This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

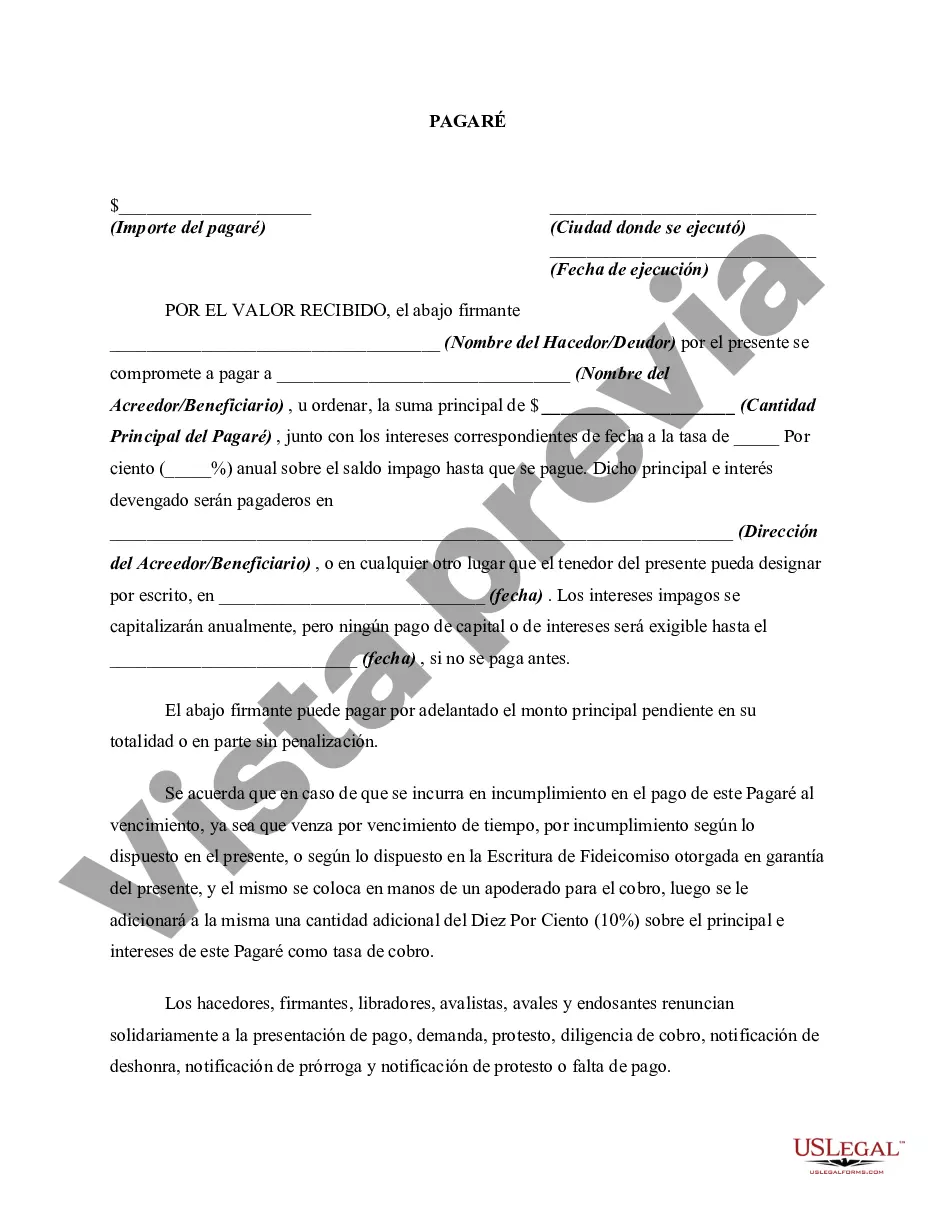

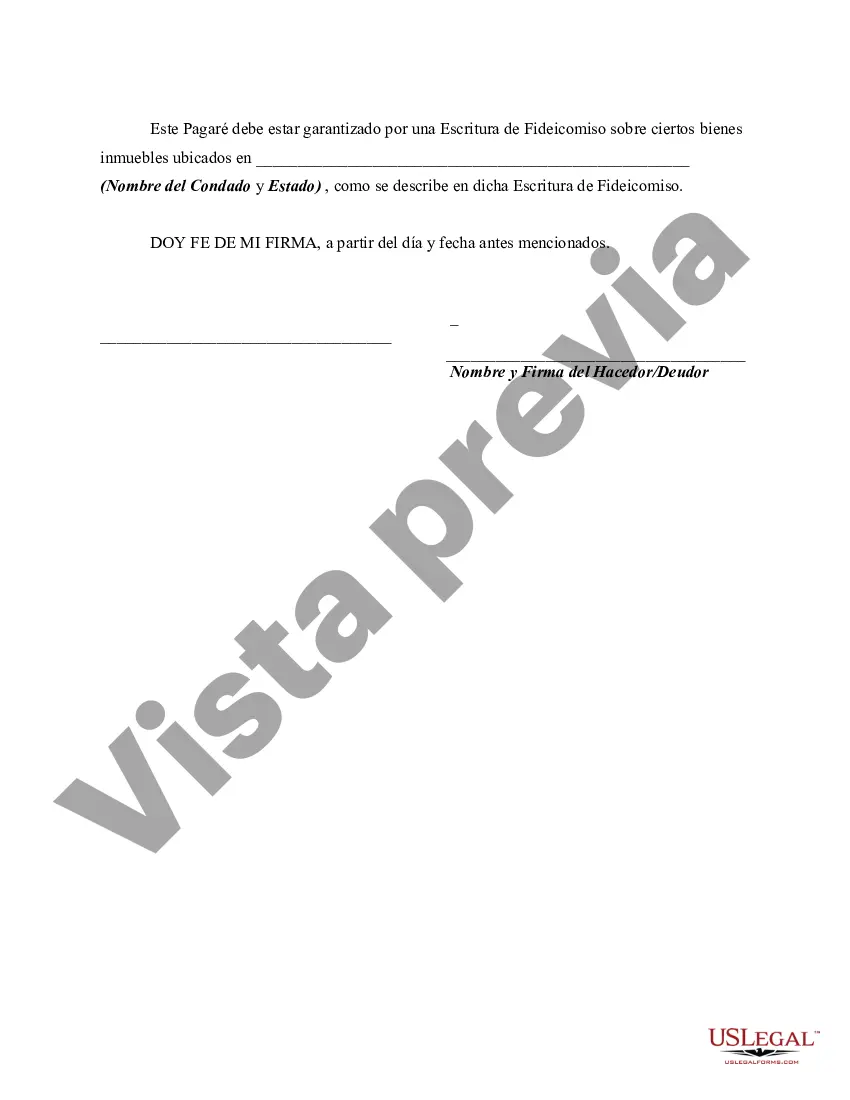

A Mecklenburg North Carolina Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in Mecklenburg County, North Carolina. This type of promissory note is characterized by its deferred payment schedule, meaning that the borrower is not required to make any payments towards the principal or interest until the maturity date. The key advantage of this type of promissory note is that it provides the borrower with more flexibility in managing their finances, as they can postpone repayment until the specified maturity date. Additionally, by allowing interest to compound annually, the borrower can benefit from potentially lower interest payments over the life of the loan. There are several variations of Mecklenburg North Carolina Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, including: 1. Fixed-Rate Promissory Note: This type of promissory note has a predetermined interest rate that remains unchanged throughout the loan term, allowing the borrower to forecast their interest expenses accurately. 2. Adjustable-Rate Promissory Note: Unlike a fixed-rate note, an adjustable-rate promissory note has an interest rate that can fluctuate periodically based on changes in a specified index or benchmark, such as the Prime Rate. This type of note offers the potential for lower initial interest rates but can increase over time. 3. Balloon Payment Promissory Note: A balloon payment note sets a relatively small payment schedule over the loan term, with the remaining balance due in full upon maturity. This type of note is typically used for larger loan amounts or when the borrower anticipates having a substantial sum to repay at the maturity date. 4. Secured Promissory Note: A secured promissory note includes collateral pledged by the borrower to secure the loan. This provides the lender with added assurance that their investment is protected in case of default. It is essential to consult legal professionals or financial advisors to draft and review Mecklenburg North Carolina Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, as the terms and conditions can significantly