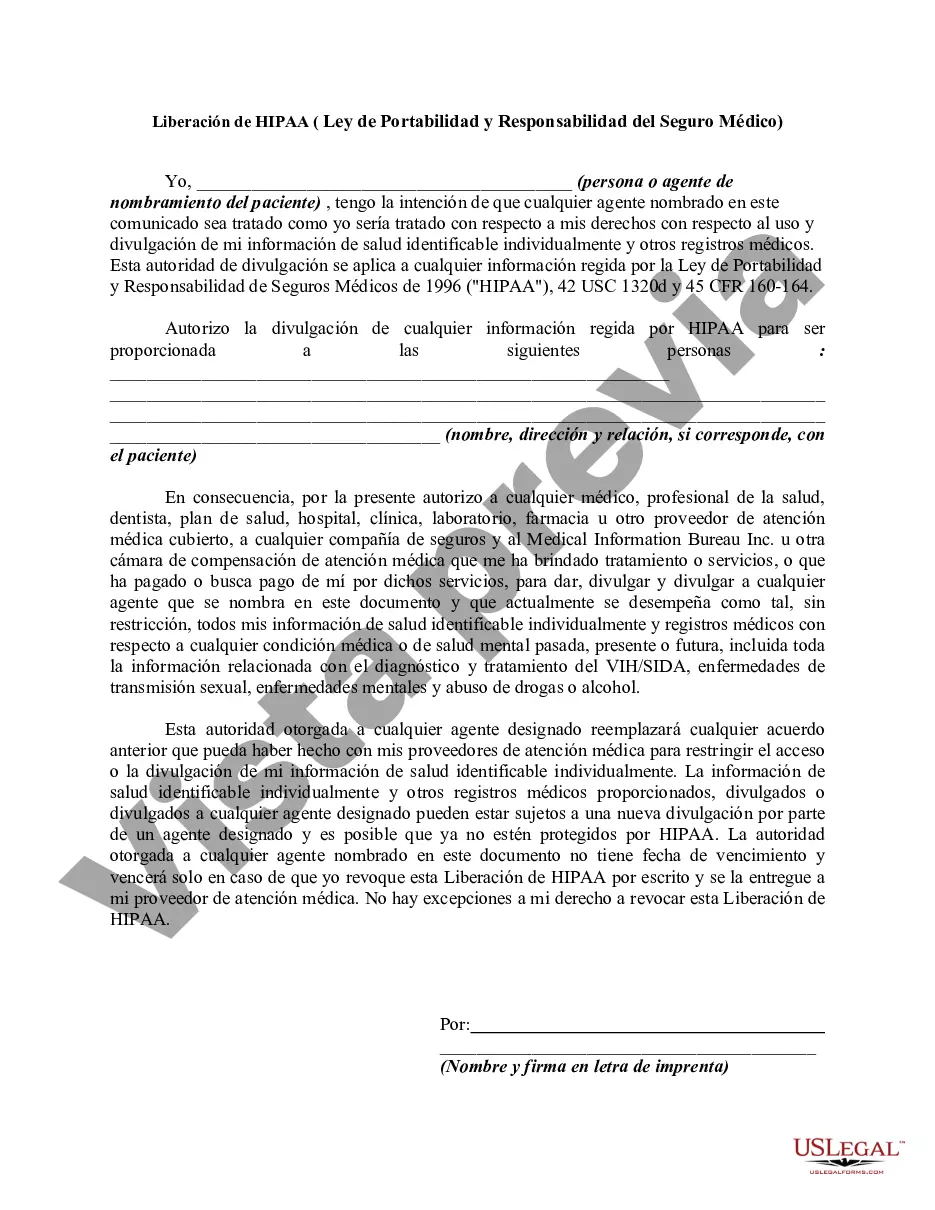

The Wake North Carolina HIPAA Release Form for Insurance is a legal document that allows individuals to authorize the disclosure of their protected health information (PHI) to insurance providers or related entities. This form ensures compliance with the Health Insurance Portability and Accountability Act (HIPAA), a federal law that protects the privacy and security of patients' medical information. By signing this HIPAA release form, patients grant permission for their healthcare providers to share specific PHI with insurance companies. This facilitates the claims process and enables insurance companies to obtain the necessary medical information to determine coverage, process payments, and administer benefits accurately. The Wake North Carolina HIPAA Release Form for Insurance typically includes essential details such as: 1. Patient's Information: This section requires the patient's full name, address, contact details, and policy information. It is crucial to provide accurate details to avoid any processing delays or errors. 2. Insurance Company Information: The form also requires the insurance company's name, address, and contact details. This information allows the covered entity to identify the appropriate insurance carrier to release the patient's PHI. 3. Authorized Recipients: Patients can specify the authorized entities or individuals permitted to receive their PHI. It can include insurance providers, their representatives, agents, or any other relevant parties involved in the insurance claims process. 4. Purpose of the Disclosure: Patients must describe the purpose for which their PHI is being disclosed. It may involve claims processing, benefit administration, or any other insurance-related activities. 5. Duration of Authorization: Patients can specify the duration or end date until which the authorization is valid. This ensures control over the release of their PHI and prevents indefinite access. Different types of Wake North Carolina HIPAA Release Forms for Insurance may exist based on various categories, such as: 1. General HIPAA Release Form for Insurance: This is a standard form that covers most insurance-related purposes, such as claims processing, billing, and benefit administration. 2. Specialized HIPAA Release Form for Insurance: Some insurance companies might require specific release forms tailored to their unique policies, coverage types, or claim procedures. These forms may contain additional fields or sections as per the company's requirements. 3. Emergency HIPAA Release Form for Insurance: In cases where immediate medical attention is required, but the patient is unconscious or unable to give consent, an emergency release form is used to grant authorization for PHI disclosure to insurance providers. This allows for prompt treatment and claims processing. It is important to consult with your insurance provider or legal counsel to ensure the proper completion of the HIPAA Release Form for Insurance, as requirements may vary. Additionally, patients should be aware of their rights and understand how their PHI will be used and protected throughout the claims process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Formulario de liberación de Hippa para seguros - Hippa Release Form for Insurance

Description

How to fill out Wake North Carolina Formulario De Liberación De Hippa Para Seguros?

If you need to find a trustworthy legal form supplier to find the Wake Hippa Release Form for Insurance, look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can search from more than 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of learning resources, and dedicated support team make it simple to get and execute different documents.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply select to search or browse Wake Hippa Release Form for Insurance, either by a keyword or by the state/county the document is created for. After locating needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Wake Hippa Release Form for Insurance template and check the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Register an account and select a subscription option. The template will be instantly ready for download as soon as the payment is processed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes these tasks less costly and more affordable. Set up your first business, organize your advance care planning, draft a real estate agreement, or complete the Wake Hippa Release Form for Insurance - all from the comfort of your sofa.

Sign up for US Legal Forms now!