This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

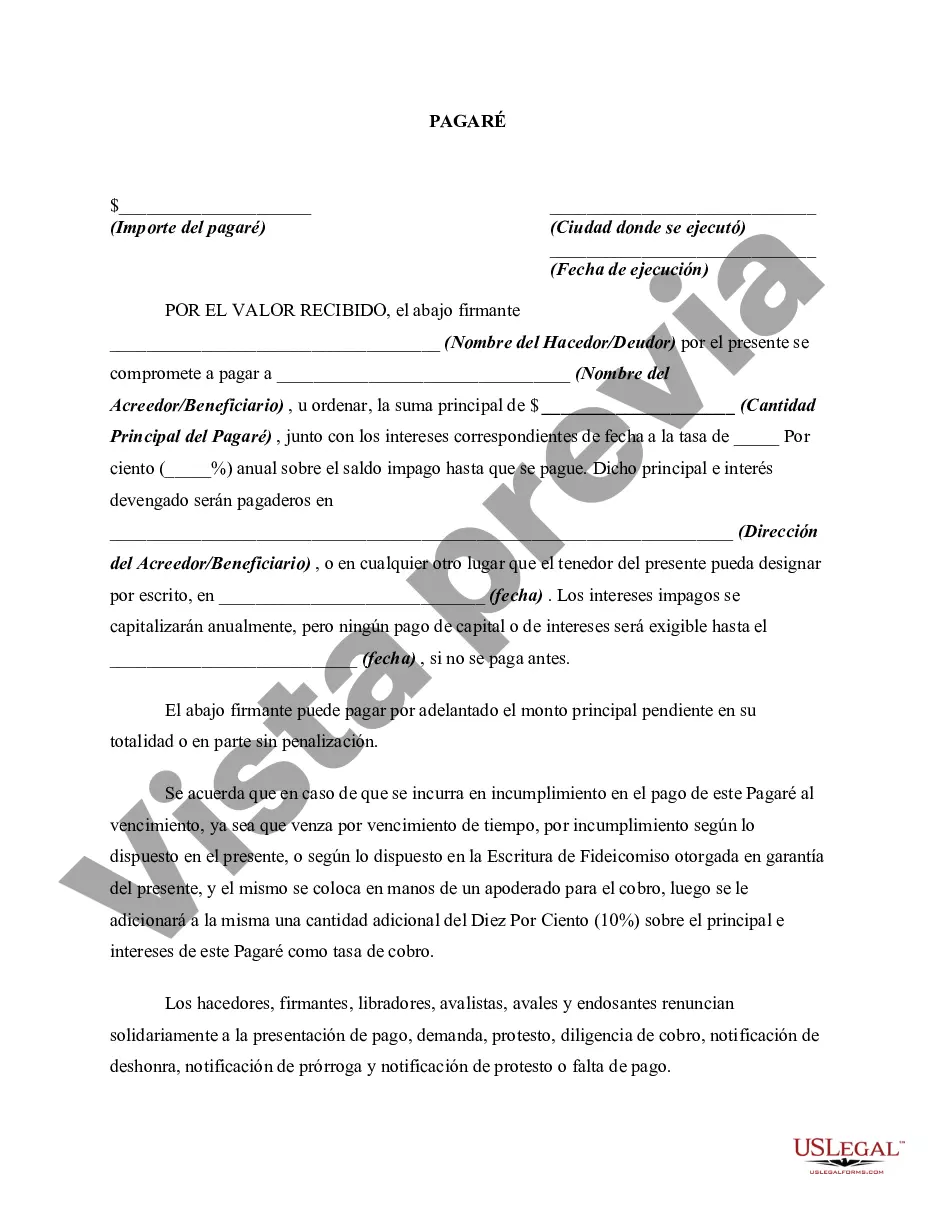

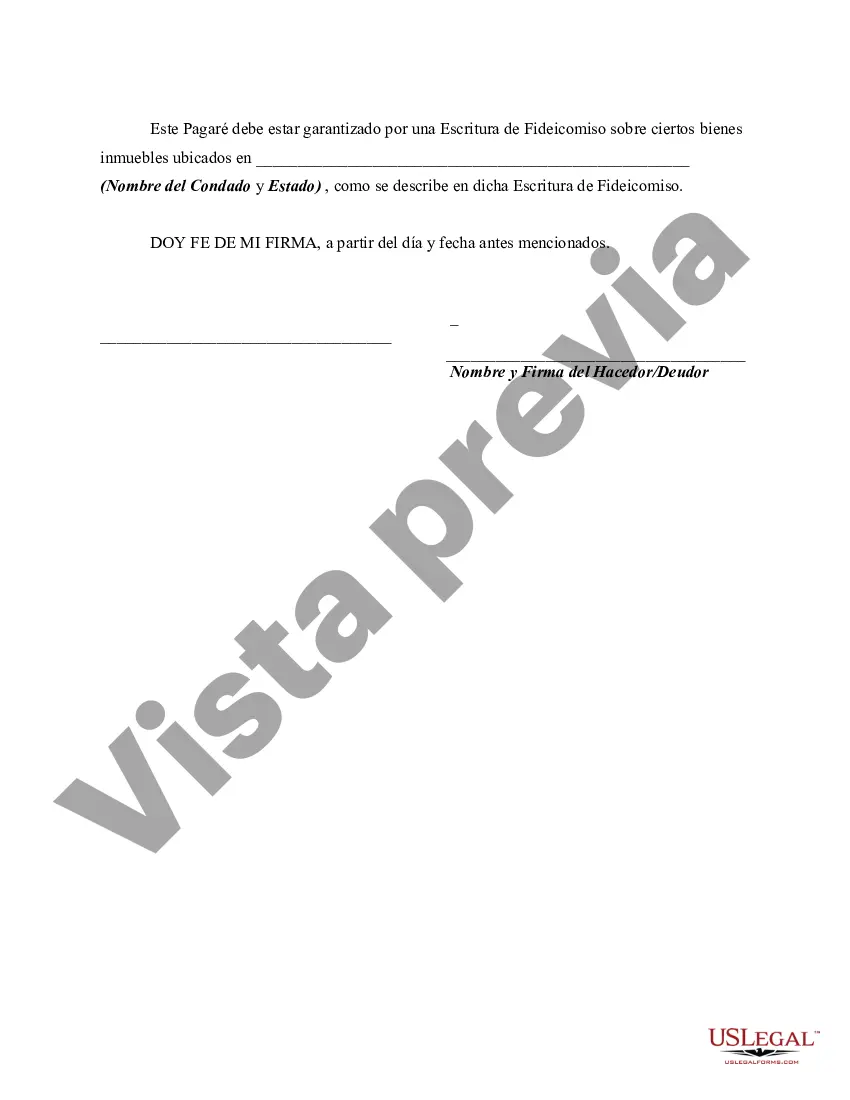

A Philadelphia Pennsylvania Promissory Note with no payment due until maturity and interest compound annually is a legal financial instrument used to document a loan agreement between a lender (often a financial institution or an individual) and a borrower (an individual or a business) in Philadelphia, Pennsylvania. This type of promissory note is unique in that it allows borrowers to defer any required payments until the maturity date of the note. This enables the borrower more flexibility in managing their cash flow since they do not have to make regular installment payments during the loan term. The interest on this promissory note is compounded annually, meaning that at the end of each year, the interest is added to the principal amount, and the new total becomes the basis for calculating interest for the following year. This compounding structure can lead to significant growth in the debt over time, making it a crucial aspect for both parties to consider before entering into the agreement. Different types of Philadelphia Pennsylvania Promissory Notes with no payment due until maturity and annual compound interest could include variations such as: 1. Personal Promissory Note: This type of promissory note is typically used for loans between individuals, such as friends or family members. It may be used to document personal loans, education financing, or other non-business related transactions. 2. Business Promissory Note: This note is designed for business-related loans, where one business lends money to another business. It could be used for purposes like funding operational expenses, purchasing inventory or equipment, or financing expansion plans. 3. Real Estate Promissory Note: This type of promissory note is prevalent in real estate transactions, where a lender provides financing to a borrower for purchasing or refinancing a property. The note is secured by the property and contains specific provisions related to the real estate transaction. 4. Convertible Promissory Note: A convertible note has additional features that allow the lender to convert the debt into equity or ownership in the borrower's business at a later date. These notes are commonly used in startup or early-stage business financing. 5. Demand Promissory Note: Unlike the typical no-payment-due-until-maturity notes, a demand note can be called by the lender at any time, requiring immediate payment. The lack of a specified maturity date adds more flexibility for the lender and may be used in situations where the borrower's financial stability is uncertain. It is important for both lenders and borrowers in Philadelphia, Pennsylvania, to consult with legal professionals or financial advisors when drafting or entering into any promissory note agreement. This ensures compliance with local laws, protects the interests of both parties, and helps