It is not uncommon for employers to make loans to their new executives. The purpose of such a loan may be to assist the executive in the purchase of a home or other relocation expenses. Frequently, the loan is forgivable over a period of time provided the executive remains employed. The loan also may be forgivable if the executive's employment terminates for specified reasons (e.g., death, disability or termination by the employer without cause).

A Mecklenburg North Carolina Promissory Note — Forgivable Loan is a legal document that outlines the terms and conditions associated with a loan that can be forgiven under specific circumstances. This type of loan is often provided by government agencies, non-profit organizations, or private entities with the objective of promoting economic development, homeownership, education, or other targeted initiatives. The Mecklenburg North Carolina Promissory Note — Forgivable Loan serves as a binding agreement between the borrower and the lender, stating the specific criteria that must be met for the loan to be forgiven. Generally, the loan will be forgiven if the borrower fulfills certain requirements such as residency, maintaining employment, making timely payments, or meeting other predetermined obligations. There are multiple types of Mecklenburg North Carolina Promissory Note — Forgivable Loans available, each catering to different purposes and target groups. Some common types include: 1. Small Business Forgivable Loans: These programs aim to encourage entrepreneurship and provide financial assistance to small businesses in Mecklenburg County. The loans are typically offered to startups or existing businesses struggling to obtain traditional financing. 2. Housing Forgivable Loans: Designed to promote affordable housing, these loans assist individuals or families in purchasing or renovating a home in Mecklenburg County. The loan may be forgiven gradually over a specified period, incentivizing long-term residency. 3. Education Forgivable Loans: Geared towards encouraging higher education or professional development, these loans assist students or professionals by offering financial support for tuition, training courses, or certifications. The loan can be forgiven by meeting specific academic or career-related milestones. 4. Workforce Development Forgivable Loans: These loans focus on bridging the skill gap in Mecklenburg County's workforce by providing financial assistance to individuals seeking vocational training, certifications, or skill-building programs. The loan forgiveness usually relies on securing employment within a particular sector or meeting predetermined employment targets. 5. Community Development Forgivable Loans: These loans facilitate community-oriented projects, such as infrastructure development, community centers, or public amenities. The loan forgiveness may be contingent upon successful project completion or monitoring community impact. It is important to note that each type of Mecklenburg North Carolina Promissory Note — Forgivable Loan may have specific eligibility requirements, application procedures, repayment terms, and forgiveness criteria. Prospective borrowers should thoroughly review the terms of the loan programs to ensure that they meet the necessary qualifications and understand the obligations involved. Overall, the Mecklenburg North Carolina Promissory Note — Forgivable Loan represents an opportunity for individuals, businesses, and communities in Mecklenburg County to access financial assistance that can potentially be forgiven, easing the burden of repayment and supporting various economic, education, and community development initiatives.A Mecklenburg North Carolina Promissory Note — Forgivable Loan is a legal document that outlines the terms and conditions associated with a loan that can be forgiven under specific circumstances. This type of loan is often provided by government agencies, non-profit organizations, or private entities with the objective of promoting economic development, homeownership, education, or other targeted initiatives. The Mecklenburg North Carolina Promissory Note — Forgivable Loan serves as a binding agreement between the borrower and the lender, stating the specific criteria that must be met for the loan to be forgiven. Generally, the loan will be forgiven if the borrower fulfills certain requirements such as residency, maintaining employment, making timely payments, or meeting other predetermined obligations. There are multiple types of Mecklenburg North Carolina Promissory Note — Forgivable Loans available, each catering to different purposes and target groups. Some common types include: 1. Small Business Forgivable Loans: These programs aim to encourage entrepreneurship and provide financial assistance to small businesses in Mecklenburg County. The loans are typically offered to startups or existing businesses struggling to obtain traditional financing. 2. Housing Forgivable Loans: Designed to promote affordable housing, these loans assist individuals or families in purchasing or renovating a home in Mecklenburg County. The loan may be forgiven gradually over a specified period, incentivizing long-term residency. 3. Education Forgivable Loans: Geared towards encouraging higher education or professional development, these loans assist students or professionals by offering financial support for tuition, training courses, or certifications. The loan can be forgiven by meeting specific academic or career-related milestones. 4. Workforce Development Forgivable Loans: These loans focus on bridging the skill gap in Mecklenburg County's workforce by providing financial assistance to individuals seeking vocational training, certifications, or skill-building programs. The loan forgiveness usually relies on securing employment within a particular sector or meeting predetermined employment targets. 5. Community Development Forgivable Loans: These loans facilitate community-oriented projects, such as infrastructure development, community centers, or public amenities. The loan forgiveness may be contingent upon successful project completion or monitoring community impact. It is important to note that each type of Mecklenburg North Carolina Promissory Note — Forgivable Loan may have specific eligibility requirements, application procedures, repayment terms, and forgiveness criteria. Prospective borrowers should thoroughly review the terms of the loan programs to ensure that they meet the necessary qualifications and understand the obligations involved. Overall, the Mecklenburg North Carolina Promissory Note — Forgivable Loan represents an opportunity for individuals, businesses, and communities in Mecklenburg County to access financial assistance that can potentially be forgiven, easing the burden of repayment and supporting various economic, education, and community development initiatives.

