A Trust is an entity which owns assets for the benefit of a third person (beneficiary). Trusts can be revocable or irrevocable. An irrevocable trust is an arrangement in which the grantor departs with ownership and control of property. Usually this involves a gift of the property to the trust. The trust then stands as a separate taxable entity and pays tax on its accumulated income. Trusts typically receive a deduction for income that is distributed on a current basis. Because the grantor must permanently depart with the ownership and control of the property being transferred to an irrevocable trust, such a device has limited appeal to most taxpayers.

Orange, California Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren is a legally binding document that establishes a trust to protect and manage assets for the long-term benefit of the trust or's descendants. This type of trust provides a reliable way to safeguard family wealth and ensure its smooth transfer across generations while offering various tax benefits and asset protection. The Orange, California Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren can be tailored to meet specific needs and circumstances. Below are different types of these agreements that one can consider: 1. Education Trust: This type of trust focuses on funding the education expenses of the trust or's children and grandchildren. It ensures that funds are available for tuition fees, books, accommodations, and other educational needs, enabling them to pursue their academic goals with financial security. 2. Medical Trust: A medical trust ensures that the healthcare needs of the trust or's children and grandchildren are well taken care of. It can cover medical expenses, health insurance premiums, long-term care costs, and other healthcare-related expenses. 3. Asset Protection Trust: This type of trust shields the assets from creditors and potential lawsuits. By transferring assets into an irrevocable trust, the trust or provides an extra layer of protection against potential financial risks while providing for the financial well-being of their children and grandchildren. 4. Special Needs Trust: This trust is specifically designed to provide ongoing support and care for children or grandchildren with special needs. It focuses on preserving eligibility for public benefits while supplementing those benefits to enhance the quality of life for beneficiaries with disabilities. 5. Charitable Trust: In the philanthropic realm, this type of trust enables the trust or to support charitable causes and organizations while also benefiting their children and grandchildren. It allows the trust or's descendants to play a significant role in continuing and expanding family philanthropy. Each of these types of Orange, California Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren can be customized to meet unique requirements. Working with an experienced attorney is highly recommended ensuring that the trust agreement aligns with specific financial goals, provides comprehensive asset protection, and maximizes tax advantages.Orange, California Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren is a legally binding document that establishes a trust to protect and manage assets for the long-term benefit of the trust or's descendants. This type of trust provides a reliable way to safeguard family wealth and ensure its smooth transfer across generations while offering various tax benefits and asset protection. The Orange, California Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren can be tailored to meet specific needs and circumstances. Below are different types of these agreements that one can consider: 1. Education Trust: This type of trust focuses on funding the education expenses of the trust or's children and grandchildren. It ensures that funds are available for tuition fees, books, accommodations, and other educational needs, enabling them to pursue their academic goals with financial security. 2. Medical Trust: A medical trust ensures that the healthcare needs of the trust or's children and grandchildren are well taken care of. It can cover medical expenses, health insurance premiums, long-term care costs, and other healthcare-related expenses. 3. Asset Protection Trust: This type of trust shields the assets from creditors and potential lawsuits. By transferring assets into an irrevocable trust, the trust or provides an extra layer of protection against potential financial risks while providing for the financial well-being of their children and grandchildren. 4. Special Needs Trust: This trust is specifically designed to provide ongoing support and care for children or grandchildren with special needs. It focuses on preserving eligibility for public benefits while supplementing those benefits to enhance the quality of life for beneficiaries with disabilities. 5. Charitable Trust: In the philanthropic realm, this type of trust enables the trust or to support charitable causes and organizations while also benefiting their children and grandchildren. It allows the trust or's descendants to play a significant role in continuing and expanding family philanthropy. Each of these types of Orange, California Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren can be customized to meet unique requirements. Working with an experienced attorney is highly recommended ensuring that the trust agreement aligns with specific financial goals, provides comprehensive asset protection, and maximizes tax advantages.