establish clear repayment terms and conditions.A Philadelphia Pennsylvania Promissory Note with no payment due until maturity and interest compound annually is a legal financial instrument used to document a loan agreement between a lender (often a financial institution or an individual) and a borrower (an individual or a business) in Philadelphia, Pennsylvania. This type of promissory note is unique in that it allows borrowers to defer any required payments until the maturity date of the note. This enables the borrower more flexibility in managing their cash flow since they do not have to make regular installment payments during the loan term. The interest on this promissory note is compounded annually, meaning that at the end of each year, the interest is added to the principal amount, and the new total becomes the basis for calculating interest for the following year. This compounding structure can lead to significant growth in the debt over time, making it a crucial aspect for both parties to consider before entering into the agreement. Different types of Philadelphia Pennsylvania Promissory Notes with no payment due until maturity and annual compound interest could include variations such as: 1. Personal Promissory Note: This type of promissory note is typically used for loans between individuals, such as friends or family members. It may be used to document personal loans, education financing, or other non-business related transactions. 2. Business Promissory Note: This note is designed for business-related loans, where one business lends money to another business. It could be used for purposes like funding operational expenses, purchasing inventory or equipment, or financing expansion plans. 3. Real Estate Promissory Note: This type of promissory note is prevalent in real estate transactions, where a lender provides financing to a borrower for purchasing or refinancing a property. The note is secured by the property and contains specific provisions related to the real estate transaction. 4. Convertible Promissory Note: A convertible note has additional features that allow the lender to convert the debt into equity or ownership in the borrower's business at a later date. These notes are commonly used in startup or early-stage business financing. 5. Demand Promissory Note: Unlike the typical no-payment-due-until-maturity notes, a demand note can be called by the lender at any time, requiring immediate payment. The lack of a specified maturity date adds more flexibility for the lender and may be used in situations where the borrower's financial stability is uncertain. It is important for both lenders and borrowers in Philadelphia, Pennsylvania, to consult with legal professionals or financial advisors when drafting or entering into any promissory note agreement. This ensures compliance with local laws, protects the interests of both parties, and helps establish clear repayment terms and conditions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.