This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

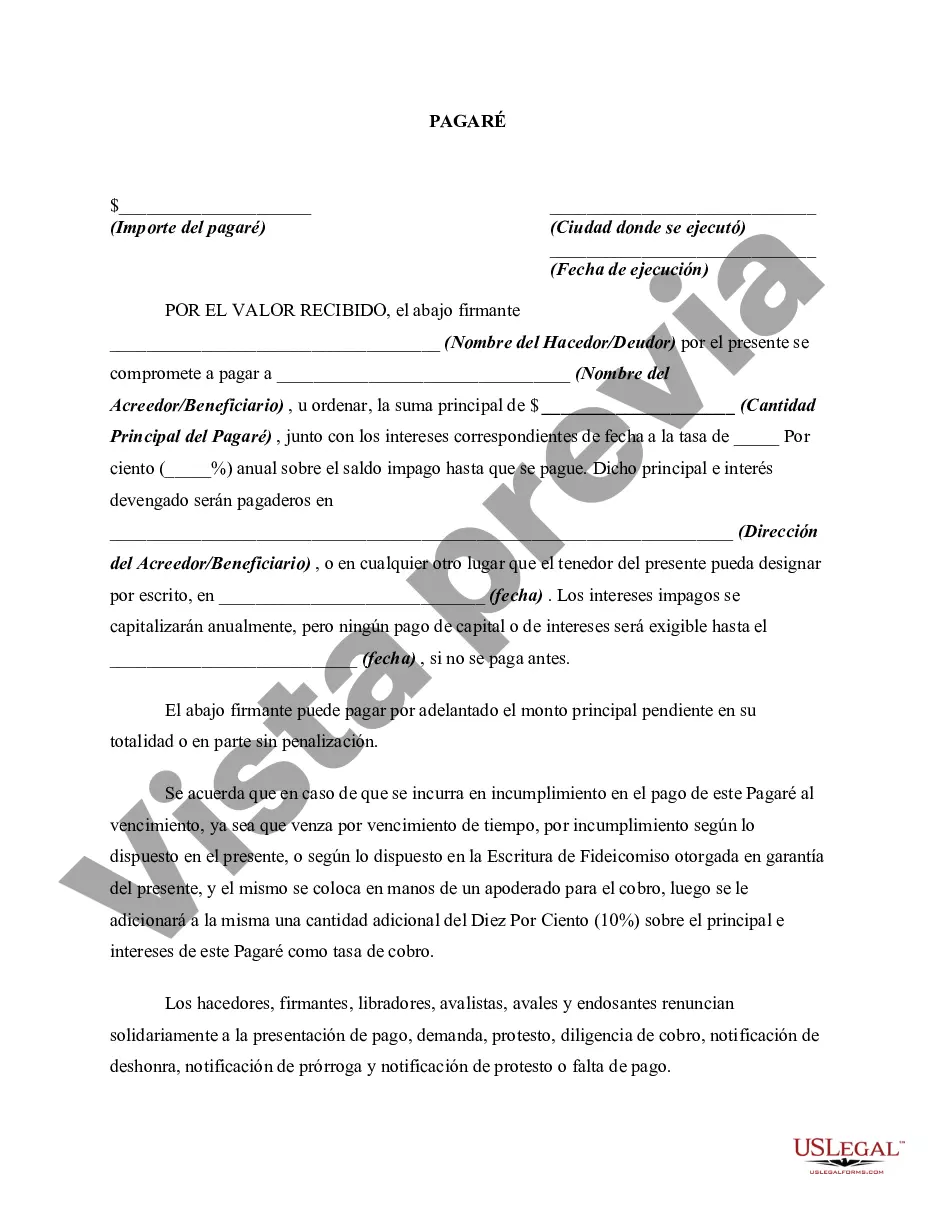

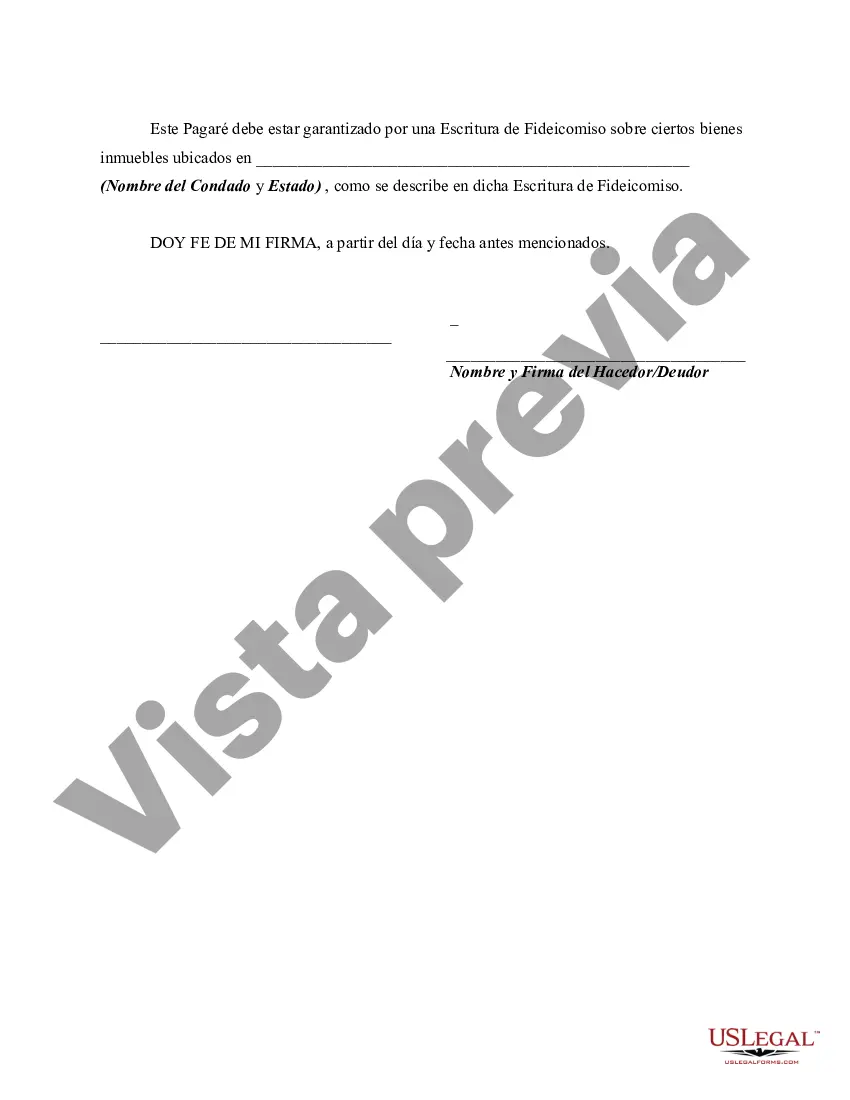

A King Washington Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legal document that outlines a promise to repay a debt within a specified time period without any required payments until the debt's maturity date. The note is a written agreement between a borrower and a lender, where the borrower promises to pay a specific sum of money to the lender on a set maturity date. This type of promissory note is unique as it offers borrowers some flexibility by allowing them to defer payments until the note reaches its maturity date. During this period, interest is calculated and compounded annually, meaning the interest earned on the loan amount is added to the principal amount each year, leading to potential growth of the debt. One instance of the King Washington Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is the "Fixed-Rate Maturity Note." As the name suggests, this note has a fixed interest rate that will be compounded annually until the maturity date. Borrowers who opt for this type of note can benefit from knowing the exact repayment amount they owe, even though it is deferred until maturity. Another variation of the King Washington Promissory Note is the "Variable-Rate Maturity Note." This note's interest rate is subject to change based on the current market conditions or a mutually agreed-upon benchmark rate. The interest will compound annually until the maturity date. Borrowers who choose this note should be aware that their repayment amount may fluctuate over time due to the variable nature of the interest rate. When applying for a King Washington Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, borrowers should carefully read and understand the terms and conditions of the agreement. They should pay close attention to the interest rate, maturity date, and any additional fees or penalties that may be applicable. Lenders, on the other hand, should ensure that the terms are clearly stated and that the borrower's creditworthiness has been properly evaluated to minimize the risk involved. Overall, a King Washington Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually provides borrowers with a flexible option for borrowing funds, giving them time to plan for repayment while still accruing compounded interest. It is essential for both parties involved to carefully consider the terms and agreements before entering into such a legal arrangement to ensure