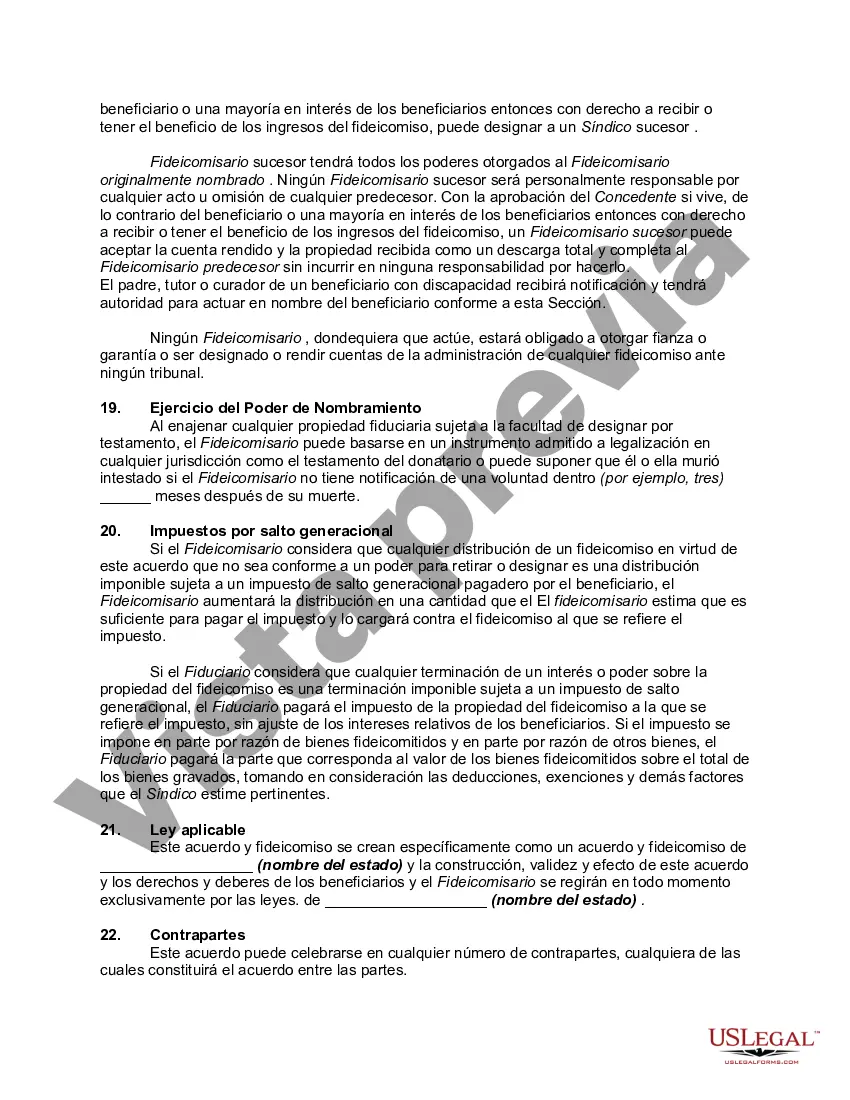

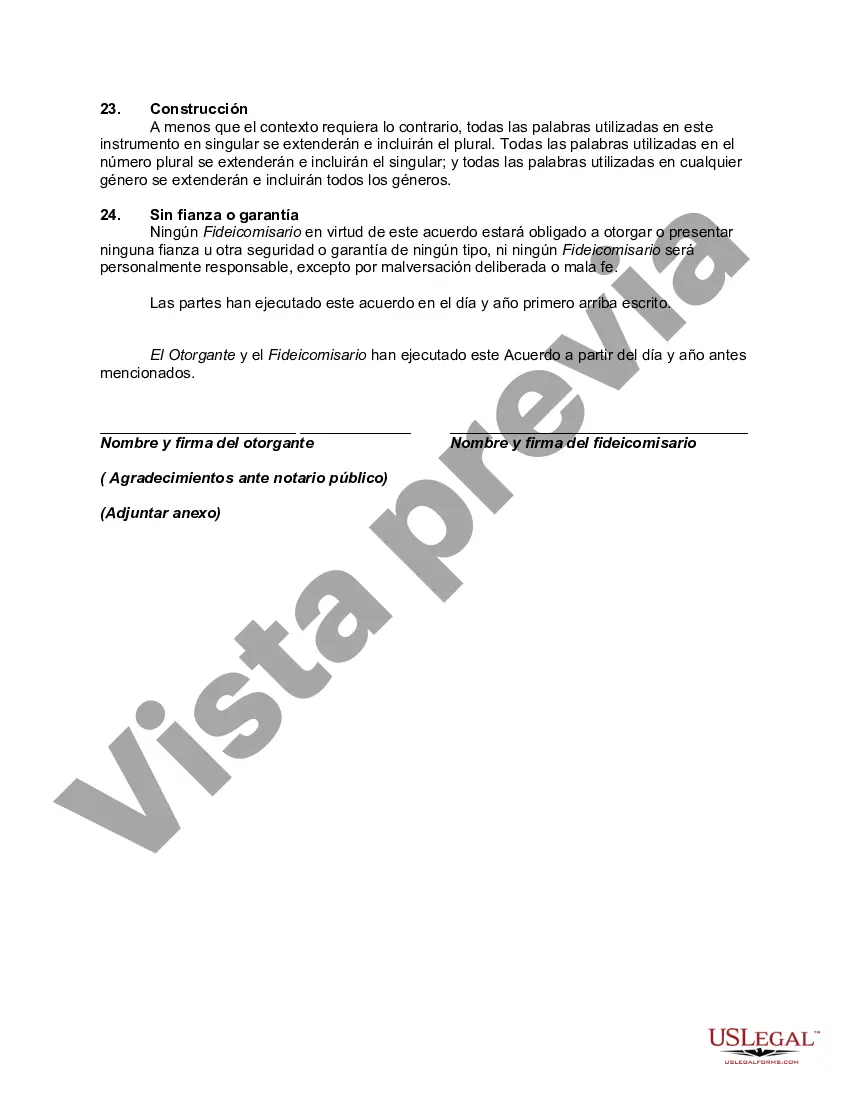

