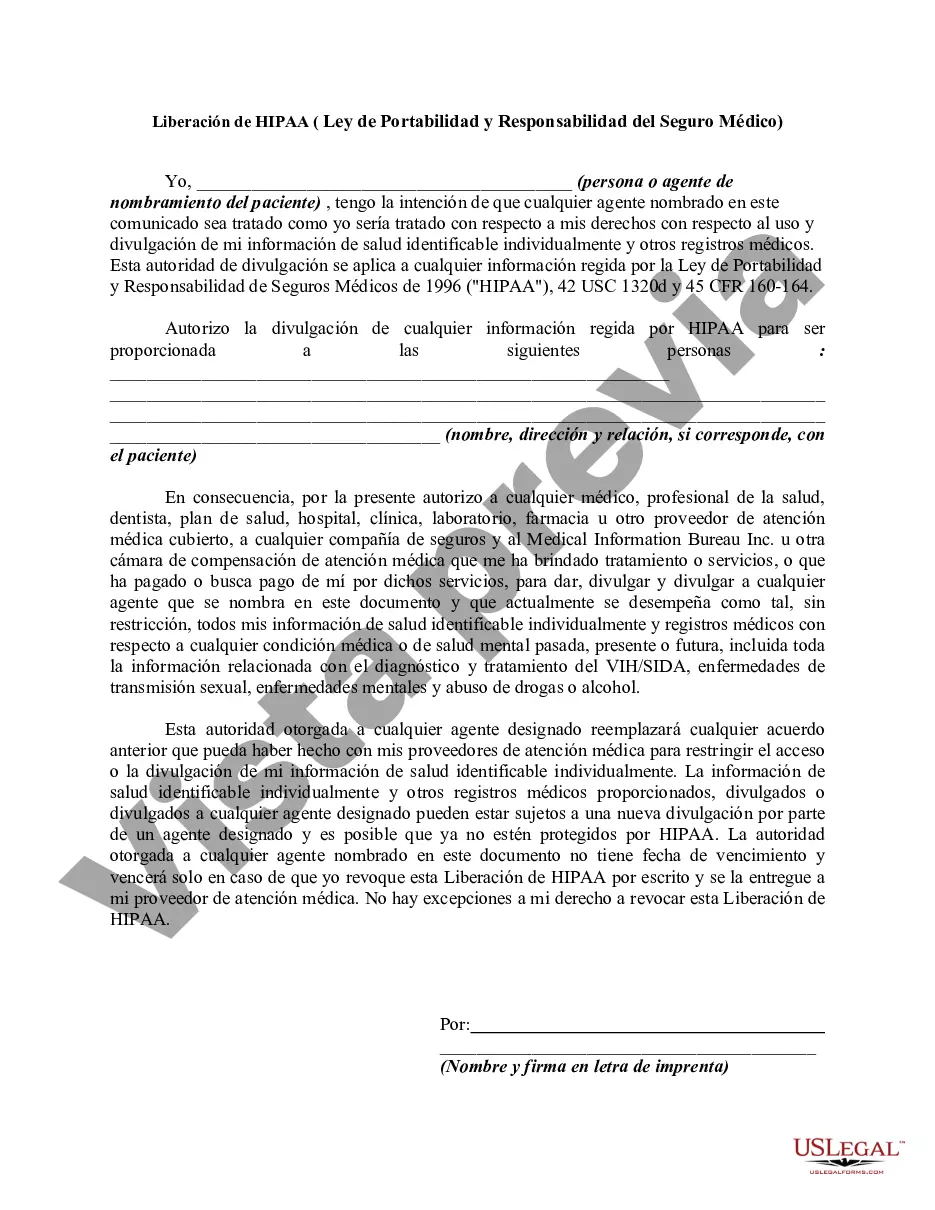

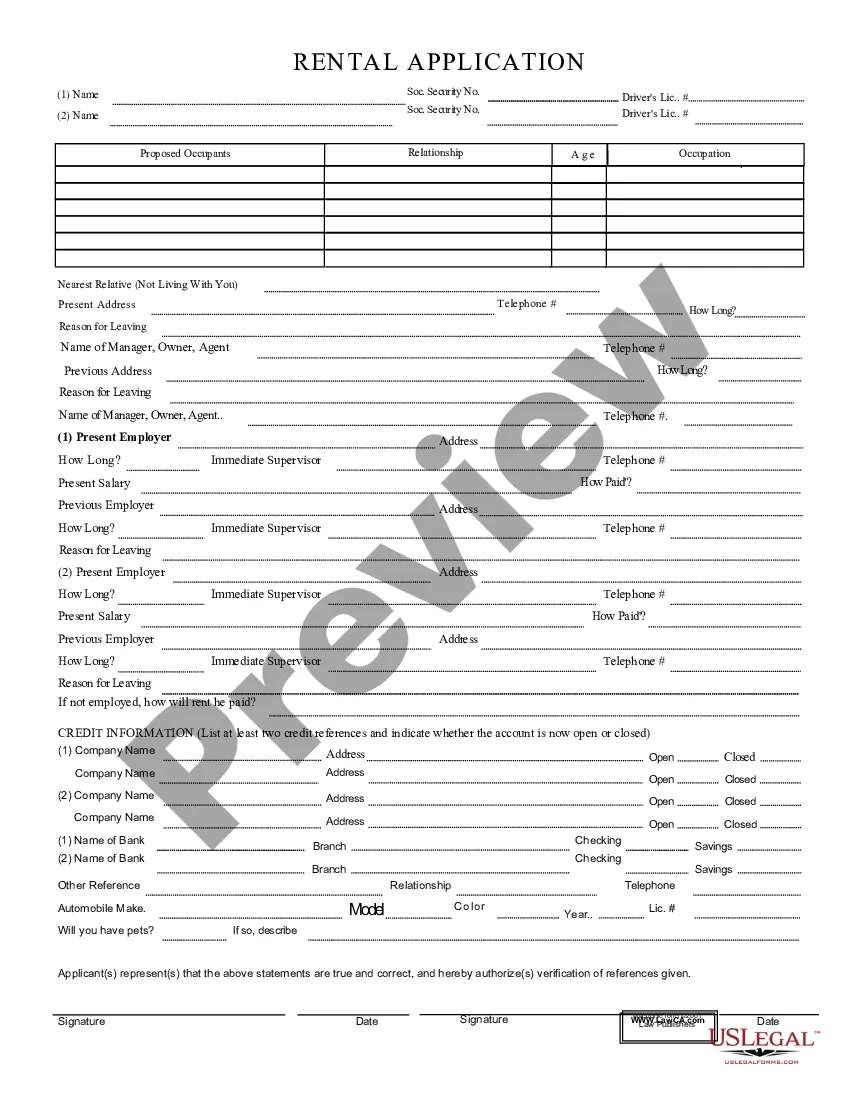

Nassau New York HIPAA Release Form for Insurance: A Comprehensive Overview HIPAA, which stands for the Health Insurance Portability and Accountability Act, is a federal law enacted in 1996 that safeguards the privacy and security of an individual's health information. In Nassau, New York, residents are required to comply with HIPAA regulations when sharing their medical records with insurance providers. To facilitate this process, Nassau has specific HIPAA release forms tailored for insurance purposes. 1. Nassau New York General HIPAA Release Form for Insurance: The general HIPAA release form allows individuals to authorize the release of their protected health information (PHI) to their insurance companies. By signing this document, patients grant permission for insurance providers to access their medical records, treatment history, diagnoses, procedures, and other pertinent information required for claim processing. 2. Nassau New York Special HIPAA Release Form for Insurance: In certain circumstances, individuals may require specialized HIPAA release forms. For instance, if an insured patient is seeking coverage for mental health treatments, substance abuse rehabilitation, or reproductive health services, a special HIPAA release form may be necessary. These forms explicitly outline the specific types of health information that can be disclosed to insurance companies for claim approval. 3. Nassau New York Minor HIPAA Release Form for Insurance: When a minor (under 18 years old) is the primary policyholder or a dependent on an insurance plan, a minor HIPAA release form is typically required. This form allows parents or legal guardians to authorize the sharing of their child's health information with insurance companies. It is essential to note that once a minor reaches legal adulthood, they may need to sign a new HIPAA release form themselves. While these are the common types of HIPAA release forms for insurance in Nassau, New York, it is crucial to consult with legal professionals or insurance providers to ensure compliance with state-specific regulations. Additionally, it is recommended to review the forms carefully before signing, ensuring that all required information is accurately provided and understood. Remember, HIPAA release forms play a significant role in protecting the privacy and confidentiality of personal health information while enabling insurance companies to process claims efficiently. By adhering to these requirements, individuals can confidently navigate the insurance process without compromising their privacy rights.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Formulario de liberación de Hippa para seguros - Hippa Release Form for Insurance

Description

How to fill out Nassau New York Formulario De Liberación De Hippa Para Seguros?

