A testamentary trust is a trust in which the trust property is bequeathed or devised by will to the trustee for the benefit of the beneficiaries. Statutes in effect in the various jurisdictions prescribe certain formalities which must be observed in connection with the execution of a will in order to give validity to the instrument and make it eligible to be probated. A valid testamentary trust is created only when the will attempting to create it complies with the formalities of the state's statutes covering wills. An instrument will be denied probate where it fails to conform at least substantially to the controlling statutory provisions governing the execution of wills.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

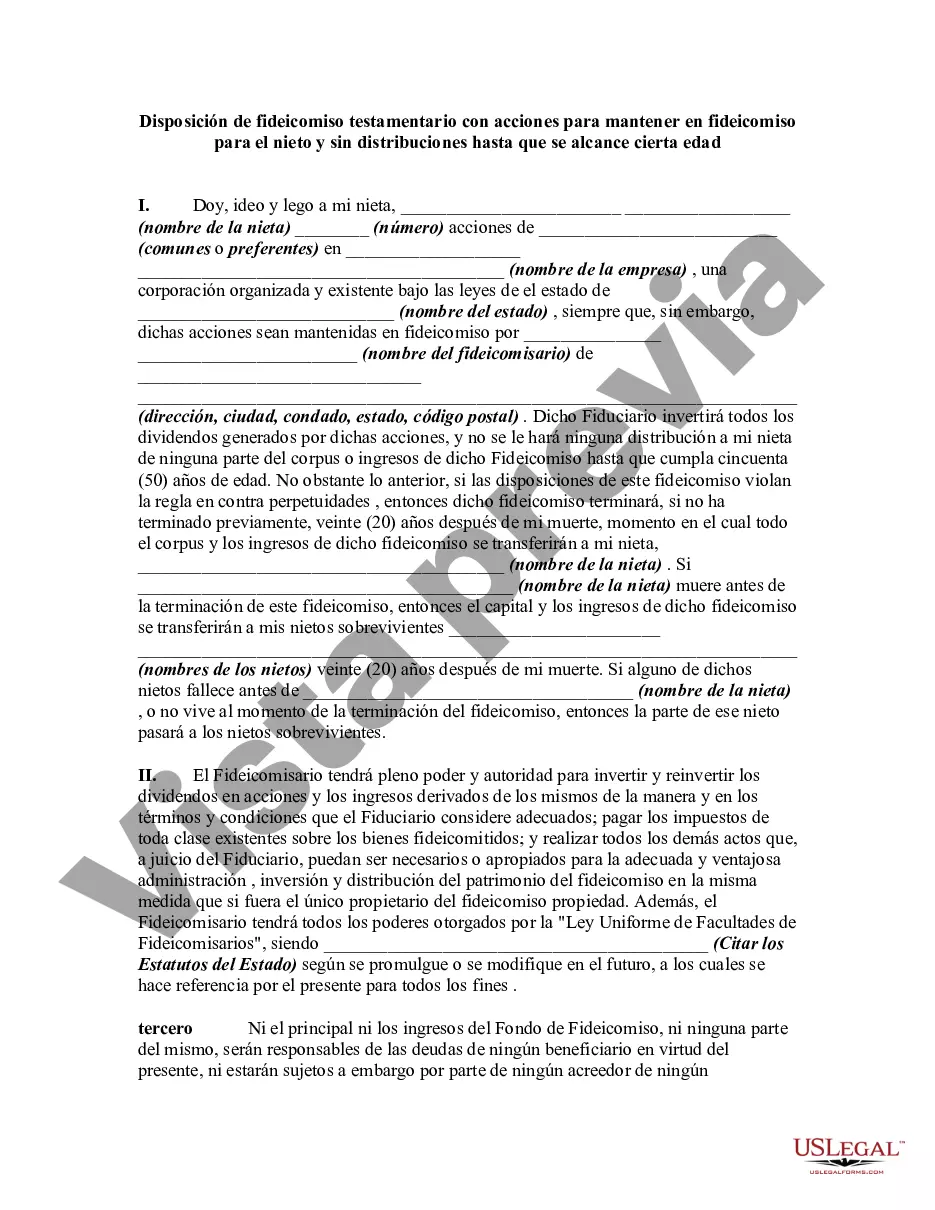

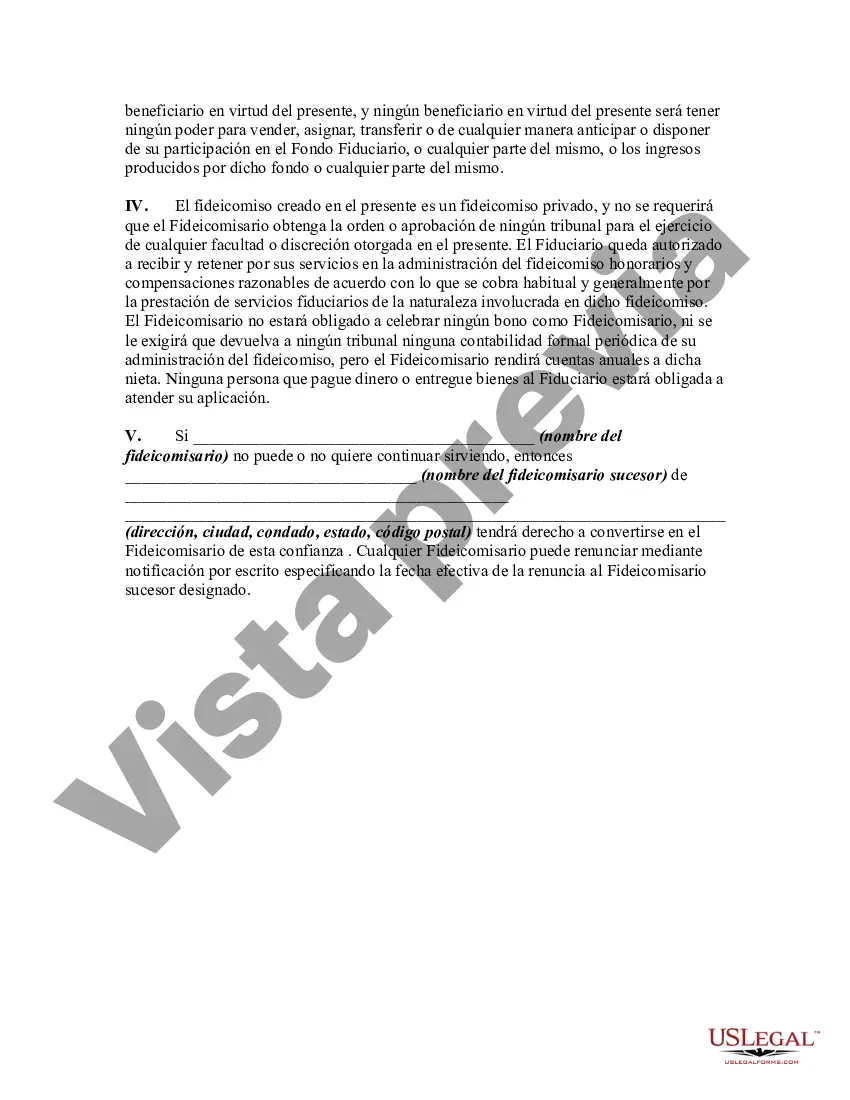

Mecklenburg North Carolina Testamentary Trust Provision with Stock to be Held in Trust for Grandchild and no Distributions to be Made until a Certain Age is Reached: In Mecklenburg, North Carolina, a testamentary trust provision is a legal arrangement that allows for the establishment of a trust upon the death of an individual. This specific provision focuses on holding stock assets in trust for a grandchild, with the condition that no distributions are made until the grandchild reaches a certain age. The purpose of this testamentary trust provision is to ensure that the grandchild's inheritance, in the form of stocks, is managed responsibly and preserved for their benefit until they are deemed mature enough to handle it. By placing the stocks within a trust, the provisions offer protection and guidance to safeguard the assets until the grandchild reaches the predetermined age. The specific details of Mecklenburg North Carolina Testamentary Trust Provision with Stock to be Held in Trust for Grandchild and no Distributions to be Made until a Certain Age is Reached can vary based on individual preferences and circumstances. Some key aspects that may be included in these provisions are: 1. Stock Assets: The provision focuses on allocating a portion of the estate in the form of stock assets for the grandchild's benefit. This could include publicly traded stocks, privately held shares, or other equity investments. 