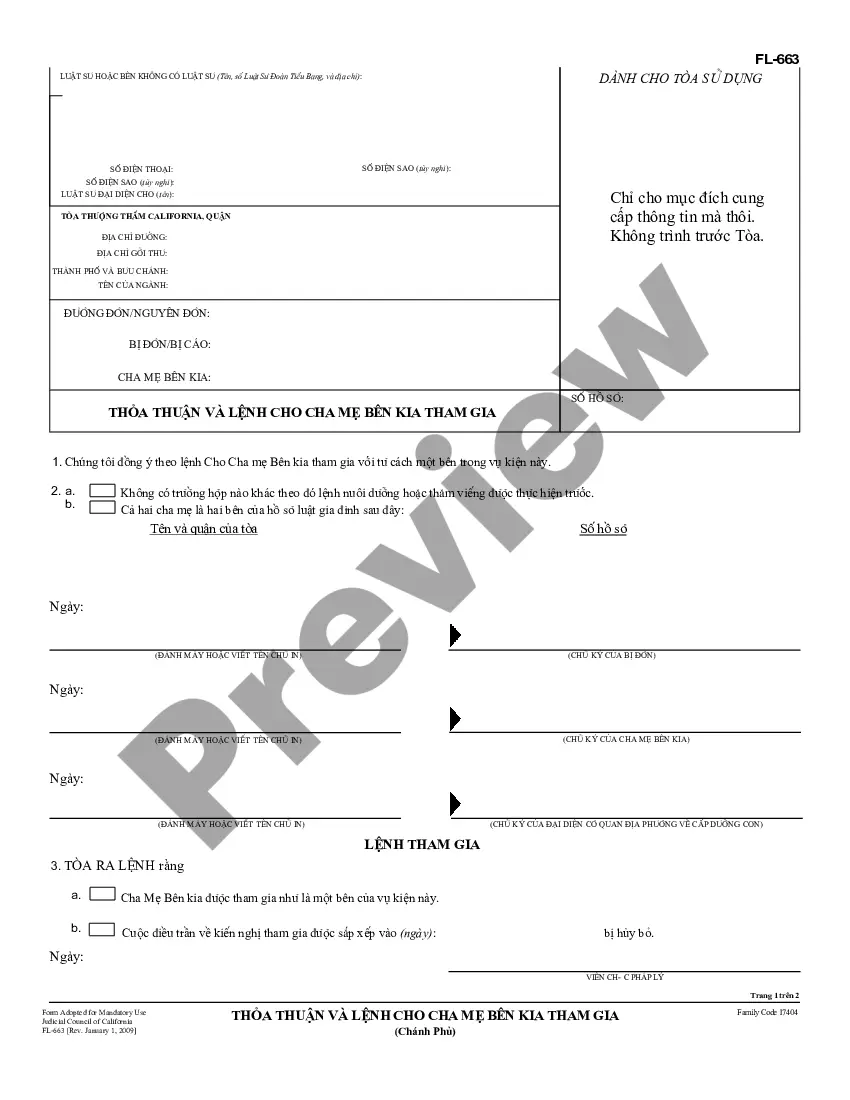

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.