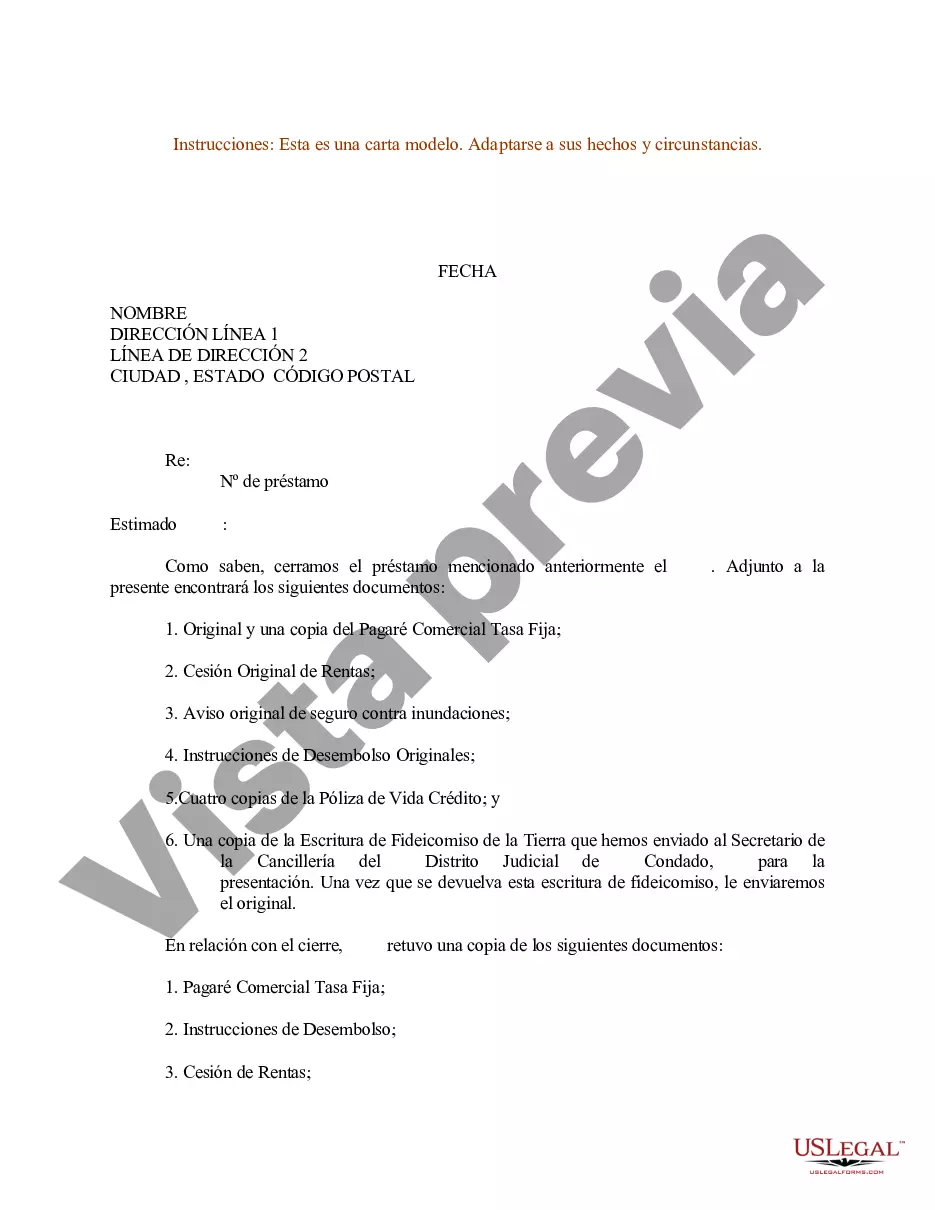

Title: Understanding Harris Texas Sample Letter for Loan: A Comprehensive Guide to Loan Application Letters Introduction: In Harris County, Texas, loan applicants may be required to submit a Sample Letter for Loan as part of their loan application process. This detailed description aims to provide an overview of what this letter entails, its purpose, and the various types of loan letters that can be submitted in Harris Texas. By using this guide, applicants can craft a compelling loan letter that effectively communicates their financial situation, loan needs, and their ability to repay the loan. Let's dive in! Key Elements of a Harris Texas Sample Letter for Loan: 1. Contact Information: Begin the letter by including your full name, residential address, phone number, and email address. Clearly state the purpose of the letter, such as "Loan Application Letter." 2. Loan Purpose and Amount: Clearly express the purpose of the loan, whether it's for home renovation, business expansion, education, or any other specific financial need. Specify the desired loan amount, keeping it realistic and justifiable. 3. Explanation of Financial Situation: Briefly explain your current financial situation, including your income sources, employment status, and any other pertinent financial details. This section should highlight your ability to repay the loan by demonstrating stability and reliability. 4. Justification of Repayment Capacity: Clearly elucidate why you believe you can repay the loan, considering your income, assets, and any existing debt responsibilities. Include factual supporting documents, such as bank statements, pay stubs, tax returns, or any other relevant financial proof. 5. Repayment Plan: Outline a repayment plan, including a proposed timeline and schedule for paying back the loan amount. This demonstrates your understanding of the loan terms and your commitment to fulfilling the financial obligation. 6. Collateral, if applicable: In case the loan requires collateral, provide details of the assets you are willing to pledge. Indicate the type of collateral, its value, and how it will serve as security against the loan. Types of Harris Texas Sample Letter for Loan: 1. Personal Loan Letter: For individuals seeking personal loans for various purposes, such as medical expenses, debt consolidation, or emergency financial needs. 2. Small Business Loan Letter: For entrepreneurs or small business owners requiring funds to start a new business venture or expand an existing one. The letter should emphasize the business plan, cash flow projections, and the potential for success. 3. Mortgage Loan Letter: Intended for homebuyers seeking a mortgage loan to finance the purchase of a house or property. The letter should detail the property details, offer price, and any down payment or pre-approval from a lender. 4. Student Loan Letter: Students seeking financial assistance for higher education can use this letter to present their case, including the desired loan amount and why it is essential for their educational pursuits. Conclusion: Crafting a Harris Texas Sample Letter for Loan requires meticulous attention to detail and a thorough understanding of the loan purpose, financial situation, and repayment capacity. Understanding the different types of loan letters available in Harris County, Texas, can help applicants tailor their letters accordingly. By following the provided guidelines and effectively conveying their needs and capabilities, applicants can increase their chances of securing the loan they require.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Ejemplo de carta de préstamo - Sample Letter for Loan

