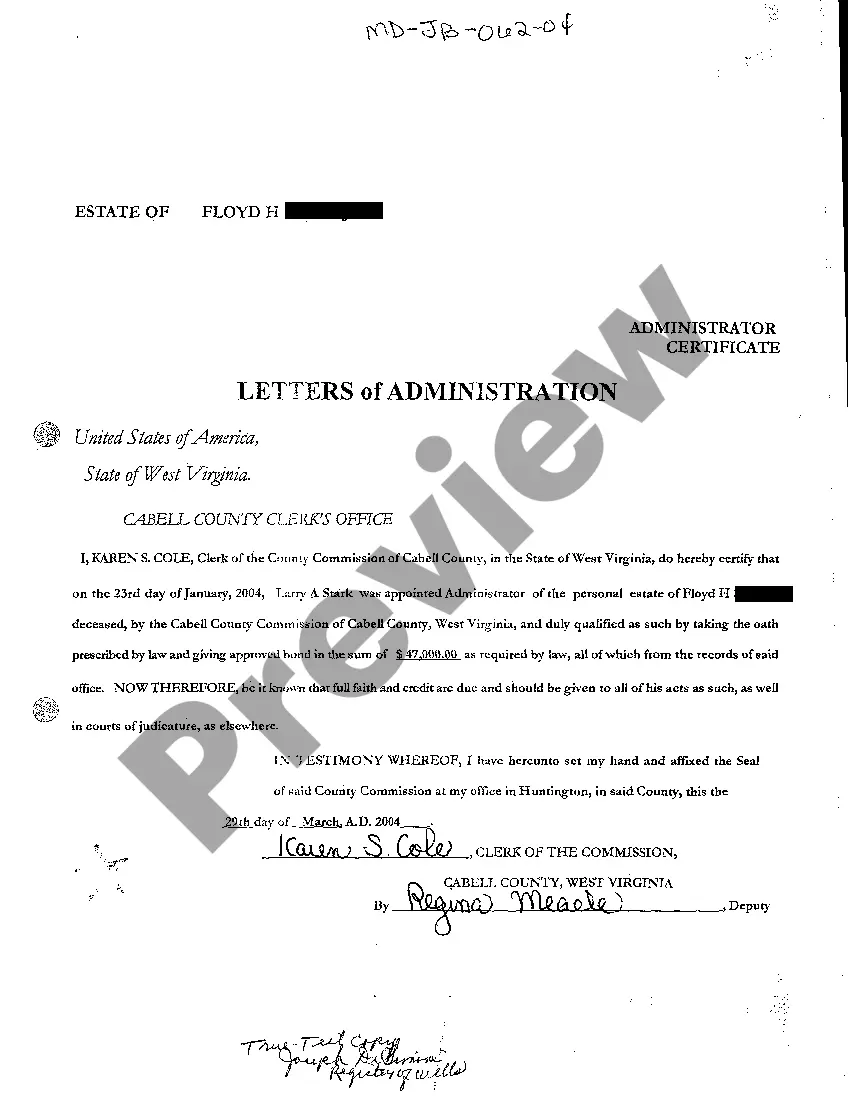

A testamentary trust is a trust in which the trust property is bequeathed or devised by will to the trustee for the benefit of the beneficiaries. Statutes in effect in the various jurisdictions prescribe certain formalities which must be observed in connection with the execution of a will in order to give validity to the instrument and make it eligible to be probated. A valid testamentary trust is created only when the will attempting to create it complies with the formalities of the state's statutes covering wills. An instrument will be denied probate where it fails to conform at least substantially to the controlling statutory provisions governing the execution of wills.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

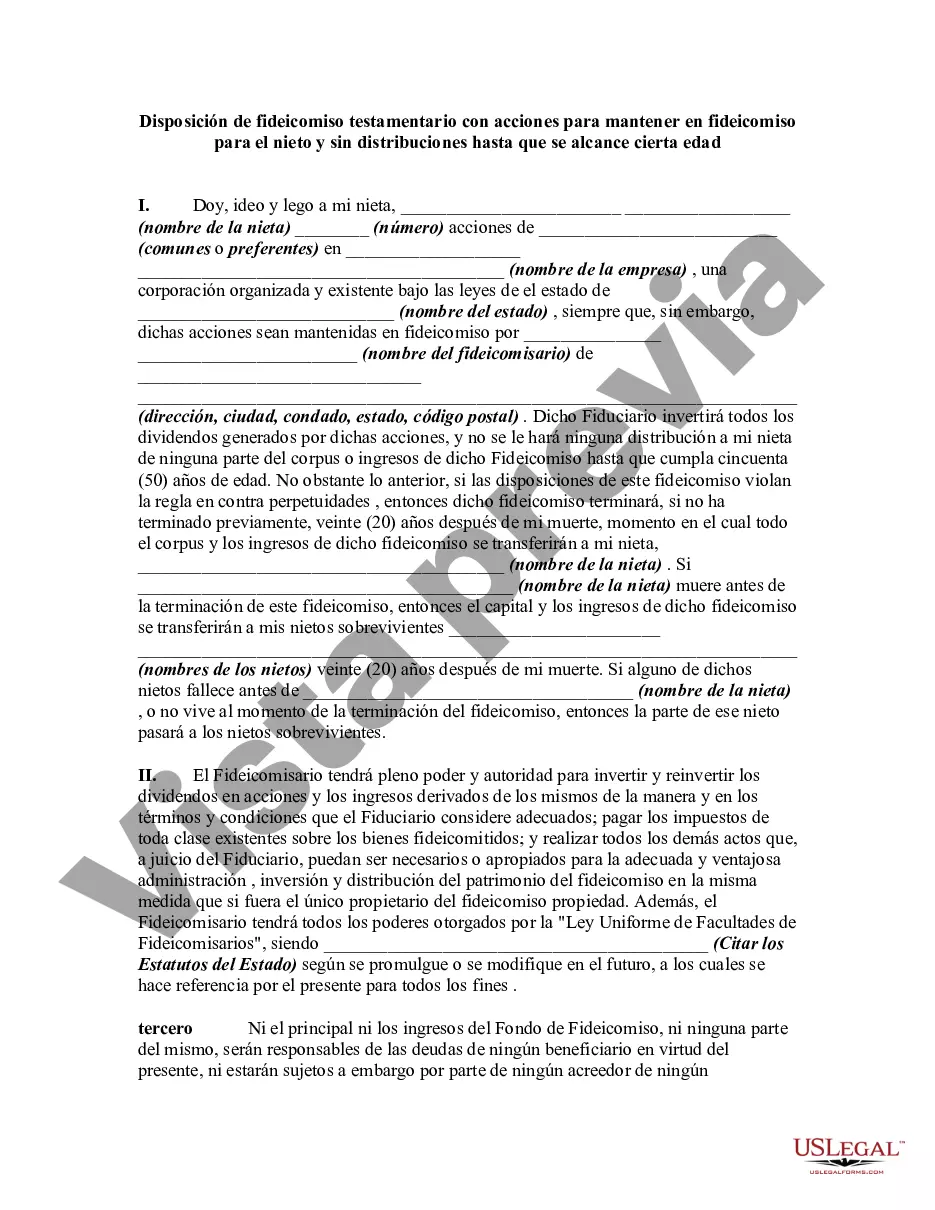

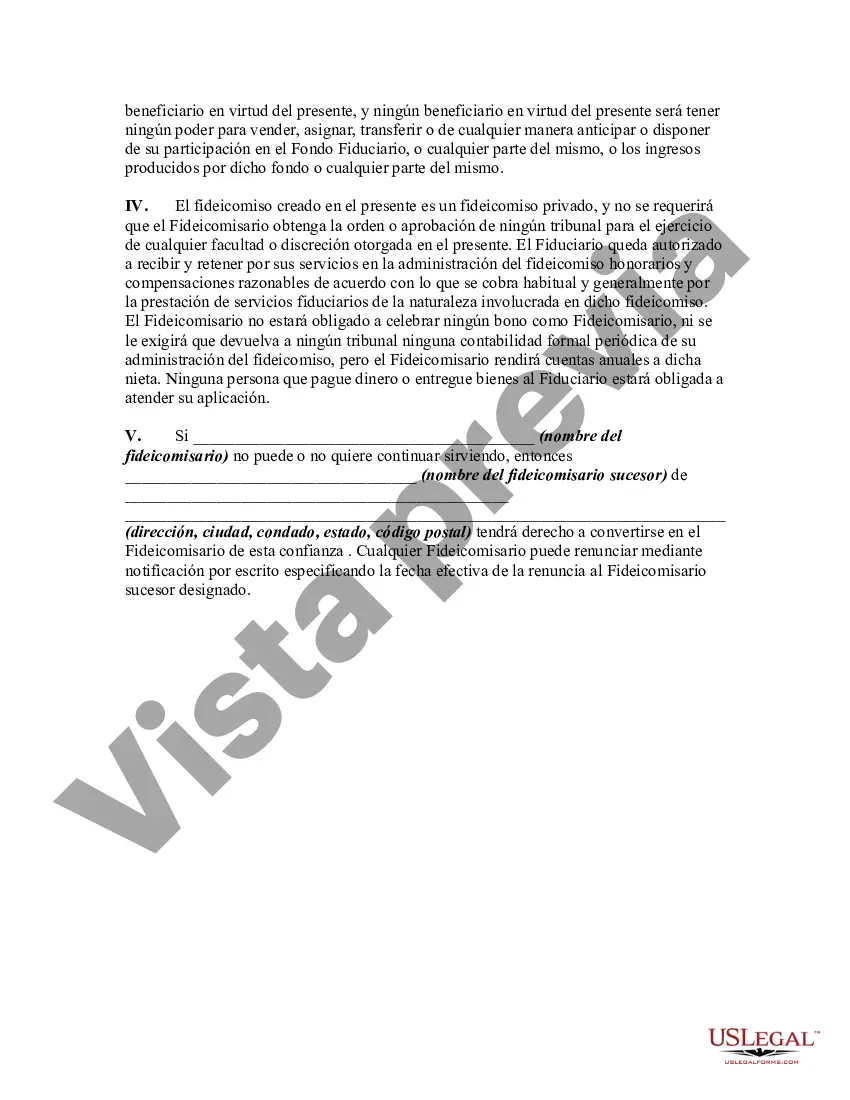

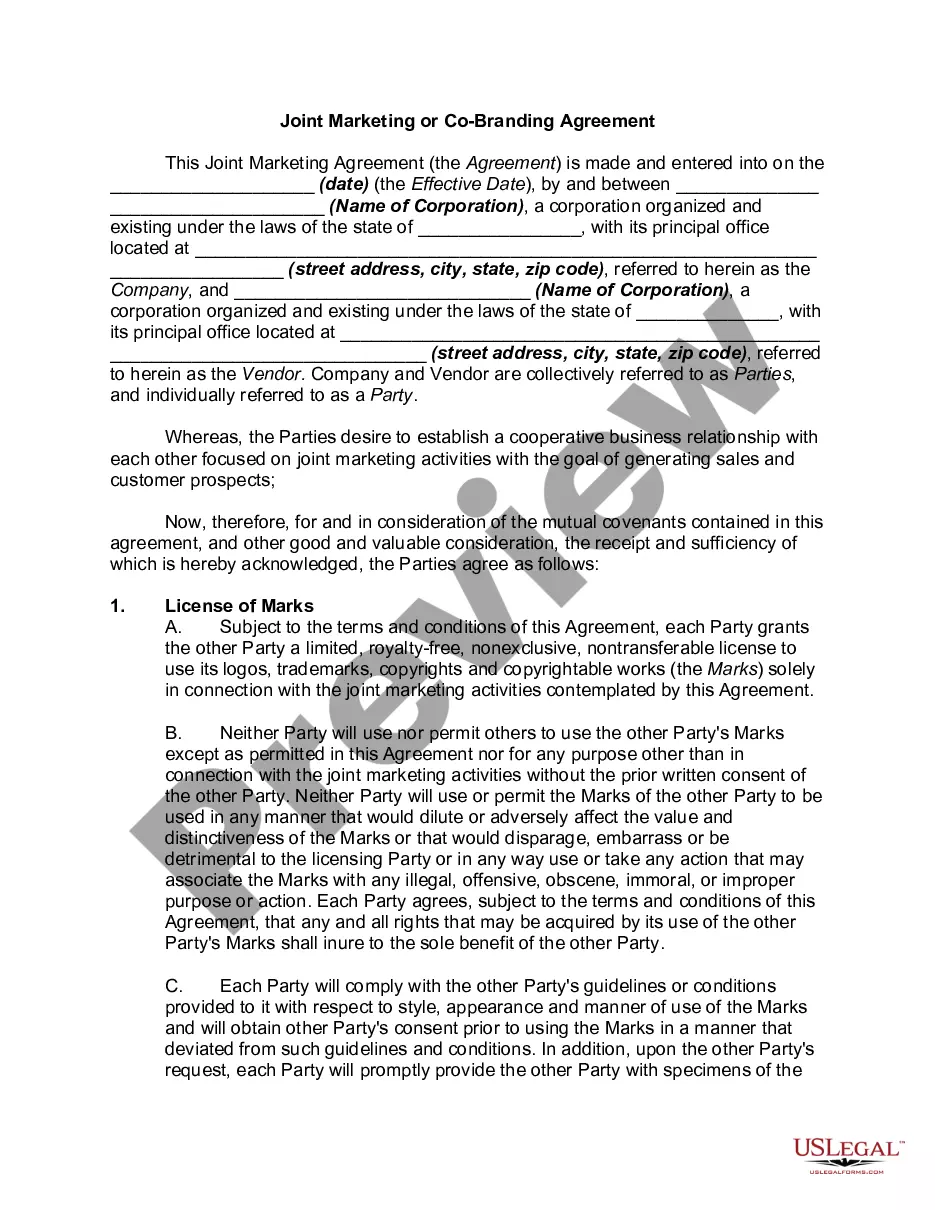

A Bexar Texas Testamentary Trust Provision with Stock to be Held in Trust for a Grandchild and no Distributions to be Made until a Certain Age is Reached is a specific type of trust agreement established in Bexar County, Texas. This provision is designed to secure and manage assets, specifically stock holdings, for the benefit of a grandchild until they reach a certain age. The testamentary trust provision ensures that the assets, in this case, stock, are held in a trust rather than being distributed immediately. This approach provides protection, control, and potential growth of the assets over time. By naming a grandchild as the