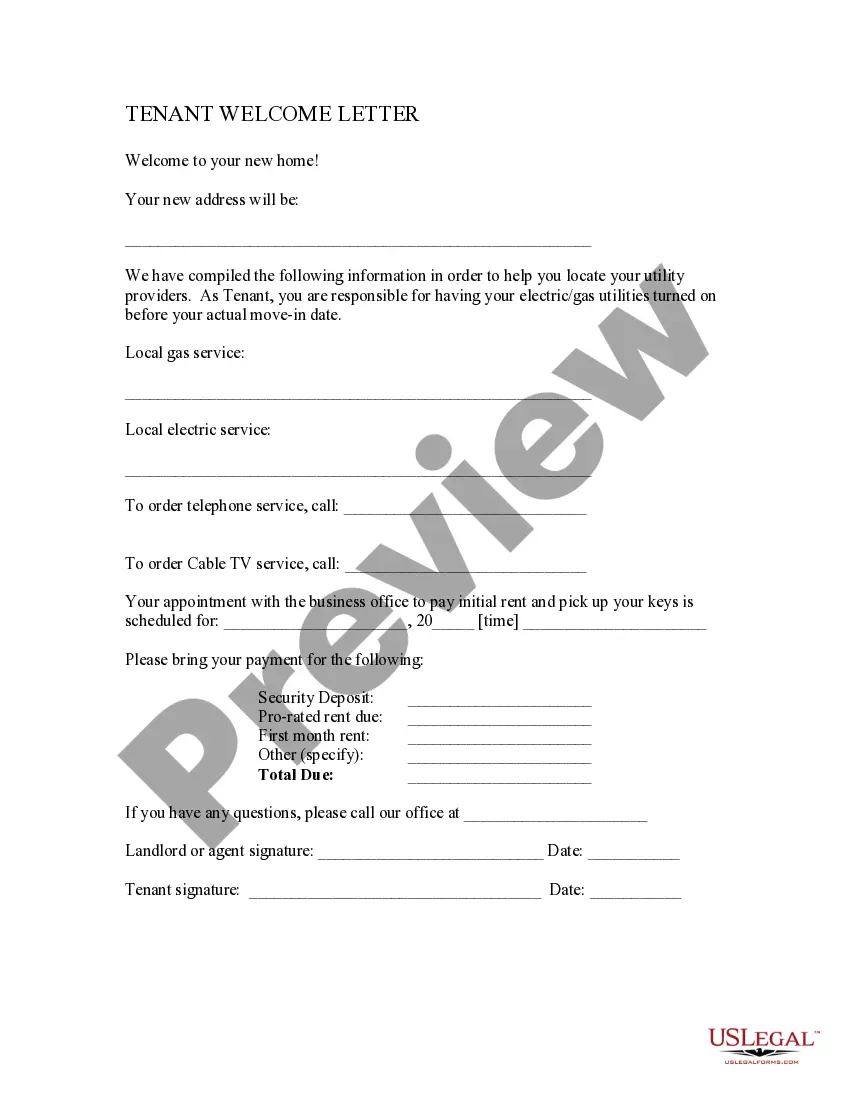

Draftwing paperwork, like Nassau Hippa Release Form for Insurance, to manage your legal matters is a difficult and time-consumming task. A lot of cases require an attorney’s participation, which also makes this task expensive. Nevertheless, you can take your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents created for various cases and life circumstances. We make sure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Nassau Hippa Release Form for Insurance template. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly easy! Here’s what you need to do before downloading Nassau Hippa Release Form for Insurance:

- Ensure that your template is compliant with your state/county since the regulations for writing legal paperwork may vary from one state another.

- Learn more about the form by previewing it or going through a quick description. If the Nassau Hippa Release Form for Insurance isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start using our service and get the form.

- Everything looks good on your end? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your template is all set. You can go ahead and download it.

It’s easy to find and purchase the needed document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!