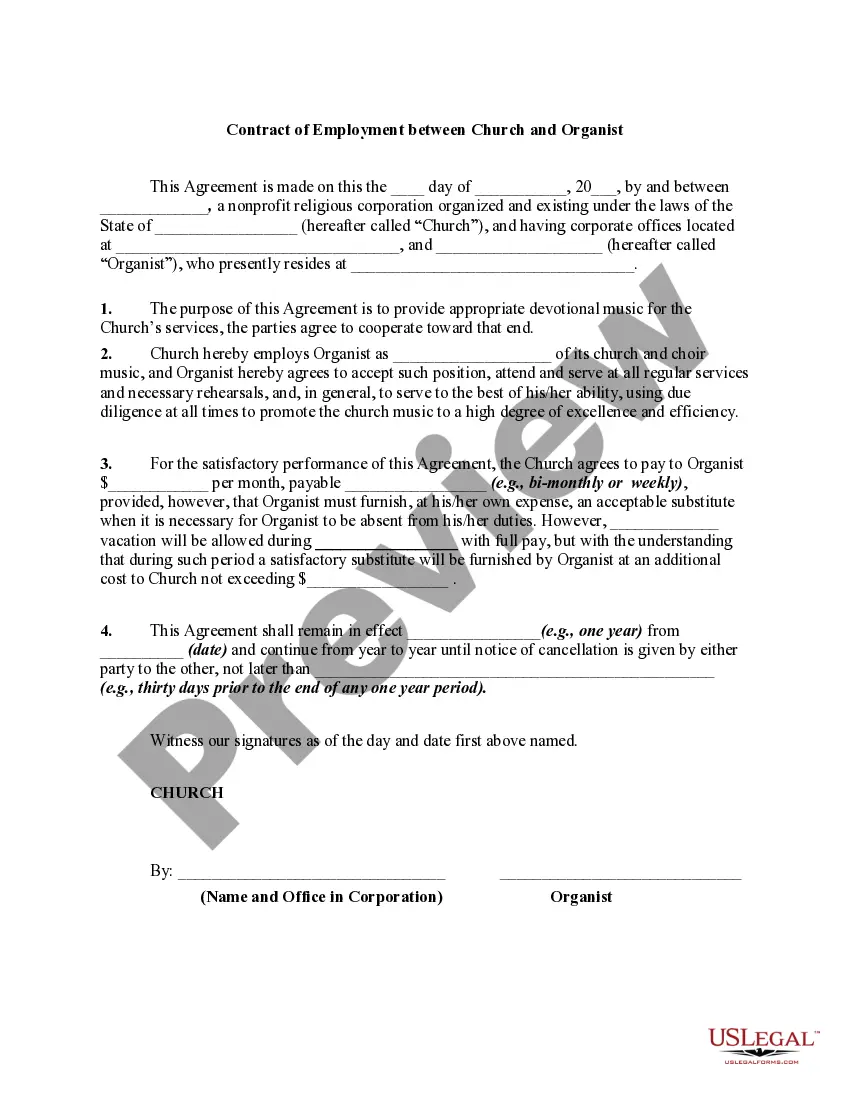

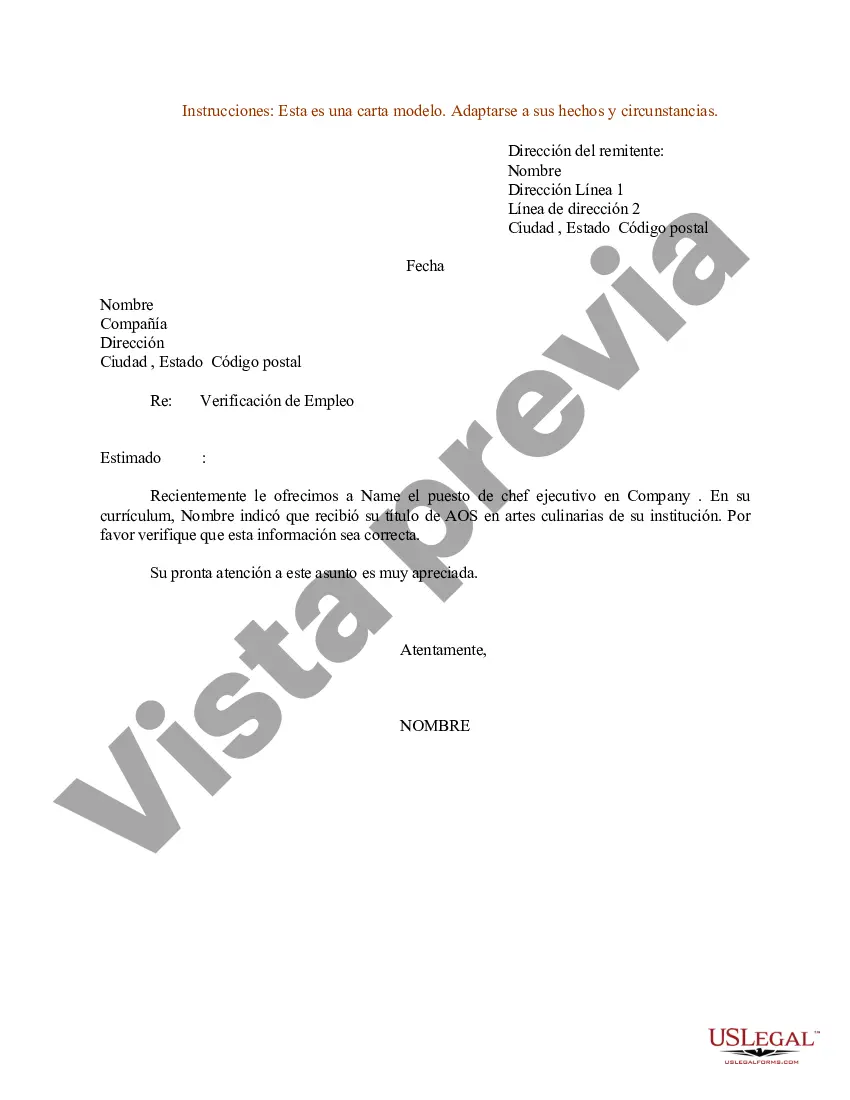

Travis Texas Employment Verification Letter for Bank is an official document issued by employers or payroll departments in Travis County, Texas, to verify an individual's employment status and income details for the purpose of banking transactions. This letter serves as proof of employment, highlighting key information that banks require to assess an individual's financial credibility. With the documentation being crucial for various financial activities, it ensures that banks have accurate details about an individual's employment history and earnings. The Travis Texas Employment Verification Letter for Bank typically includes essential information such as the employee's name, job title, tenure of employment, and current employment status (full-time, part-time, or contract basis). In addition to these details, it may also include the individual's salary or hourly wage rate, number of hours worked per week, and any other applicable compensations, such as bonuses or commissions. Having all pertinent information accurately mentioned in the letter enables the bank to make informed decisions regarding loan applications, mortgage approvals, or any other financial services. Furthermore, depending on the nature of the bank's requirements or the individual's specific circumstances, there might be different types of employment verification letters issued in Travis, Texas. Some variants may include: 1. Standard Employment Verification Letter: This is the most common type of employment verification letter, providing comprehensive details about an employee's income and employment status to support loan applications, lease agreements, or other financial matters. 2. Income Verification Letter: Specifically intended to solely verify an employee's income details, this variation explicitly states the individual's salary or wages without revealing other personal information. 3. Self-Employment Verification Letter: Generally required for self-employed individuals, freelancers, or those working in the gig economy, this type of verification letter validates income generated from an individual's own business or freelance work. 4. Salary Increase Verification Letter: If an employee has recently received a salary raise, this letter confirms the new salary structure and can be used as proof for salary negotiations, rental agreements, or credit applications. 