This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

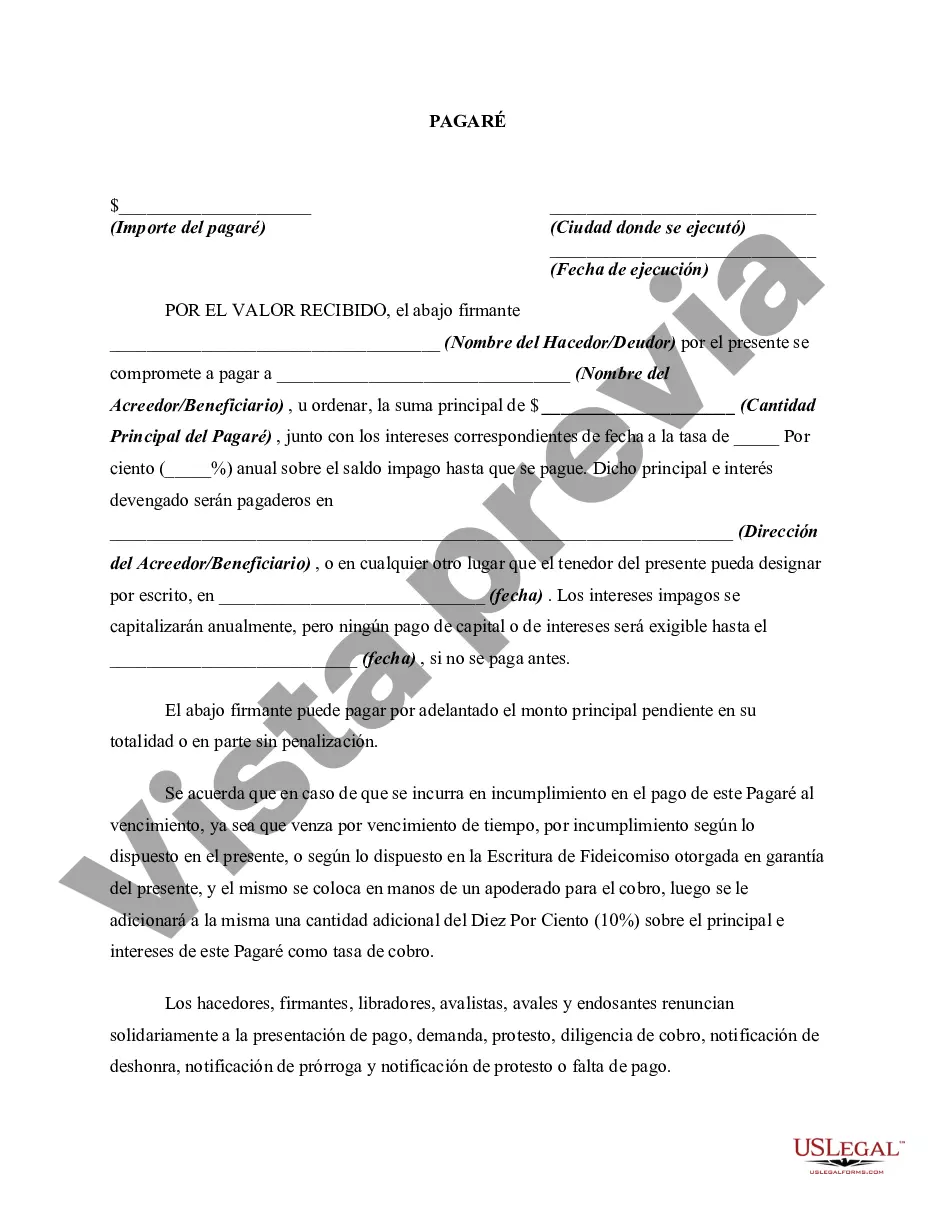

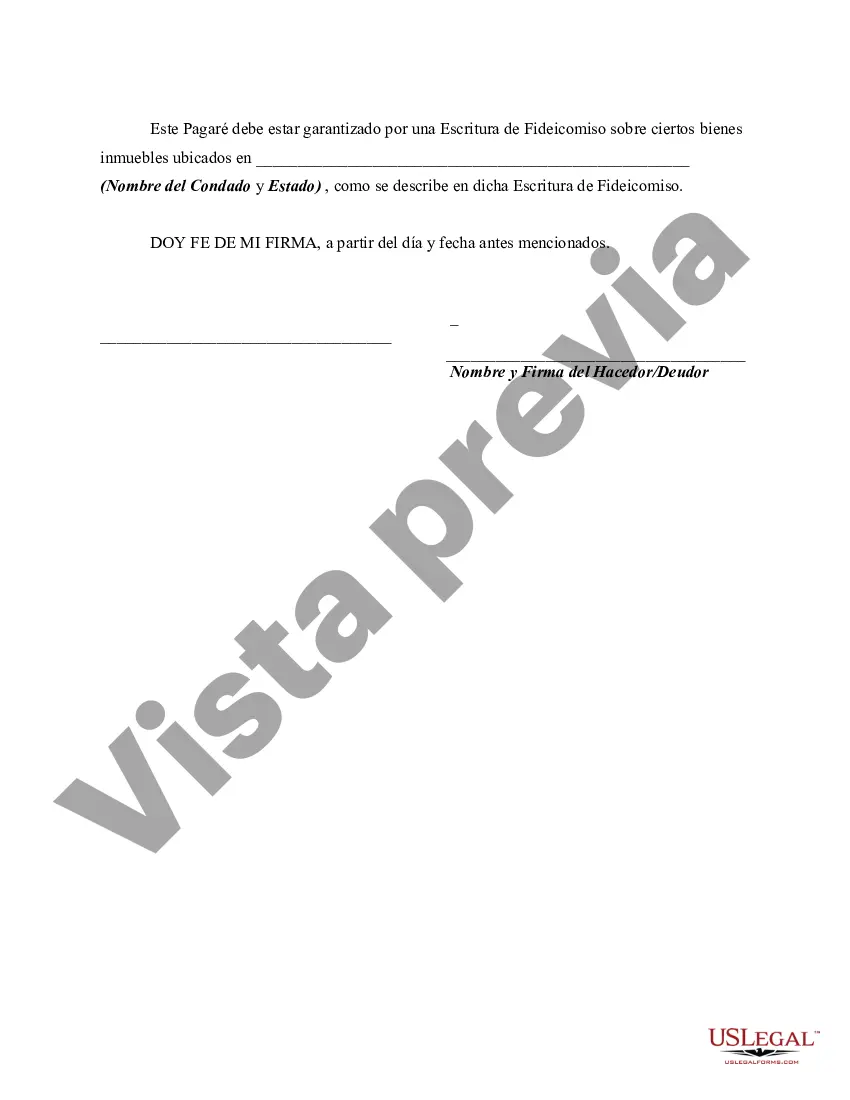

A Nassau New York Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally binding agreement between a lender and a borrower. This type of promissory note is unique because it allows the borrower to defer all payments until the maturity date, while also specifying that the interest will compound annually. Nassau County, located in the state of New York, follows specific regulations for promissory notes, ensuring that both parties are compliant with the law. These notes serve as a documented promise from the borrower to repay a specified amount of borrowed money to the lender. The note includes essential details such as the loan amount, interest rate, and maturity date. The absence of payments until maturity date distinguishes this promissory note from others. Instead of paying periodic installments, the borrower is not required to make any payments until the end of the agreed-upon term. This type of note is commonly used in long-term loans, allowing borrowers to postpone financial obligations while still benefiting from the borrowed funds. Another crucial feature of the Nassau New York Promissory Note with no Payment Due Until Maturity is the compounding annual interest. Typically, interest on loans accrues over time, but with the compounding annual interest method, not only does the borrower have no immediate payment obligations, but interest also accumulates on the outstanding loan balance each year. This can result in a higher total repayment amount over the loan term. Different types of Nassau New York Promissory Notes with no Payment Due Until Maturity and Interest to Compound Annually can vary based on the loan's purpose or specific terms agreed upon between the borrower and lender. For example, there may be promissory notes designed for real estate transactions, business loans, personal loans, etc. Additionally, the interest rate, loan amount, and maturity date can also differ depending on the negotiated terms. These promissory notes play a crucial role in facilitating financial transactions while ensuring both parties are protected by legal documentation. If you are considering entering into such an agreement, it is vital to consult with a legal professional who can assist in drafting a Nassau New York Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually that suits your specific needs