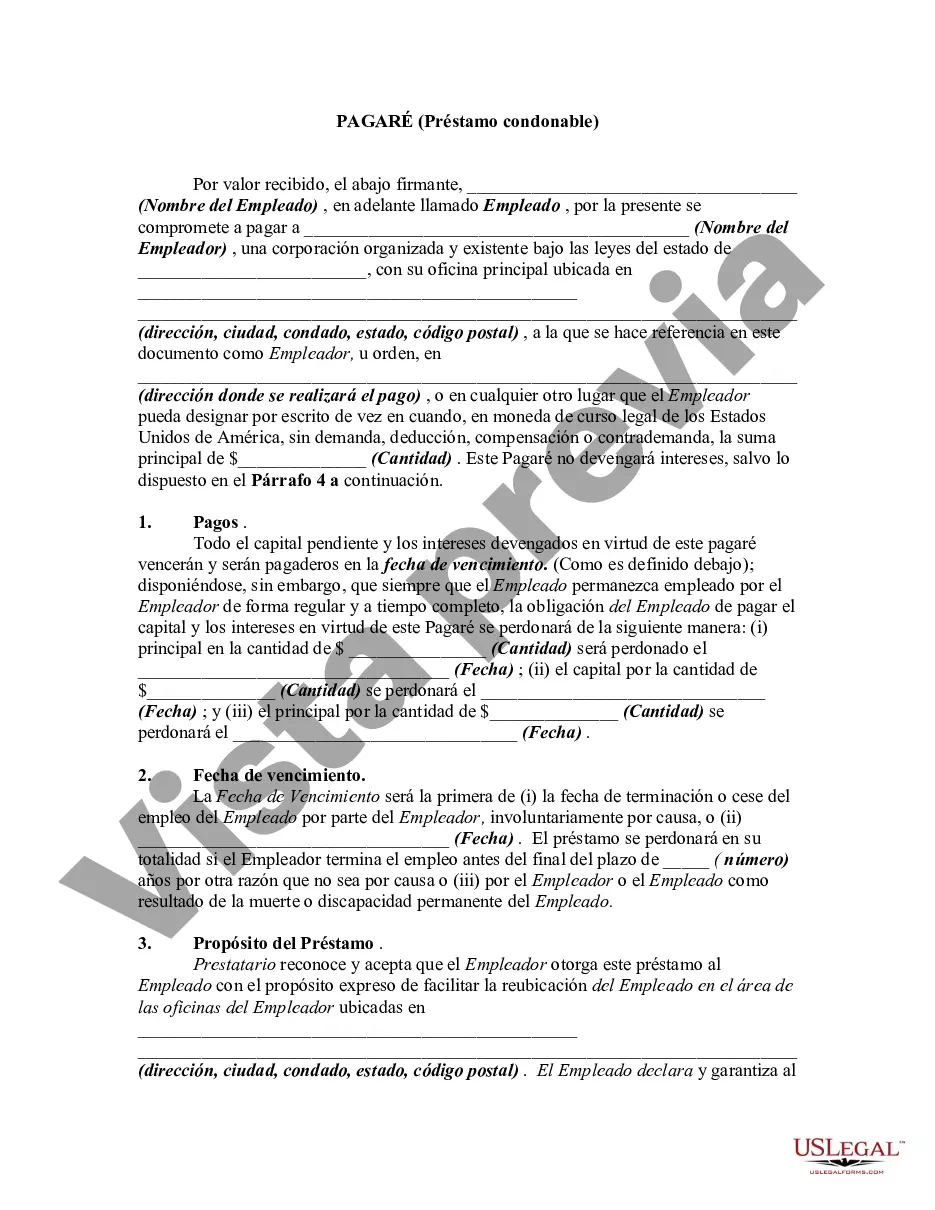

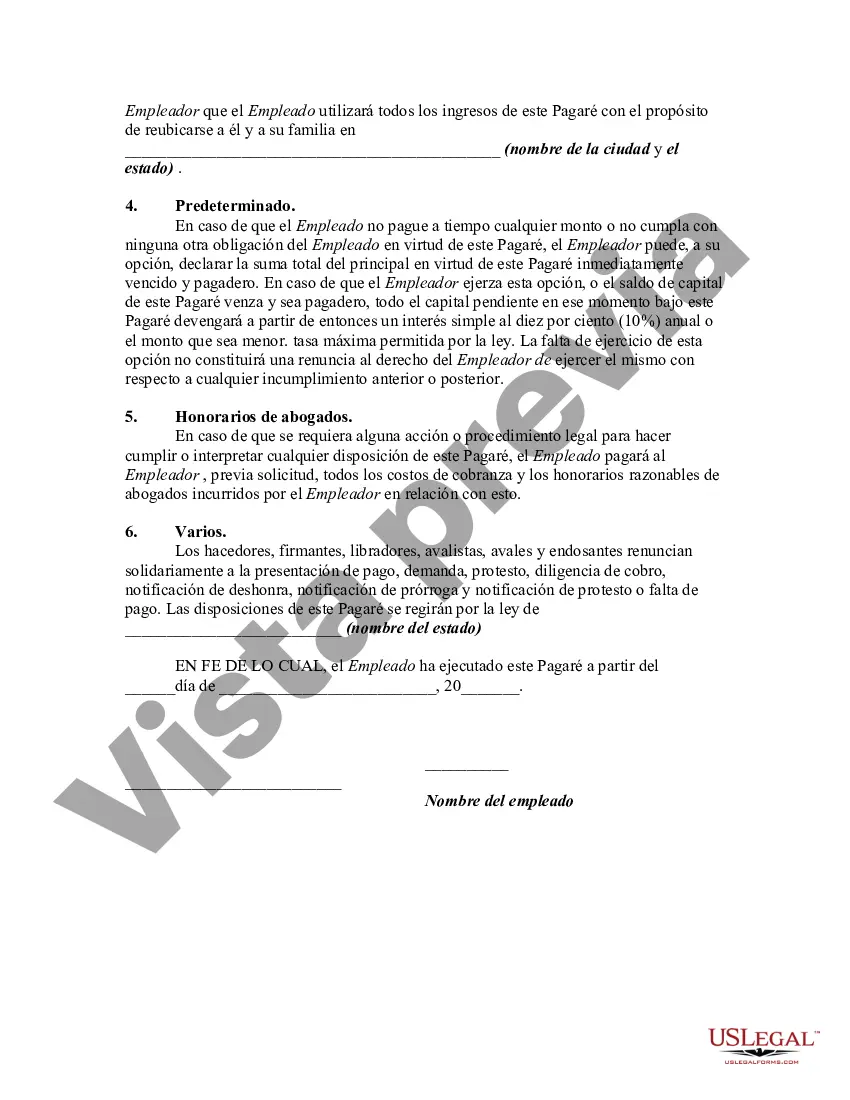

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.