beneficiary, it allows the assets to be reserved for their benefit, while restricting access until they reach a specified age or milestone. This type of trust provision acknowledges that the beneficiary (grandchild) may not have the necessary maturity, financial responsibility, or understanding handling significant assets at a young age. It aims to provide financial security and support for their future needs, such as education, starting a business, or investing in real estate. There might be different variations or subtypes of Bexar Texas Testamentary Trust Provision with Stock to be Held in Trust for a Grandchild and no Distributions to be Made until a Certain Age is Reached, depending on specific conditions and parameters set by the granter: 1. Age-Based Trust: The provision could specify a certain age at which the grandchild gains access to the trust assets. For example, the stock holdings may be held in trust until the grandchild reaches 25 years old or graduates from college. 2. Milestone-Based Trust: Instead of relying solely on a specific age, this provision could require the grandchild to meet certain milestones or achievements before distributions are made. These may include completing a specific educational degree, attaining a specific professional certification, or demonstrating responsible financial management. 3. Trustee Discretion: The trust agreement may grant the trustee certain discretionary powers to determine when and how distributions will be made. This allows the trustee to assess the grandchild's financial acumen, maturity, and overall circumstances before releasing the trust assets. Overall, a Bexar Texas Testamentary Trust Provision with Stock to be Held in Trust for a Grandchild and no Distributions to be Made until a Certain Age is Reached is a vital estate planning tool that ensures responsible management of assets for the future welfare and benefit of a grandchild while protecting their long-term financial interests.A Bexar Texas Testamentary Trust Provision with Stock to be Held in Trust for a Grandchild and no Distributions to be Made until a Certain Age is Reached is a specific type of trust agreement established in Bexar County, Texas. This provision is designed to secure and manage assets, specifically stock holdings, for the benefit of a grandchild until they reach a certain age. The testamentary trust provision ensures that the assets, in this case, stock, are held in a trust rather than being distributed immediately. This approach provides protection, control, and potential growth of the assets over time. By naming a grandchild as the beneficiary, it allows the assets to be reserved for their benefit, while restricting access until they reach a specified age or milestone. This type of trust provision acknowledges that the beneficiary (grandchild) may not have the necessary maturity, financial responsibility, or understanding handling significant assets at a young age. It aims to provide financial security and support for their future needs, such as education, starting a business, or investing in real estate. There might be different variations or subtypes of Bexar Texas Testamentary Trust Provision with Stock to be Held in Trust for a Grandchild and no Distributions to be Made until a Certain Age is Reached, depending on specific conditions and parameters set by the granter: 1. Age-Based Trust: The provision could specify a certain age at which the grandchild gains access to the trust assets. For example, the stock holdings may be held in trust until the grandchild reaches 25 years old or graduates from college. 2. Milestone-Based Trust: Instead of relying solely on a specific age, this provision could require the grandchild to meet certain milestones or achievements before distributions are made. These may include completing a specific educational degree, attaining a specific professional certification, or demonstrating responsible financial management. 3. Trustee Discretion: The trust agreement may grant the trustee certain discretionary powers to determine when and how distributions will be made. This allows the trustee to assess the grandchild's financial acumen, maturity, and overall circumstances before releasing the trust assets. Overall, a Bexar Texas Testamentary Trust Provision with Stock to be Held in Trust for a Grandchild and no Distributions to be Made until a Certain Age is Reached is a vital estate planning tool that ensures responsible management of assets for the future welfare and benefit of a grandchild while protecting their long-term financial interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.