a fair and mutually beneficial loan agreement.A King Washington Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legal document that outlines a promise to repay a debt within a specified time period without any required payments until the debt's maturity date. The note is a written agreement between a borrower and a lender, where the borrower promises to pay a specific sum of money to the lender on a set maturity date. This type of promissory note is unique as it offers borrowers some flexibility by allowing them to defer payments until the note reaches its maturity date. During this period, interest is calculated and compounded annually, meaning the interest earned on the loan amount is added to the principal amount each year, leading to potential growth of the debt. One instance of the King Washington Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is the "Fixed-Rate Maturity Note." As the name suggests, this note has a fixed interest rate that will be compounded annually until the maturity date. Borrowers who opt for this type of note can benefit from knowing the exact repayment amount they owe, even though it is deferred until maturity. Another variation of the King Washington Promissory Note is the "Variable-Rate Maturity Note." This note's interest rate is subject to change based on the current market conditions or a mutually agreed-upon benchmark rate. The interest will compound annually until the maturity date. Borrowers who choose this note should be aware that their repayment amount may fluctuate over time due to the variable nature of the interest rate. When applying for a King Washington Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, borrowers should carefully read and understand the terms and conditions of the agreement. They should pay close attention to the interest rate, maturity date, and any additional fees or penalties that may be applicable. Lenders, on the other hand, should ensure that the terms are clearly stated and that the borrower's creditworthiness has been properly evaluated to minimize the risk involved. Overall, a King Washington Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually provides borrowers with a flexible option for borrowing funds, giving them time to plan for repayment while still accruing compounded interest. It is essential for both parties involved to carefully consider the terms and agreements before entering into such a legal arrangement to ensure a fair and mutually beneficial loan agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.