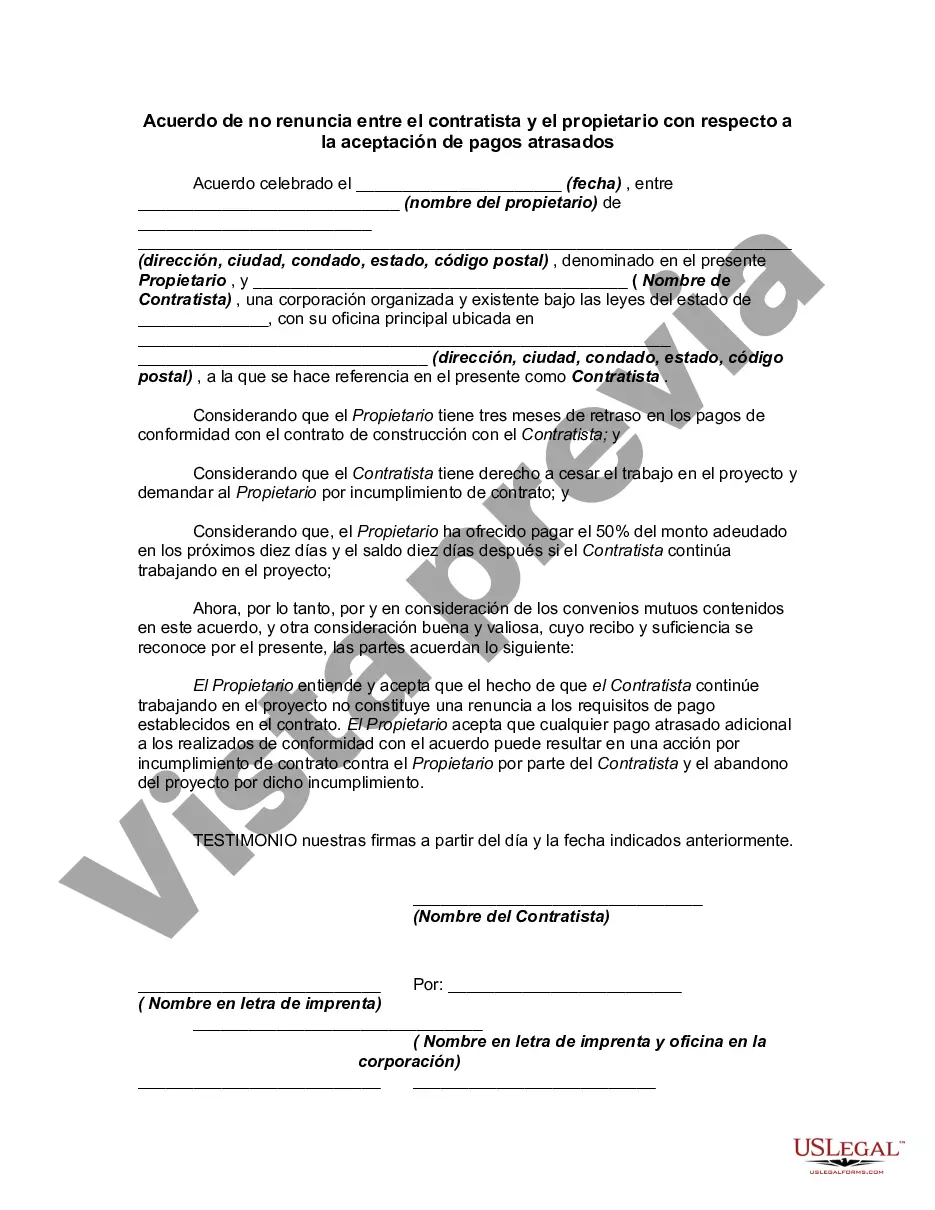

This form is a sample agreement between the owner of property and the contractor agreeing that acceptance by contractor of late payments as described in the agreement do not constitute a waiver of the right to receive timely payments pursuant to the agreement in the future.

