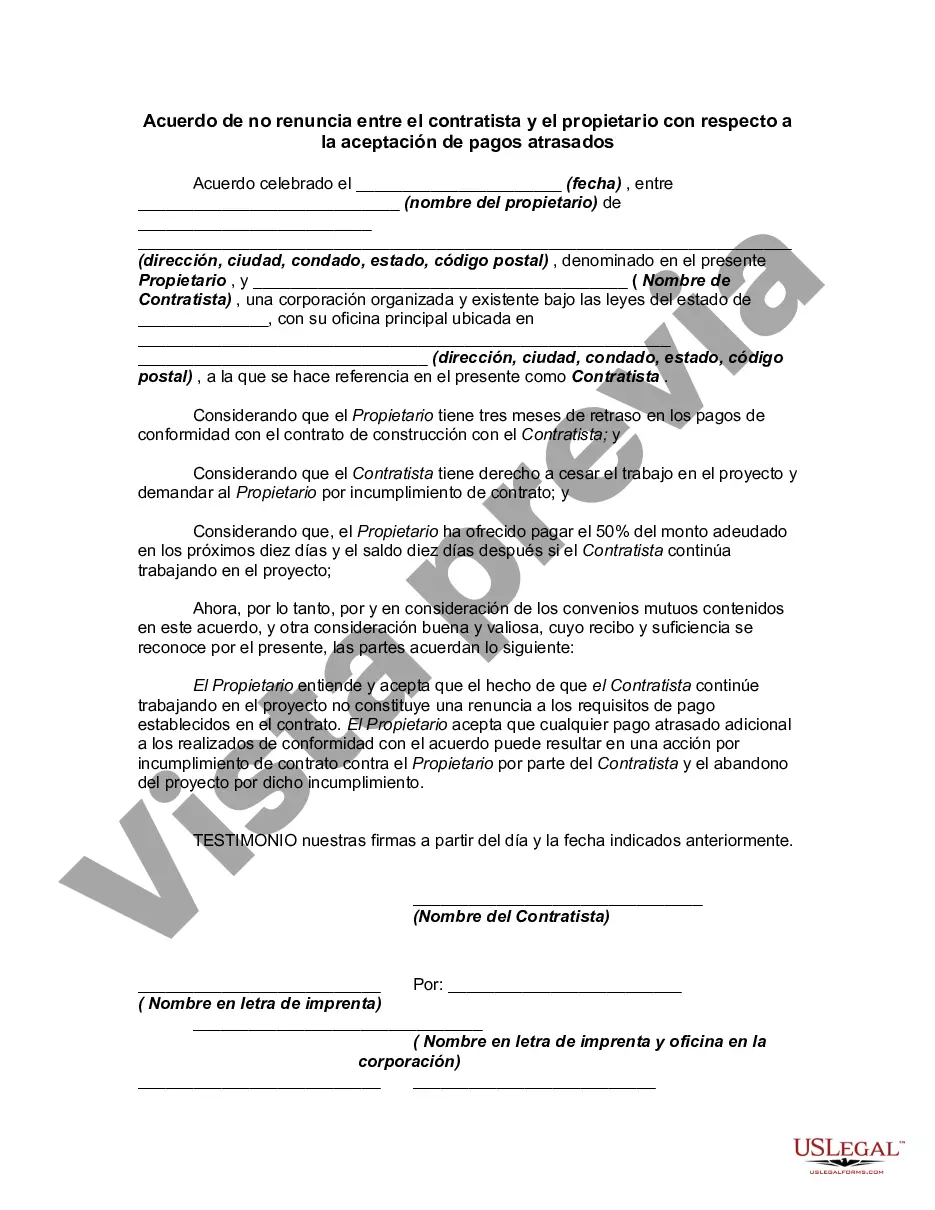

This form is a sample agreement between the owner of property and the contractor agreeing that acceptance by contractor of late payments as described in the agreement do not constitute a waiver of the right to receive timely payments pursuant to the agreement in the future.

