This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

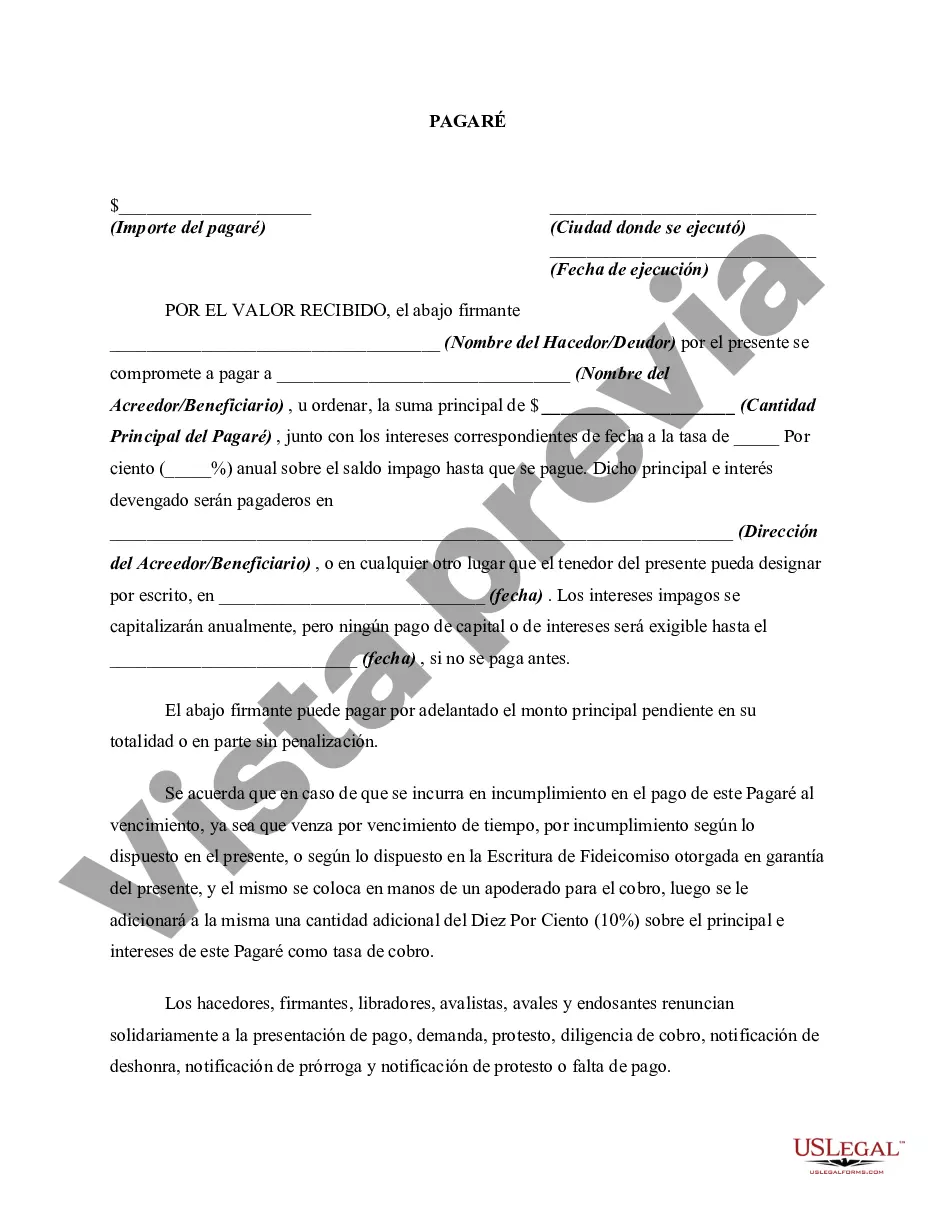

Miami-Dade Florida is a thriving and diverse county located in the southeastern part of the state of Florida. It is one of the most populous counties in the United States and is known for its vibrant culture, stunning beaches, and bustling cities. Within this dynamic region, individuals and businesses often utilize financial instruments such as promissory notes to facilitate transactions and support economic growth. A Miami-Dade Florida Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a specific type of financial agreement between a lender (the party providing funds) and a borrower (the party receiving funds). This promissory note outlines the terms and conditions of the loan, including the repayment schedule and the rate of interest. However, it differentiates from traditional promissory notes by deferring any payments until the maturity date, which means the borrower does not have to make regular installment payments. The use of this type of promissory note has various benefits for both parties involved. For borrowers, it allows for greater financial flexibility since they do not have to make immediate payments, potentially enabling the funds to be used for other investment opportunities or to support business expansion. On the other hand, lenders benefit by earning interest on the loan amount while waiting for the maturity date, as the interest is compounded annually. Within the category of Miami-Dade Florida Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, there might be different subtypes based on specific agreements and terms. These variations can include adjustable interest rates, balloon payments at the maturity date, or even customized repayment terms according to the mutual agreement of the parties involved. Overall, a Miami-Dade Florida Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a financial instrument commonly used in the region to facilitate loans and support economic activities. By deferring payments until maturity and allowing interest to compound annually, this type of promissory note offers flexibility and potential financial growth for both borrowers and lenders in Miami-Dade Florida. Keywords: Miami-Dade Florida, promissory note, payment due, maturity, interest, compounding annually, financial agreement, loan, repayment schedule, lender, borrower, investment, financial flexibility, business expansion, adjustable interest rates, balloon payments, customized repayment terms.Miami-Dade Florida is a thriving and diverse county located in the southeastern part of the state of Florida. It is one of the most populous counties in the United States and is known for its vibrant culture, stunning beaches, and bustling cities. Within this dynamic region, individuals and businesses often utilize financial instruments such as promissory notes to facilitate transactions and support economic growth. A Miami-Dade Florida Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a specific type of financial agreement between a lender (the party providing funds) and a borrower (the party receiving funds). This promissory note outlines the terms and conditions of the loan, including the repayment schedule and the rate of interest. However, it differentiates from traditional promissory notes by deferring any payments until the maturity date, which means the borrower does not have to make regular installment payments. The use of this type of promissory note has various benefits for both parties involved. For borrowers, it allows for greater financial flexibility since they do not have to make immediate payments, potentially enabling the funds to be used for other investment opportunities or to support business expansion. On the other hand, lenders benefit by earning interest on the loan amount while waiting for the maturity date, as the interest is compounded annually. Within the category of Miami-Dade Florida Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, there might be different subtypes based on specific agreements and terms. These variations can include adjustable interest rates, balloon payments at the maturity date, or even customized repayment terms according to the mutual agreement of the parties involved. Overall, a Miami-Dade Florida Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a financial instrument commonly used in the region to facilitate loans and support economic activities. By deferring payments until maturity and allowing interest to compound annually, this type of promissory note offers flexibility and potential financial growth for both borrowers and lenders in Miami-Dade Florida. Keywords: Miami-Dade Florida, promissory note, payment due, maturity, interest, compounding annually, financial agreement, loan, repayment schedule, lender, borrower, investment, financial flexibility, business expansion, adjustable interest rates, balloon payments, customized repayment terms.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.