The Harris Texas Non-Waiver Agreement between Contractor and Owner Regarding Accepting Late Payments is a legally binding document that outlines the terms and conditions regarding the acceptance of late payments for construction services provided by the contractor to the owner in Harris County, Texas. This agreement serves as a protection mechanism for both parties involved in the construction project, clarifying their rights and responsibilities in case of late payment occurrences. The agreement begins by clearly stating the parties involved, including their legal names, addresses, and contact information. It outlines the specific construction project, providing details such as project location, commencement date, and expected completion date. The agreement also includes a summarized scope of work, specifying the nature and extent of the services to be provided by the contractor. One of the key provisions of this Non-Waiver Agreement is the establishment of a payment schedule, indicating the regular intervals at which payments are expected to be made by the owner to the contractor. It highlights the importance of timely payments and the potential consequences of delayed or non-payment. The agreement acknowledges that late payments can arise due to unforeseen circumstances or financial constraints, and provides a framework for handling such situations. There are different types of Harris Texas Non-Waiver Agreement between Contractor and Owner Regarding Accepting Late Payments, categorized based on the specific terms agreed upon. These may include: 1. Fixed Late Payment Schedule Agreement: This type of agreement establishes a predetermined schedule for accepting late payments. It outlines the grace period within which payments can be made after the due date without incurring any penalties or additional costs. 2. Penalty-Based Late Payment Agreement: This agreement sets explicit penalties or interest charges that the owner must pay in the event of late payment. The penalties are often calculated based on a predetermined percentage of the outstanding balance, applied on a per-day or per-week basis. 3. Revised Payment Schedule Agreement: In situations where the owner is unable to make payments as per the original agreement, this type of agreement allows for a revised payment schedule to be established. It outlines the terms under which the contractor agrees to accept delayed payments, taking into consideration the owner's financial situation. 4. Pre-Approval Late Payment Agreement: This agreement requires the owner to seek pre-approval from the contractor before making any late payments. It establishes a process by which the owner must demonstrate a valid reason for the delay and obtain consent from the contractor before the payment can be accepted. Regardless of the specific type of Harris Texas Non-Waiver Agreement between Contractor and Owner Regarding Accepting Late Payments, it is essential for both parties to thoroughly review the terms and negotiate any necessary modifications before signing. Seeking legal advice before finalizing the agreement is highly recommended ensuring compliance with Texas construction laws and regulations.The Harris Texas Non-Waiver Agreement between Contractor and Owner Regarding Accepting Late Payments is a legally binding document that outlines the terms and conditions regarding the acceptance of late payments for construction services provided by the contractor to the owner in Harris County, Texas. This agreement serves as a protection mechanism for both parties involved in the construction project, clarifying their rights and responsibilities in case of late payment occurrences. The agreement begins by clearly stating the parties involved, including their legal names, addresses, and contact information. It outlines the specific construction project, providing details such as project location, commencement date, and expected completion date. The agreement also includes a summarized scope of work, specifying the nature and extent of the services to be provided by the contractor. One of the key provisions of this Non-Waiver Agreement is the establishment of a payment schedule, indicating the regular intervals at which payments are expected to be made by the owner to the contractor. It highlights the importance of timely payments and the potential consequences of delayed or non-payment. The agreement acknowledges that late payments can arise due to unforeseen circumstances or financial constraints, and provides a framework for handling such situations. There are different types of Harris Texas Non-Waiver Agreement between Contractor and Owner Regarding Accepting Late Payments, categorized based on the specific terms agreed upon. These may include: 1. Fixed Late Payment Schedule Agreement: This type of agreement establishes a predetermined schedule for accepting late payments. It outlines the grace period within which payments can be made after the due date without incurring any penalties or additional costs. 2. Penalty-Based Late Payment Agreement: This agreement sets explicit penalties or interest charges that the owner must pay in the event of late payment. The penalties are often calculated based on a predetermined percentage of the outstanding balance, applied on a per-day or per-week basis. 3. Revised Payment Schedule Agreement: In situations where the owner is unable to make payments as per the original agreement, this type of agreement allows for a revised payment schedule to be established. It outlines the terms under which the contractor agrees to accept delayed payments, taking into consideration the owner's financial situation. 4. Pre-Approval Late Payment Agreement: This agreement requires the owner to seek pre-approval from the contractor before making any late payments. It establishes a process by which the owner must demonstrate a valid reason for the delay and obtain consent from the contractor before the payment can be accepted. Regardless of the specific type of Harris Texas Non-Waiver Agreement between Contractor and Owner Regarding Accepting Late Payments, it is essential for both parties to thoroughly review the terms and negotiate any necessary modifications before signing. Seeking legal advice before finalizing the agreement is highly recommended ensuring compliance with Texas construction laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.