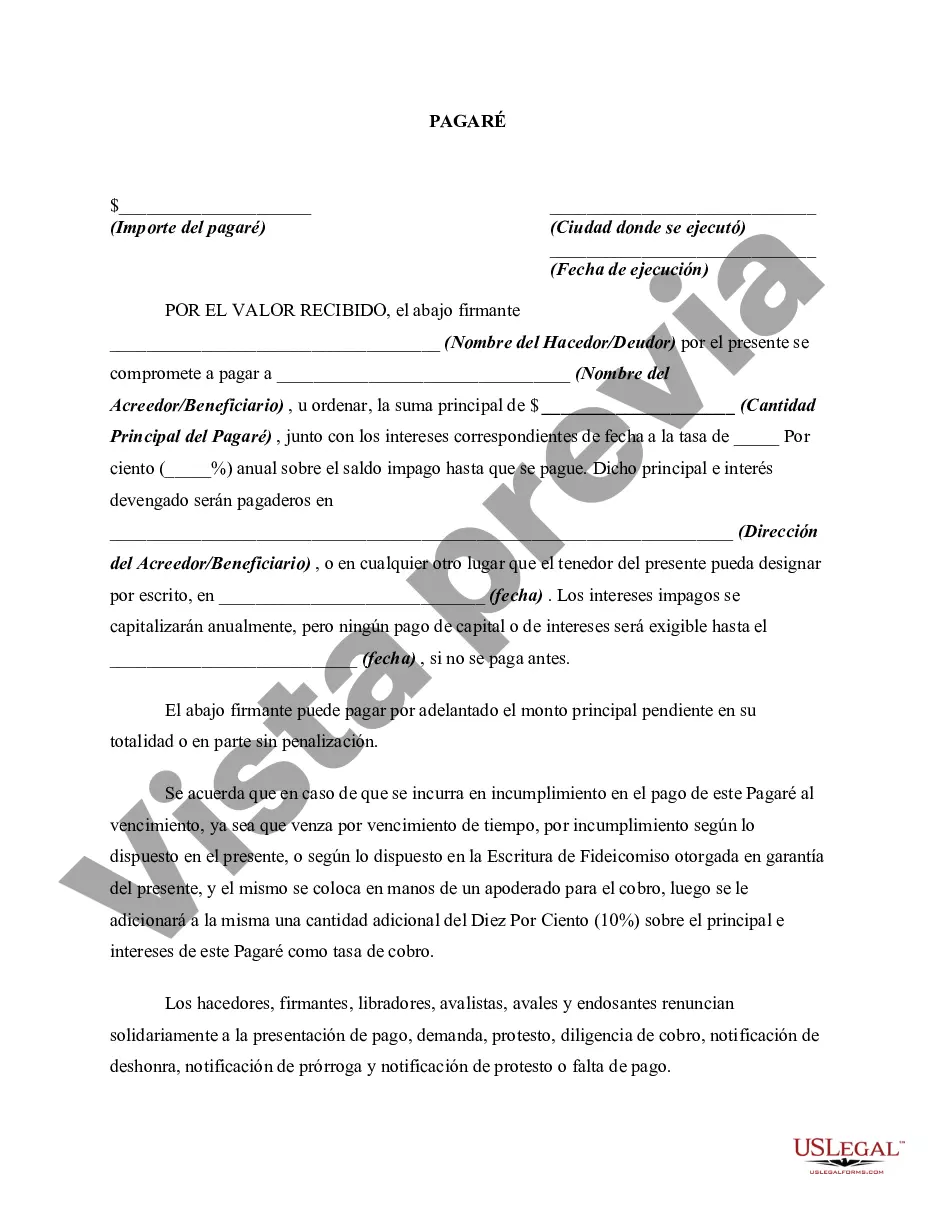

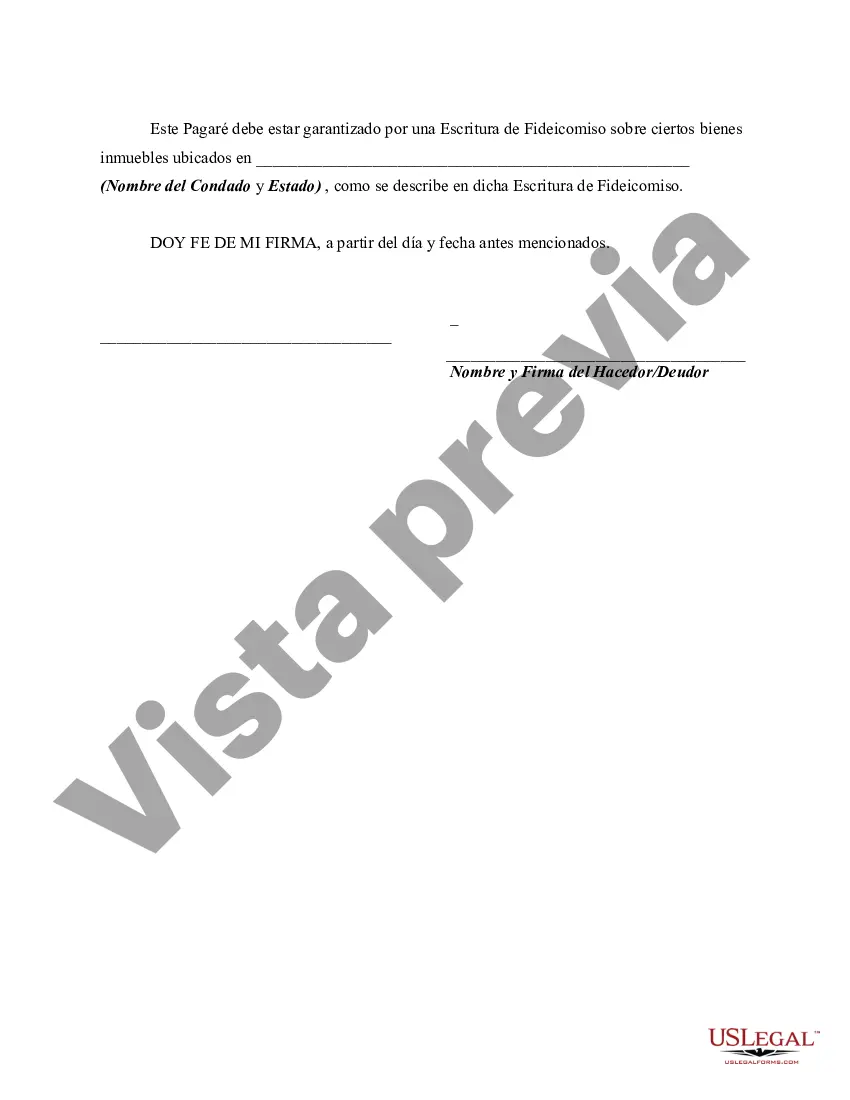

A Houston Texas Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally binding document that outlines the terms of a loan agreement between a lender and a borrower in the Houston, Texas area. This type of promissory note is unique because it allows the borrower to defer any payments on the loan until the maturity date. Additionally, the interest on the loan is compounded annually, meaning it accrues each year and is added to the principal amount. This type of promissory note offers benefits for both the borrower and the lender. For the borrower, it provides flexibility by allowing them to defer payments until a later date, which can be advantageous for managing cash flow or obtaining additional financing. It also allows the borrower the option to pay off the loan early without incurring any penalties or fees. For the lender, this type of promissory note ensures a consistent and predictable return on their investment. The annual compounding of the interest helps to grow the principal amount, resulting in a higher payback when the loan reaches maturity. It also provides the lender with the opportunity to earn additional interest if the borrower chooses to defer payment until maturity. Although there is typically only one main type of Houston Texas Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, there may be variations in the specific terms of the note. These variations can include the loan amount, interest rate, maturity date, and any additional provisions or conditions agreed upon between the lender and the borrower. Overall, a Houston Texas Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a useful financial tool for individuals or businesses in the Houston area who require a flexible loan arrangement while still ensuring the lender's return on investment.A Houston Texas Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally binding document that outlines the terms of a loan agreement between a lender and a borrower in the Houston, Texas area. This type of promissory note is unique because it allows the borrower to defer any payments on the loan until the maturity date. Additionally, the interest on the loan is compounded annually, meaning it accrues each year and is added to the principal amount. This type of promissory note offers benefits for both the borrower and the lender. For the borrower, it provides flexibility by allowing them to defer payments until a later date, which can be advantageous for managing cash flow or obtaining additional financing. It also allows the borrower the option to pay off the loan early without incurring any penalties or fees. For the lender, this type of promissory note ensures a consistent and predictable return on their investment. The annual compounding of the interest helps to grow the principal amount, resulting in a higher payback when the loan reaches maturity. It also provides the lender with the opportunity to earn additional interest if the borrower chooses to defer payment until maturity. Although there is typically only one main type of Houston Texas Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, there may be variations in the specific terms of the note. These variations can include the loan amount, interest rate, maturity date, and any additional provisions or conditions agreed upon between the lender and the borrower. Overall, a Houston Texas Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a useful financial tool for individuals or businesses in the Houston area who require a flexible loan arrangement while still ensuring the lender's return on investment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.