2. Trustee Appointment: A trustee is designated to manage the assets held in trust. They are responsible for ensuring the stocks are properly maintained, dividends are reinvested, and any necessary actions are taken to protect the value of the assets. The trustee may be a family member, a professional trust company, or a legal professional. 3. Age Requirement: The provision specifies the age at which distributions from the trust can be made to the grandchild. This is typically set to a certain age, such as 18, 21, or older, depending on the wishes of the granter. Until the grandchild reaches the designated age, no distributions are permitted, ensuring the assets are preserved and protected. 4. Discretionary Distributions: While the provision may restrict distributions until the specified age is reached, it may allow for discretionary distributions under certain circumstances. For example, if the grandchild requires funds for education, medical expenses, or other essential needs, the trustee may have the authority to make limited distributions before the designated age. It is important to note that variations of this Mecklenburg North Carolina testamentary trust provision may exist, depending on the granter's objectives and unique circumstances. These provisions can be tailored to meet specific requirements, and legal advice should be sought to ensure compliance with relevant laws and regulations. Overall, the Mecklenburg North Carolina Testamentary Trust Provision with Stock to be Held in Trust for Grandchild and no Distributions to be Made until a Certain Age is Reached serves as a valuable tool in protecting and managing stock assets for the future benefit of a beloved grandchild.Mecklenburg North Carolina Testamentary Trust Provision with Stock to be Held in Trust for Grandchild and no Distributions to be Made until a Certain Age is Reached: In Mecklenburg, North Carolina, a testamentary trust provision is a legal arrangement that allows for the establishment of a trust upon the death of an individual. This specific provision focuses on holding stock assets in trust for a grandchild, with the condition that no distributions are made until the grandchild reaches a certain age. The purpose of this testamentary trust provision is to ensure that the grandchild's inheritance, in the form of stocks, is managed responsibly and preserved for their benefit until they are deemed mature enough to handle it. By placing the stocks within a trust, the provisions offer protection and guidance