5. Zero Income Verification Letter: Rarely requested, this type of letter is applicable for individuals who have no income source, retired individuals, or students with no work history. It certifies that the person has zero earnings or financial dependency. Employers or payroll departments are responsible for preparing these letters accurately and providing them on company letterheads with relevant contact information. Banks may have specific requirements for formatting or content, so it's crucial to ensure compliance and prompt submission to facilitate seamless banking transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Carta de verificación de empleo para el banco - Employment Verification Letter for Bank

Description

How to fill out Travis Texas Carta De Verificación De Empleo Para El Banco?

Creating legal forms is a must in today's world. However, you don't always need to look for professional help to create some of them from scratch, including Travis Employment Verification Letter for Bank, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in various categories varying from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find information materials and tutorials on the website to make any tasks associated with paperwork execution straightforward.

Here's how you can find and download Travis Employment Verification Letter for Bank.

- Go over the document's preview and outline (if provided) to get a general idea of what you’ll get after downloading the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can impact the validity of some documents.

- Check the related document templates or start the search over to find the appropriate file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment method, and buy Travis Employment Verification Letter for Bank.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Travis Employment Verification Letter for Bank, log in to your account, and download it. Needless to say, our website can’t replace a legal professional completely. If you need to deal with an exceptionally difficult situation, we advise getting an attorney to review your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Become one of them today and purchase your state-specific paperwork effortlessly!