affect both parties' rights and obligations.A Mecklenburg North Carolina Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in Mecklenburg County, North Carolina. This type of promissory note is characterized by its deferred payment schedule, meaning that the borrower is not required to make any payments towards the principal or interest until the maturity date. The key advantage of this type of promissory note is that it provides the borrower with more flexibility in managing their finances, as they can postpone repayment until the specified maturity date. Additionally, by allowing interest to compound annually, the borrower can benefit from potentially lower interest payments over the life of the loan. There are several variations of Mecklenburg North Carolina Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, including: 1. Fixed-Rate Promissory Note: This type of promissory note has a predetermined interest rate that remains unchanged throughout the loan term, allowing the borrower to forecast their interest expenses accurately. 2. Adjustable-Rate Promissory Note: Unlike a fixed-rate note, an adjustable-rate promissory note has an interest rate that can fluctuate periodically based on changes in a specified index or benchmark, such as the Prime Rate. This type of note offers the potential for lower initial interest rates but can increase over time. 3. Balloon Payment Promissory Note: A balloon payment note sets a relatively small payment schedule over the loan term, with the remaining balance due in full upon maturity. This type of note is typically used for larger loan amounts or when the borrower anticipates having a substantial sum to repay at the maturity date. 4. Secured Promissory Note: A secured promissory note includes collateral pledged by the borrower to secure the loan. This provides the lender with added assurance that their investment is protected in case of default. It is essential to consult legal professionals or financial advisors to draft and review Mecklenburg North Carolina Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, as the terms and conditions can significantly affect both parties' rights and obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.