and ensures compliance with applicable laws and regulations.A Nassau New York Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally binding agreement between a lender and a borrower. This type of promissory note is unique because it allows the borrower to defer all payments until the maturity date, while also specifying that the interest will compound annually. Nassau County, located in the state of New York, follows specific regulations for promissory notes, ensuring that both parties are compliant with the law. These notes serve as a documented promise from the borrower to repay a specified amount of borrowed money to the lender. The note includes essential details such as the loan amount, interest rate, and maturity date. The absence of payments until maturity date distinguishes this promissory note from others. Instead of paying periodic installments, the borrower is not required to make any payments until the end of the agreed-upon term. This type of note is commonly used in long-term loans, allowing borrowers to postpone financial obligations while still benefiting from the borrowed funds. Another crucial feature of the Nassau New York Promissory Note with no Payment Due Until Maturity is the compounding annual interest. Typically, interest on loans accrues over time, but with the compounding annual interest method, not only does the borrower have no immediate payment obligations, but interest also accumulates on the outstanding loan balance each year. This can result in a higher total repayment amount over the loan term. Different types of Nassau New York Promissory Notes with no Payment Due Until Maturity and Interest to Compound Annually can vary based on the loan's purpose or specific terms agreed upon between the borrower and lender. For example, there may be promissory notes designed for real estate transactions, business loans, personal loans, etc. Additionally, the interest rate, loan amount, and maturity date can also differ depending on the negotiated terms. These promissory notes play a crucial role in facilitating financial transactions while ensuring both parties are protected by legal documentation. If you are considering entering into such an agreement, it is vital to consult with a legal professional who can assist in drafting a Nassau New York Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually that suits your specific needs and ensures compliance with applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.