Hennepin County, located in the state of Minnesota, has specific regulations in place when it comes to non-waiver agreements between contractors and owners regarding accepting late payments. These agreements help establish the terms and conditions related to late payments and provide a clear framework for both parties involved. The Hennepin Minnesota Non-Waiver Agreement between Contractor and Owner Regarding Accepting Late Payments is a legally binding contract that protects the rights of both parties. This agreement ensures that even if the contractor accepts late payments on certain occasions, it does not waive their right to collect late payment fees or take legal action in the future for non-timely compensation. There can be different types of Hennepin Minnesota Non-Waiver Agreement between Contractor and Owner Regarding Accepting Late Payments, depending on the specific terms and conditions agreed upon by the parties involved. Let's explore some possible variations: 1. Standard Non-Waiver Agreement: This is the most common type of agreement, where the contractor and owner establish a framework for late payments. It typically outlines the consequences of late payments, such as the amount of late fees, interest rates, and any additional costs incurred for non-timely compensation. 2. Partial Payment Non-Waiver Agreement: In some instances, the contractor and owner may agree to a partial payment plan, allowing the owner to make smaller payments over a specified period to satisfy their debt. This type of agreement can include specific terms regarding the schedule and amount of partial payments. 3. Temporary Financial Hardship Non-Waiver Agreement: In situations where the owner is facing temporary financial difficulties, a specialized agreement may be crafted to address this issue. It could include provisions for a grace period or modified payment terms to accommodate the owner's financial constraints, while still ensuring the contractor's rights are protected. 4. Agreement with Alternative Forms of Collateral: In rare cases, an agreement could be established in which the contractor may accept alternative forms of collateral instead of immediate payment. This may involve the owner providing valuable assets that could be seized or sold by the contractor in case of continued non-payment. It's important for both contractors and owners in Hennepin County, Minnesota, to familiarize themselves with the specific regulations and provisions outlined in the relevant Non-Waiver Agreement they enter into. This ensures that their rights and responsibilities are adequately protected, and any potential disputes can be resolved in a fair and legal manner.Hennepin County, located in the state of Minnesota, has specific regulations in place when it comes to non-waiver agreements between contractors and owners regarding accepting late payments. These agreements help establish the terms and conditions related to late payments and provide a clear framework for both parties involved. The Hennepin Minnesota Non-Waiver Agreement between Contractor and Owner Regarding Accepting Late Payments is a legally binding contract that protects the rights of both parties. This agreement ensures that even if the contractor accepts late payments on certain occasions, it does not waive their right to collect late payment fees or take legal action in the future for non-timely compensation. There can be different types of Hennepin Minnesota Non-Waiver Agreement between Contractor and Owner Regarding Accepting Late Payments, depending on the specific terms and conditions agreed upon by the parties involved. Let's explore some possible variations: 1. Standard Non-Waiver Agreement: This is the most common type of agreement, where the contractor and owner establish a framework for late payments. It typically outlines the consequences of late payments, such as the amount of late fees, interest rates, and any additional costs incurred for non-timely compensation. 2. Partial Payment Non-Waiver Agreement: In some instances, the contractor and owner may agree to a partial payment plan, allowing the owner to make smaller payments over a specified period to satisfy their debt. This type of agreement can include specific terms regarding the schedule and amount of partial payments. 3. Temporary Financial Hardship Non-Waiver Agreement: In situations where the owner is facing temporary financial difficulties, a specialized agreement may be crafted to address this issue. It could include provisions for a grace period or modified payment terms to accommodate the owner's financial constraints, while still ensuring the contractor's rights are protected. 4. Agreement with Alternative Forms of Collateral: In rare cases, an agreement could be established in which the contractor may accept alternative forms of collateral instead of immediate payment. This may involve the owner providing valuable assets that could be seized or sold by the contractor in case of continued non-payment. It's important for both contractors and owners in Hennepin County, Minnesota, to familiarize themselves with the specific regulations and provisions outlined in the relevant Non-Waiver Agreement they enter into. This ensures that their rights and responsibilities are adequately protected, and any potential disputes can be resolved in a fair and legal manner.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.