This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

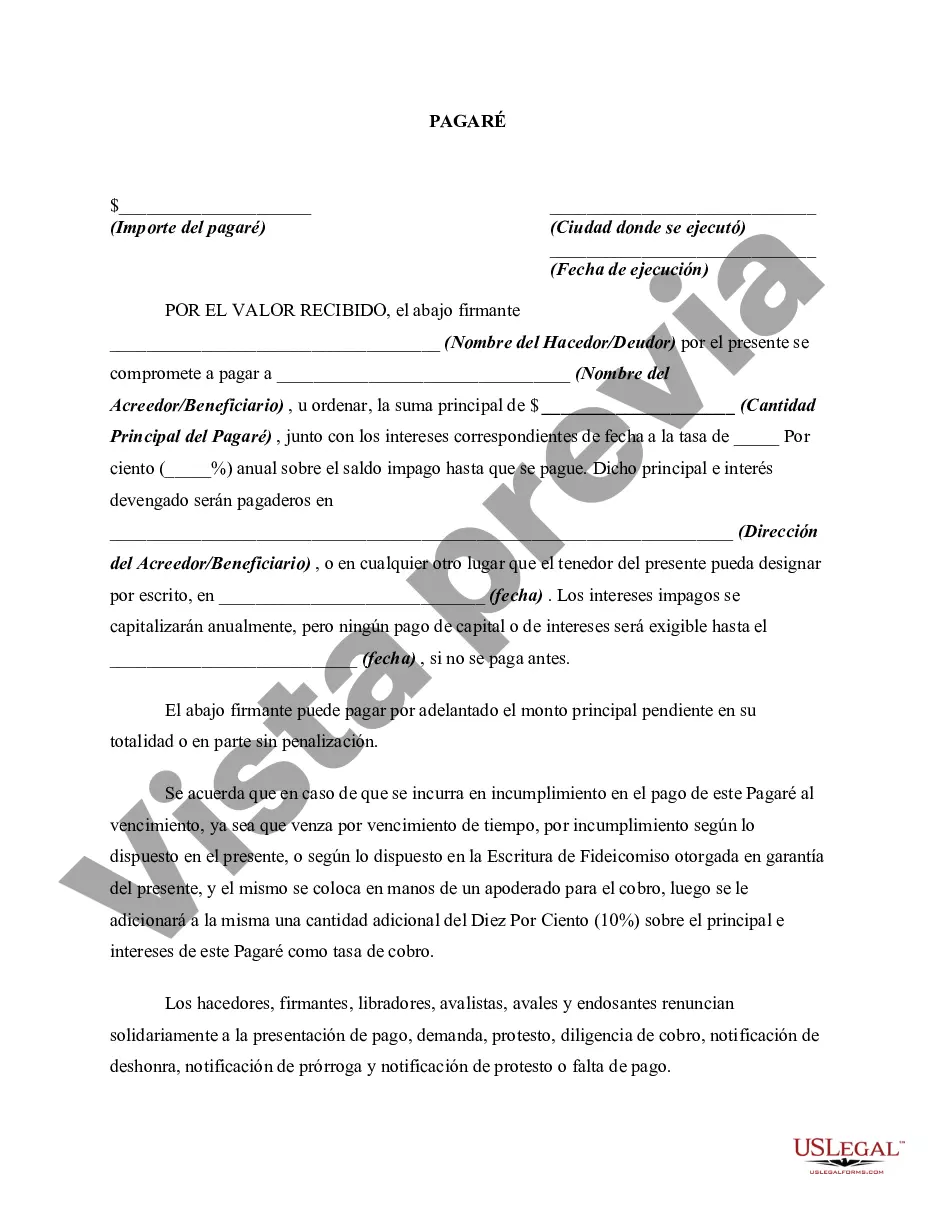

A San Antonio Texas Promissory Note with no payment due until maturity and interest to compound annually is a legally binding agreement made between a lender and a borrower in the city of San Antonio, Texas. This type of Promissory Note sets forth the terms and conditions for a loan, stating that no payments are required to be made until the maturity date, at which point both the principal amount and the accumulated interest are due. One notable feature of this Promissory Note is that the interest will compound annually, meaning that the interest earned on the loan will be added to the principal amount each year, further increasing the total amount due at maturity. This compounding interest structure allows the lender to maximize their return on investment. There are several variations of San Antonio Texas Promissory Notes with no payment due until maturity and interest to compound annually, each designed to meet specific needs and circumstances: 1. Fixed-Rate Promissory Note: This type of Promissory Note locks in a predetermined interest rate at the start of the loan, ensuring that the interest rate remains constant throughout the loan term. Borrowers may opt for this type of note to secure a stable payment schedule for the duration of the loan. 2. Adjustable-Rate Promissory Note: Unlike the fixed-rate note, an adjustable-rate Promissory Note allows for the interest rate to fluctuate over time. The interest rate is typically tied to a benchmark such as the prime rate or a specific index. The adjustment typically occurs annually or at specified intervals, based on market conditions. Adapting to changes in interest rates may benefit borrowers if rates decline but could pose a risk if rates increase. 3. Convertible Promissory Note: A convertible Promissory Note empowers the lender to convert the outstanding loan balance, including the interest, into equity in the borrower's company under predetermined conditions. This option is particularly common in the context of financing startups and provides the lender with the potential for future ownership. 4. Balloon Promissory Note: This variation of the San Antonio Texas Promissory Note requires no periodic payments until maturity; however, it includes a large, final payment known as a balloon payment. Borrowers may choose this option when they anticipate having a substantial lump sum available at the end of the loan term, such as through an inheritance or the expected sale of an asset. In conclusion, a San Antonio Texas Promissory Note with no payment due until maturity and interest to compound annually serves as a legally binding agreement between a lender and a borrower, detailing the terms of a loan. The various types of notes cater to different preferences and circumstances, ensuring flexibility and customized loan arrangements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.