to safeguard the assets until the grandchild reaches the predetermined age. The specific details of Mecklenburg North Carolina Testamentary Trust Provision with Stock to be Held in Trust for Grandchild and no Distributions to be Made until a Certain Age is Reached can vary based on individual preferences and circumstances. Some key aspects that may be included in these provisions are: 1. Stock Assets: The provision focuses on allocating a portion of the estate in the form of stock assets for the grandchild's benefit. This could include publicly traded stocks, privately held shares, or other equity investments. 2. Trustee Appointment: A trustee is designated to manage the assets held in trust. They are responsible for ensuring the stocks are properly maintained, dividends are reinvested, and any necessary actions are taken to protect the value of the assets. The trustee may be a family member, a professional trust company, or a legal professional. 3. Age Requirement: The provision specifies the age at which distributions from the trust can be made to the grandchild. This is typically set to a certain age, such as 18, 21, or older, depending on the wishes of the granter. Until the grandchild reaches the designated age, no distributions are permitted, ensuring the assets are preserved and protected. 4. Discretionary Distributions: While the provision may restrict distributions until the specified age is reached, it may allow for discretionary distributions under certain circumstances. For example, if the grandchild requires funds for education, medical expenses, or other essential needs, the trustee may have the authority to make limited distributions before the designated age. It is important to note that variations of this Mecklenburg North Carolina testamentary trust provision may exist, depending on the granter's objectives and unique circumstances. These provisions can be tailored to meet specific requirements, and legal advice should be sought to ensure compliance with relevant laws and regulations. Overall, the Mecklenburg North Carolina Testamentary Trust Provision with Stock to be Held in Trust for Grandchild and no Distributions to be Made until a Certain Age is Reached serves as a valuable tool in protecting and managing stock assets for the future benefit of a beloved grandchild.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.