Description

How to fill out Harris Texas Ejemplo De Carta De Préstamo?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from the ground up, including Harris Sample Letter for Loan, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in various categories ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching experience less overwhelming. You can also find information materials and tutorials on the website to make any tasks related to document completion simple.

Here's how to locate and download Harris Sample Letter for Loan.

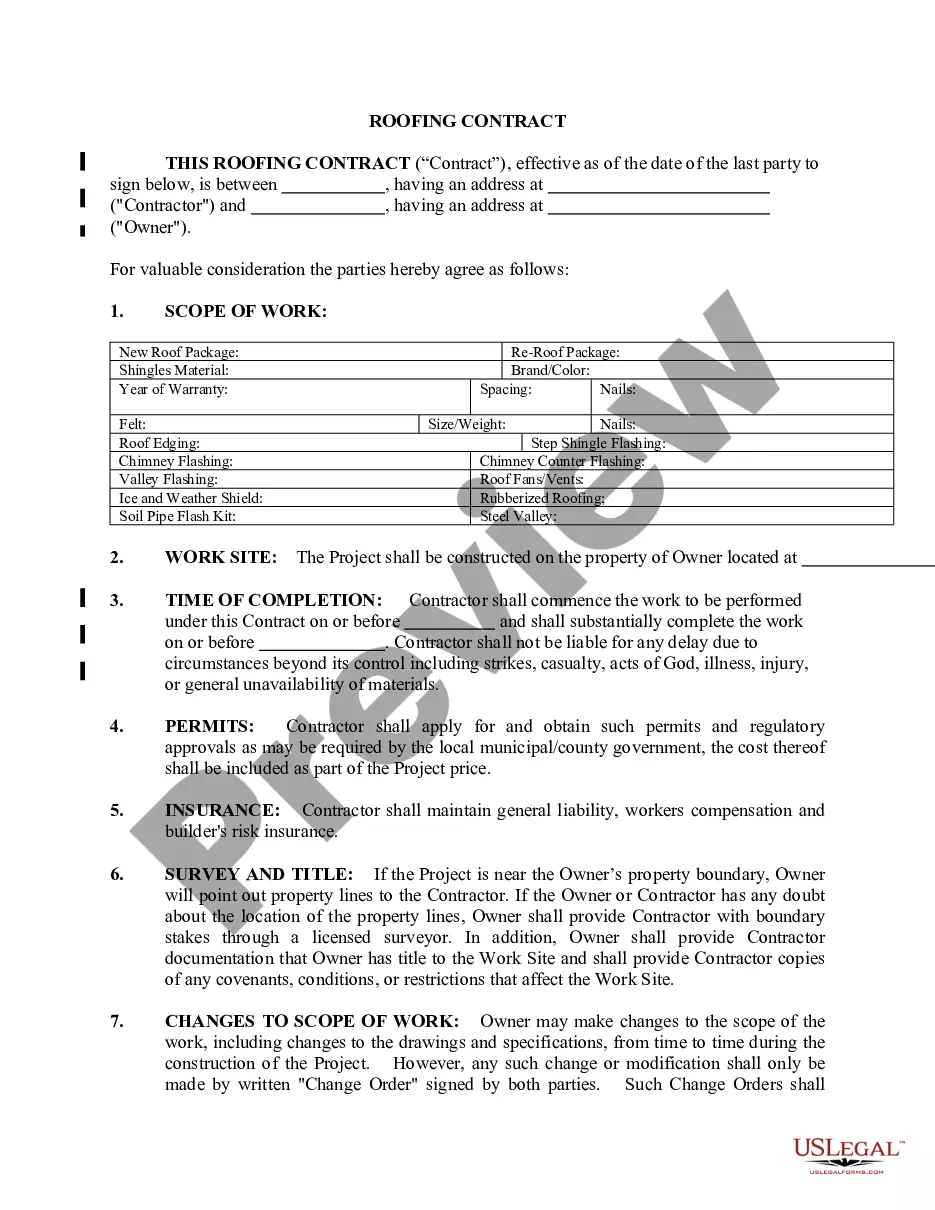

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after downloading the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can affect the validity of some records.

- Check the related document templates or start the search over to find the appropriate document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment gateway, and buy Harris Sample Letter for Loan.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Harris Sample Letter for Loan, log in to your account, and download it. Needless to say, our website can’t take the place of an attorney entirely. If you need to deal with an exceptionally complicated case, we recommend using the services of an attorney to examine your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Become one of them today and get your state-specific paperwork effortlessly!